Albertsons Companies Intrinsic Value Calculator – Albertsons Unifies Brands with Signature SELECT Consolidation

June 1, 2023

🌥️Trending News

To better unify its various brands, Albertsons ($NYSE:ACI) recently announced the consolidation of several of their store brands under the Signature SELECT umbrella. Through the consolidation, Albertsons plans to leverage the Signature SELECT name to have a single identity across all of its product categories. Signature SELECT products will offer a wide variety of items, ranging from essential staples such as cereals, cookies, and canned goods to specialty items such as cheese, olive oil, and sauces.

Additionally, they will offer organic and gluten-free options for consumers seeking them out. Albertsons has also worked to make shopping easier for their customers by streamlining the store branding, making it easier to spot their signature products. They have invested in new technology and processes that will enable them to offer more customized services and offerings to their customers. With the consolidation of their brands under one umbrella, Albertsons hopes to build an even stronger brand loyalty amongst their current and potential customers.

Share Price

On Wednesday, ALBERTSONS COMPANIES stock opened at $20.1 and closed at $20.4, up by 1.3% from last closing price of 20.1. This surge was attributed to the company’s decision to unify its brands through the Signature SELECT consolidation. The consolidation process will allow ALBERTSONS to unify its primary store-brand items under one umbrella brand, Signature SELECT. The new brand will bring together selected products from the company’s existing store brands, such as Lucerne and O Organics, as well as new items.

As part of this process, ALBERTSONS will also be introducing a new logo for the unified brand, which will be used across all packaging, display tags, and promotional materials. The consolidation is intended to simplify the shopping experience for customers, as well as improve the efficiency of the ALBERTSONS’ supply chain. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Albertsons Companies. More…

| Total Revenues | Net Income | Net Margin |

| 77.65k | 1.51k | 1.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Albertsons Companies. More…

| Operations | Investing | Financing |

| 2.85k | -1.98k | -3.37k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Albertsons Companies. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 26.17k | 24.56k | 2.83 |

Key Ratios Snapshot

Some of the financial key ratios for Albertsons Companies are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 7.5% | 31.4% | 3.0% |

| FCF Margin | ROE | ROA |

| 0.9% | 120.4% | 5.6% |

Analysis – Albertsons Companies Intrinsic Value Calculator

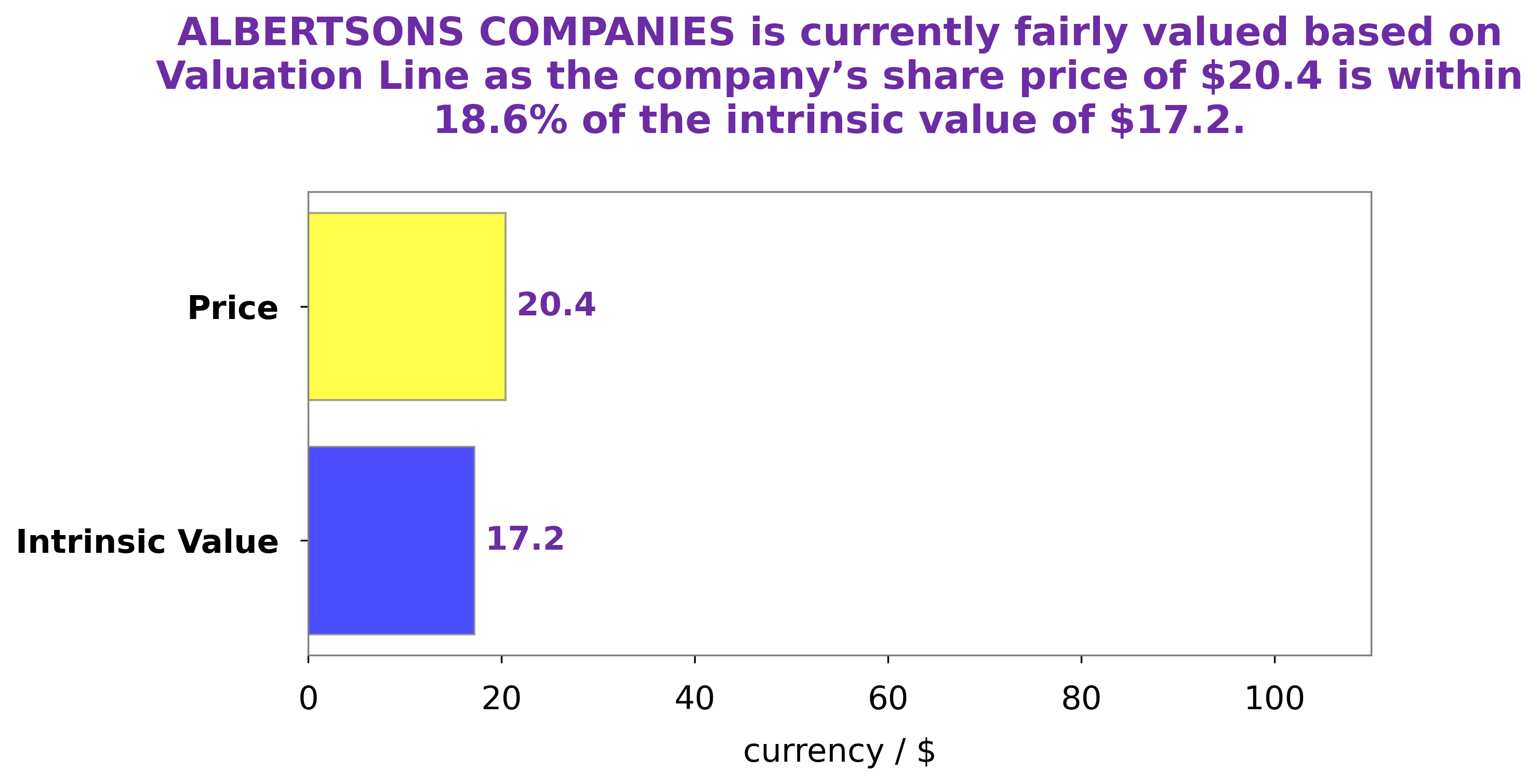

At GoodWhale, we have analyzed the fundamentals of ALBERTSONS COMPANIES and come up with a fair value of its shares around $17.2. This is based on our proprietary Valuation Line that takes into account various factors such as the company’s financials, industry trends, and competitive landscape. Currently, ALBERTSONS COMPANIES stock is trading at $20.4, thus making it a fair price overvalued by 18.4%. More…

Peers

Albertsons Companies Inc is one of the largest food and drug retailers in the United States, with more than 2,200 stores in 36 states and the District of Columbia. The company operates under 19 banners, including Albertsons, Safeway, Vons, Pavilions, Randalls, Tom Thumb, Shaw’s, Star Market, United Express, Jewel-Osco, Acme Markets, Albertsons Market, Carrs, Haggen, Lucky, Market Street, Pavilions, and United. Albertsons Companies is headquartered in Boise, Idaho. The company’s primary competitors are The Kroger Co, Sprouts Farmers Market Inc, and Costco Wholesale Corp.

– The Kroger Co ($NYSE:KR)

Kroger Co is a grocery store chain with a market cap of 30.19B as of 2022. It has a Return on Equity of 23.61%. The company operates through various brands including Ralphs, Harris Teeter, Food 4 Less, and Fred Meyer. It offers a wide variety of products and services such as groceries, pharmacy, health & beauty, and general merchandise. Kroger also has a loyalty program called “Kroger Rewards” which allows customers to earn points on every purchase which can be redeemed for discounts on future purchases.

– Sprouts Farmers Market Inc ($NASDAQ:SFM)

Sprouts Farmers Market Inc. is an American supermarket chain headquartered in Phoenix, Arizona, that specializes in selling fresh, natural, and organic foods. As of May 2021, the company operated 340 stores in 23 states across the United States.

The company has a market cap of $3 billion as of 2022 and a return on equity of 21.14%. Sprouts Farmers Market is a publicly traded company on the Nasdaq stock exchange under the ticker symbol SFM.

– Costco Wholesale Corp ($NASDAQ:COST)

Costco Wholesale Corporation is a membership-only warehouse club that provides a wide array of merchandise, including food, electronics, housewares, and clothing. As of 2022, it had a market cap of 205.64 billion and a return on equity of 24.62%. Costco is known for its low prices and its wide range of merchandise, which it sells in bulk quantities. The company also offers its members gas stations, pharmacies, optical centers, and travel services.

Summary

Albertsons Companies is an American grocery retailer with a strong presence across the United States. Recent investments in the company have been focused on modernizing operations, expanding store formats, and consolidating several brands under the Signature SELECT banner. Analysts suggest that Albertsons Companies has a strong history of dividends and a consistent history of stock price growth.

Additionally, the company is well positioned to benefit from the increasing popularity of online grocery shopping. While there is some potential downside risk due to competition and changing consumer preferences, overall the company remains a strong investment given its long-term track record of success.

Recent Posts