-TSX

April 29, 2023

Trending News 🌧️

Osisko Development ($TSXV:ODV) C. ODV is a company listed on the Toronto Stock Exchange (TSX). It is a gold exploration and development company focused on the Canada-based Windfall Lake gold deposit located in Quebec. Recently, the National Bank of Canada has backed Osisko Development with a $51.8 million financing package. The financing package will be used to fund the development of the Windfall Lake gold deposit, including the ongoing pre-development and construction activities. National Bank of Canada has also agreed to provide additional financing and financial advisory services, as well as an equity participation in the project.

This financing marks a major milestone for Osisko Development, allowing it to execute its mining plan and begin the process of becoming a large-scale gold producer. The company has already achieved significant progress in pre-development activities, including the construction of a new mill and the installation of specialized equipment, and is now in a position to move into the construction phase of the project. The funding from National Bank of Canada is an endorsement of Osisko Development’s management and its commitment to develop the Windfall Lake gold deposit. With the additional financial support, Osisko Development is confident that it will be able to complete the construction phase in a timely and cost-effective manner and become a major gold producer in the near future.

Share Price

On Tuesday, OSISKO DEVELOPMENT (TSX) stock opened at CA$7.2 and closed at the same price, down 0.3% from last closing price. National Bank of Canada has recently announced it has provided the company with $51.8 million in financing, showing confidence in the company’s prospects. This financing will help the company to fund its development projects, invest in capital expenditure and acquisitions, and support its working capital needs. This infusion of capital provides Osisko with a major boost, as it looks to strengthen its financial position and create long term value for shareholders. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Osisko Development. More…

| Total Revenues | Net Income | Net Margin |

| 64.05 | -192.46 | -206.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Osisko Development. More…

| Operations | Investing | Financing |

| -50.26 | -145.92 | 254.53 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Osisko Development. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 968.2 | 237.76 | 9.66 |

Key Ratios Snapshot

Some of the financial key ratios for Osisko Development are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | -288.8% |

| FCF Margin | ROE | ROA |

| -199.3% | -15.2% | -11.9% |

Analysis

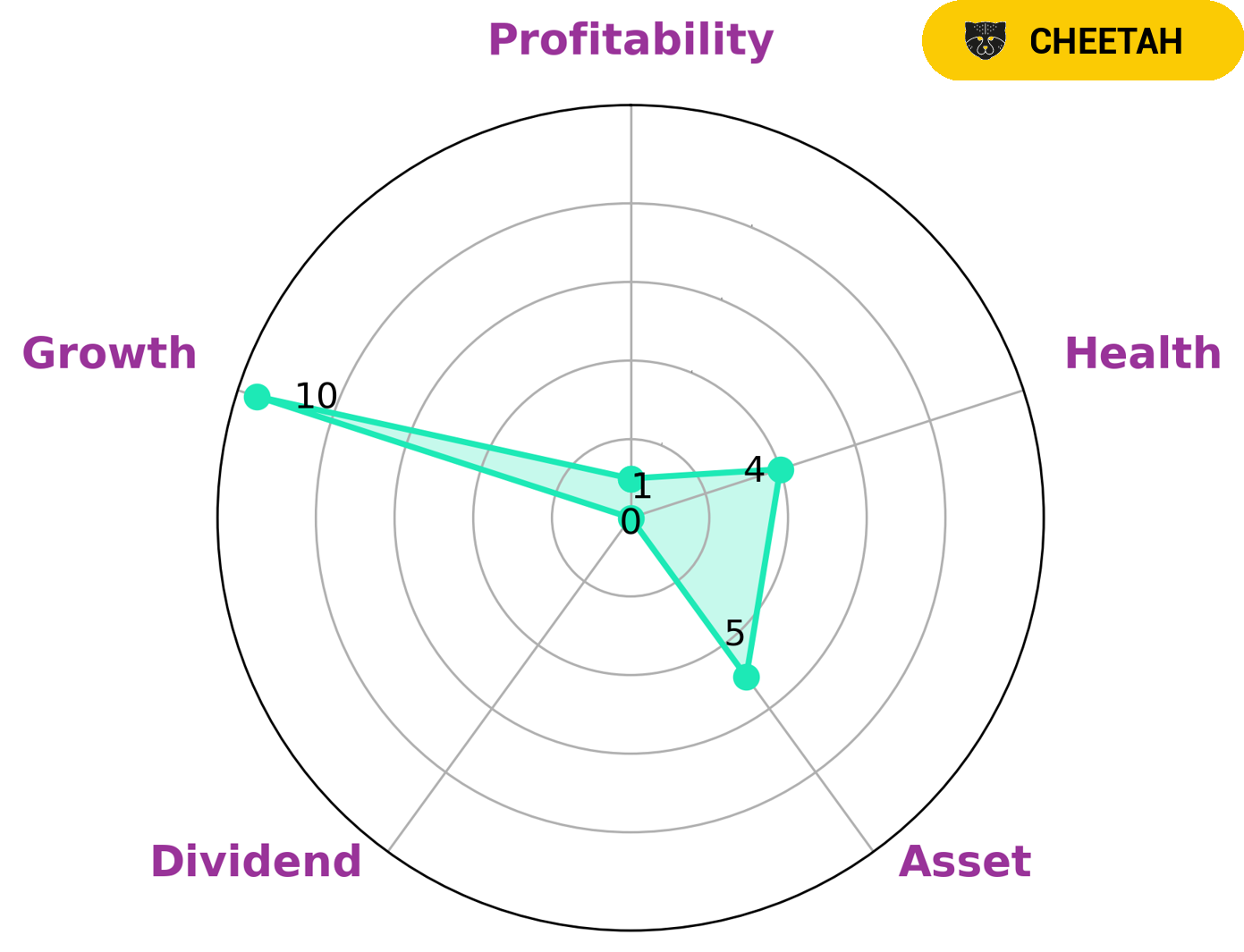

At GoodWhale, we conducted an analysis of OSISKO DEVELOPMENT‘s wellbeing, and based on the star chart, it has an intermediate health score of 4/10 considering its cashflows and debt. It is likely that OSISKO DEVELOPMENT can pay off debt and fund future operations. Furthermore, OSISKO DEVELOPMENT is classified as ‘cheetah’, a type of company that achieved high revenue or earnings growth but is considered less stable due to lower profitability. Given this information, investors interested in OSISKO DEVELOPMENT may be those looking for companies that are strong in growth, medium in asset and weak in dividend, profitability. As such, it would be beneficial to review their current financial statements and projections to ensure that their investments are well placed. More…

Peers

The company operates in the Province of Quebec and has its head office in Montreal. The company is listed on the Toronto Stock Exchange and the NASDAQ. Osisko Development Corp is engaged in the exploration and development of gold properties in North America. The company has a portfolio of gold properties in the United States, Canada and Mexico. The company’s principal assets are the Windfall Lake gold property located in the Abitibi greenstone belt in Quebec, Canada and the Goldex mine located in the Val-d’Or mining camp in Quebec, Canada.

– Xtra-Gold Resources Corp ($TSX:XTG)

Xtra-Gold Resources Corp is a Canadian-based gold exploration company with operations in Ghana, West Africa. The company has a market cap of 41.38M as of 2022 and a Return on Equity of -10.23%. Xtra-Gold Resources Corp is engaged in the business of acquiring, exploring, and developing gold properties. The company’s flagship property is the Kibi Gold Belt, which is located in Ghana and covers an area of approximately 1,000 square kilometers.

– Gold Springs Resource Corp ($TSX:GRC)

Gold Springs Resource Corp is a gold mining company with a market cap of $42.3 million as of 2022. The company has a return on equity of 3.46%. Gold Springs Resource Corp is engaged in the exploration and development of gold properties in the United States.

Summary

Osisko Development Corp. recently announced that it has secured a $51.8 million financing from the National Bank of Canada. This financing is intended to help fund the company’s current and upcoming projects, which will allow the firm to expand its assets and operations in the mineral exploration and development sector. This financing will allow Osisko to pursue its business objectives and further enhance its financial position. This financing provides Osisko with additional financial flexibility and support for its current and upcoming projects, making it an attractive investment opportunity for investors interested in the mineral exploration and development sector.

Recent Posts