$100 Invested in Veeva Systems 5 Years Ago is Now Worth How Much?

November 4, 2023

☀️Trending News

Analyzing the performance of a stock can be a great way to gauge whether it is a good investment for your portfolio. With the growth of the company, it has been an attractive option for many investors who have been wondering: What would be the value of $100 invested in Veeva Systems ($NYSE:VEEV) 5 years ago? This growth has been largely due to the strong performance of Veeva’s products, as well as the increasing demand for life sciences software solutions.

In addition, Veeva Systems has shown resilience in times of market volatility, which has made it a popular choice for investors looking for a stable, long-term investment. With the added benefit of Veeva Systems’ growing customer base and a consistent expansion of their product portfolio, it is no wonder that many investors have turned to this popular stock. If you are looking to make a long-term investment, this company is definitely worth considering.

Stock Price

On Tuesday, VEEVA SYSTEMS stock opened at $191.1 and closed at $192.7, representing a 1.3% increase from its previous closing price of $190.3. This significant growth over the past five years has been impressive, as investors who had the foresight to invest $100 in the company five years ago would now have a much higher return. This growth can be attributed to the company’s innovative technology solutions and commitment to providing customers with the best customer experience possible. Veeva Systems has also gained traction in the financial markets with its strategic acquisitions, as well as a strong focus on developing new products and services. Additionally, the company has a long track record of strong financial performance, having reported positive earnings per share in each of the past five years. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Veeva Systems. More…

| Total Revenues | Net Income | Net Margin |

| 2.23k | 540.14 | 24.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Veeva Systems. More…

| Operations | Investing | Financing |

| 977.03 | -1.36k | -11.6 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Veeva Systems. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 5.23k | 1.08k | 25.92 |

Key Ratios Snapshot

Some of the financial key ratios for Veeva Systems are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 20.3% | 7.5% | 17.7% |

| FCF Margin | ROE | ROA |

| 43.8% | 6.1% | 4.7% |

Analysis

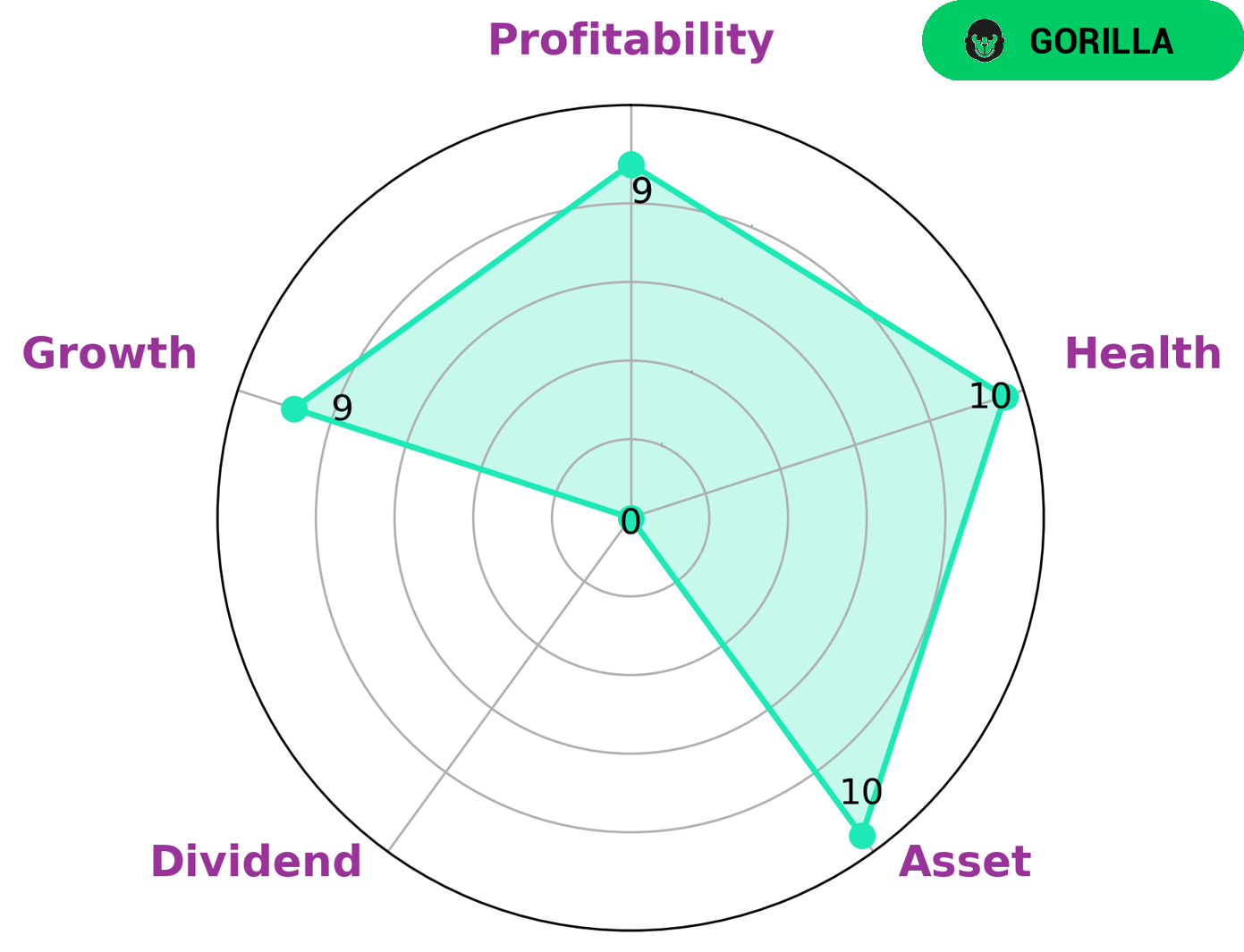

GoodWhale has conducted an analysis of VEEVA SYSTEMS‘s financials and classified it as a ‘gorilla’, based on its Star Chart. This type of company is characterized by stable and high revenue or earning growth due to its strong competitive advantage. In terms of investment interest, VEEVA SYSTEMS is strong in asset, growth, and profitability, yet weak in dividends. Additionally, the company has a high health score of 10/10 with regard to its cashflows and debt, indicating that it has the ability to pay off debt and fund future operations. Thanks to this impressive financial standing, VEEVA SYSTEMS could be a very attractive option for investors looking for long-term growth and stability. More…

Peers

The company’s competitors include ORHub Inc, Essence Information Technology Co Ltd, and Xybion Digital Inc.

– ORHub Inc ($OTCPK:ORHB)

CrowdStrike Holdings, Inc. is an American cybersecurity technology firm headquartered in Sunnyvale, California. It provides endpoint security, threat intelligence, and cyber attack response services. The company was founded in 2011 by George Kurtz and Dmitri Alperovitch.

– Essence Information Technology Co Ltd ($SHSE:688555)

Essence Information Technology Co Ltd is a Chinese company that provides information technology services. It has a market cap of 1.01B as of 2022 and a Return on Equity of -2.84%. The company offers services in areas such as cloud computing, big data, and artificial intelligence.

– Xybion Digital Inc ($TSXV:XYBN)

Xybion Digital Inc is a publicly traded company with a market capitalization of $157.07 million as of 2022. The company has a negative return on equity of 12.47% and is involved in the digital media industry. Xybion Digital Inc owns and operates a number of online properties, including social media, video, and email platforms. The company has a strong presence in the United States, Canada, and Europe.

Summary

Investing in Veeva Systems has been a wise decision for many investors over the past five years. This remarkable success can be attributed to the company’s introduction of data-driven solutions for life science companies, which have been wildly successful and well-received in the industry. With new and innovative products, Veeva Systems is a company worth looking into for potential investors.

Recent Posts