CPF Global Food Solution Public Company Limited to Launch IPO Following Uoriki Joint Venture Formation in 2022

May 12, 2023

Trending News ☀️

This joint venture between CP Foods and Uoriki ($TSE:7596), formed in May 2022, will be funded by an initial public offering (IPO). Uoriki is well known for specializing in the production and distribution of fresh, premium seafood products and is highly regarded in Asia. Their stocks are expected to be in high demand due to the company’s excellent reputation. The joint venture between CP Foods and Uoriki is sure to present investors with a great opportunity for growth and expansion. CP Foods is a highly respected global food provider and their expertise in the sector combined with Uoriki’s exceptional standing in Asia will ensure that the joint venture is a success.

The IPO will be beneficial to both companies, giving them access to additional capital to continue their growth. It marks an exciting new chapter for both CP Foods and Uoriki, providing them with the resources needed to further their international presence and expand into new markets. Investors should keep an eye out for Uoriki stocks when they launch as this could be a great opportunity for long-term growth and investment.

Stock Price

The news sent UORIKI stock soaring, with the opening price of JP¥2180.0 and the closing price of JP¥2193.0, representing a slight increase of 0.1% from its previous closing price of 2190.0. With the joint venture in place, UORIKI is expected to expand its market share and create new opportunities for growth. Uoriki_Joint_Venture_Formation_in_2022″>Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Uoriki. More…

| Total Revenues | Net Income | Net Margin |

| 33.85k | 621.18 | 2.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Uoriki. More…

| Operations | Investing | Financing |

| 1.15k | -201.73 | -669.24 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Uoriki. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 20.5k | 4.3k | 1.15k |

Key Ratios Snapshot

Some of the financial key ratios for Uoriki are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 3.6% | -1.7% | 3.3% |

| FCF Margin | ROE | ROA |

| 2.8% | 4.4% | 3.4% |

Analysis

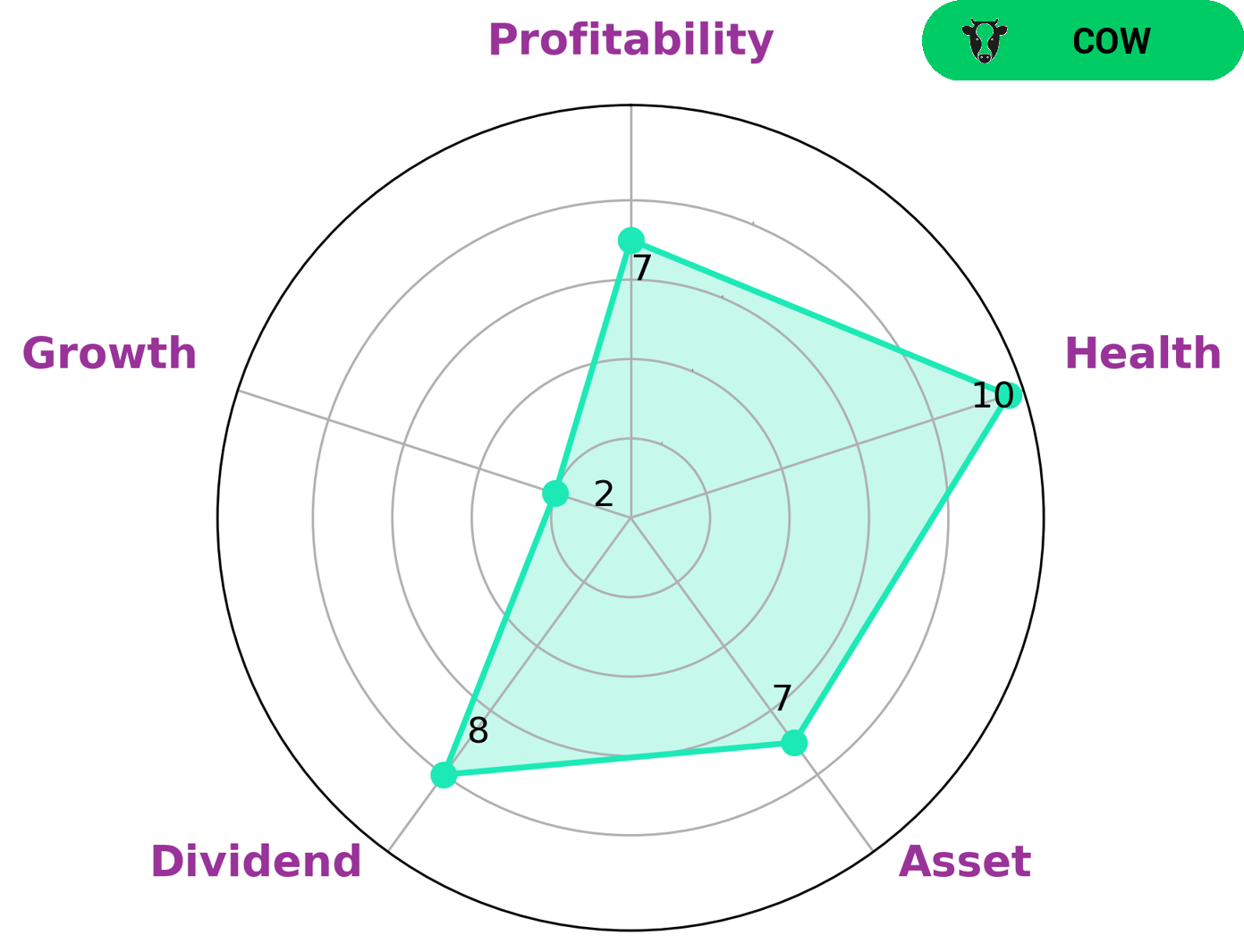

GoodWhale has conducted an analysis of UORIKI’s well-being and the results show that UORIKI is strong in asset, dividend, profitability, while being weak in growth. According to Star Chart, UORIKI is classified as a ‘cow’, which is a type of company that has a track record of paying out consistent and sustainable dividends. This means that UORIKI may be particularly attractive to investors who are looking for stable, regular income streams. In addition, UORIKI has a high health score of 10/10 according to GoodWhale. This suggests that UORIKI is in a strong financial position and is capable to safely ride out any crisis without facing the risk of bankruptcy. As such, UORIKI could be a great investment opportunity for those looking for a safe bet with reliable returns. Uoriki_Joint_Venture_Formation_in_2022″>More…

Peers

The competition between Uoriki Co Ltd and its competitors has been fierce, with Fujiya Co Ltd, Rock Field Co Ltd, and Artnature Inc all vying for market share. Each company has its own strengths, and the competition is a testament to the innovation and drive that these businesses possess.

– Fujiya Co Ltd ($TSE:2211)

Fujiya Co Ltd is a Japanese confectionery and snack food maker, with a wide variety of products ranging from chocolate to snacks. As of 2023, the company has a market cap of 61.63B, which is indicative of its size and stability in the market. Fujiya Co Ltd also has a Return on Equity of 6.7%, which indicates that it has a good level of profitability compared to its equity. With a strong presence in the Japanese market, Fujiya Co Ltd is well-positioned to expand further in the near future.

– Rock Field Co Ltd ($TSE:2910)

Rock Field Co Ltd is an international real estate and development company based in the United Kingdom. It has a market cap of 40.28 billion as of 2023 and a Return on Equity (ROE) of 3.07%. The company focuses on the development of residential, commercial, and industrial properties in key growth markets throughout the world. The current high market cap is a testament to the success of the company, indicating its ability to generate consistent returns from its projects. The modest ROE indicates that the company is able to maintain a healthy balance sheet and is making prudent investments in its long-term growth strategy.

– Artnature Inc ($TSE:7823)

Artnature Inc is a prominent international company that produces a variety of products such as furniture, home accessories, and lighting. As of 2023, the company has a market cap of 24.1B, demonstrating its dominance in the industry. Additionally, Artnature Inc has a Return on Equity of 6.94%, indicating that they are efficiently using the capital invested by shareholders to generate returns. This is an impressive feat considering the large size of the company. Going forward, Artnature Inc is sure to remain one of the leading companies in the industry.

Summary

CP Foods’ Thai subsidiary, CPF Global Food Solution Public Company Limited, is planning to go public following the joint venture between CP Foods and Uoriki in May 2022. Investors should take note of the strong potential of this venture as it is expected to generate promising returns. Analyzing the respective strengths of both companies in the business strategy, as well as their financial performance and track records, should give investors an idea of the possible returns they could expect. Uoriki’s share price could potentially rise with the upcoming IPO, making it a viable investment opportunity.

Recent Posts