Royal Gold Intrinsic Value – Analysts Issue ‘Hold’ Rating on Royal Gold, Stock

December 31, 2023

🌥️Trending News

Analysts have recently issued a ‘Hold’ rating on the stock of Royal Gold ($NASDAQ:RGLD), Inc., one of the world’s leading precious metals streaming and royalty companies. The average analyst rating for Royal Gold, Inc. stands at ‘Hold’, meaning there is little to no upside expectation for the stock in the near future. The company specializes in the acquisition and management of precious metal streams and royalties, and also provides consulting services related to the evaluation and management of mineral assets. Through its many investments, the company has become a leader in providing financial stability to its partners in the gold and silver mining industry. Despite this strong portfolio, the ‘Hold’ rating issued by analysts suggests a lack of bullish sentiment towards the stock. Investors may be more inclined to wait until a more favorable rating is issued before investing in Royal Gold, Inc.

However, given the company’s track record and its ability to consistently generate earnings, investors with a long-term horizon may still find it attractive.

Market Price

Analysts have issued a ‘Hold’ rating on the stock of Royal Gold, Inc. On Tuesday, the stock opened at $122.6 and closed at $123.4, a rise of 0.7% from its previous closing price of 122.4. This modest increase in share prices reflects the overall market sentiment that the stock is not expected to move significantly in either direction in the short-term. Investors are advised to pay close attention to any further developments in the company’s performance as well as any changes in the analyst opinion. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Royal Gold. More…

| Total Revenues | Net Income | Net Margin |

| 616.03 | 233.03 | 38.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Royal Gold. More…

| Operations | Investing | Financing |

| 415.73 | -209.2 | -225.87 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Royal Gold. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.4k | 535.38 | 43.41 |

Key Ratios Snapshot

Some of the financial key ratios for Royal Gold are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 7.6% | 15.6% | 49.7% |

| FCF Margin | ROE | ROA |

| 33.6% | 6.7% | 5.6% |

Analysis – Royal Gold Intrinsic Value

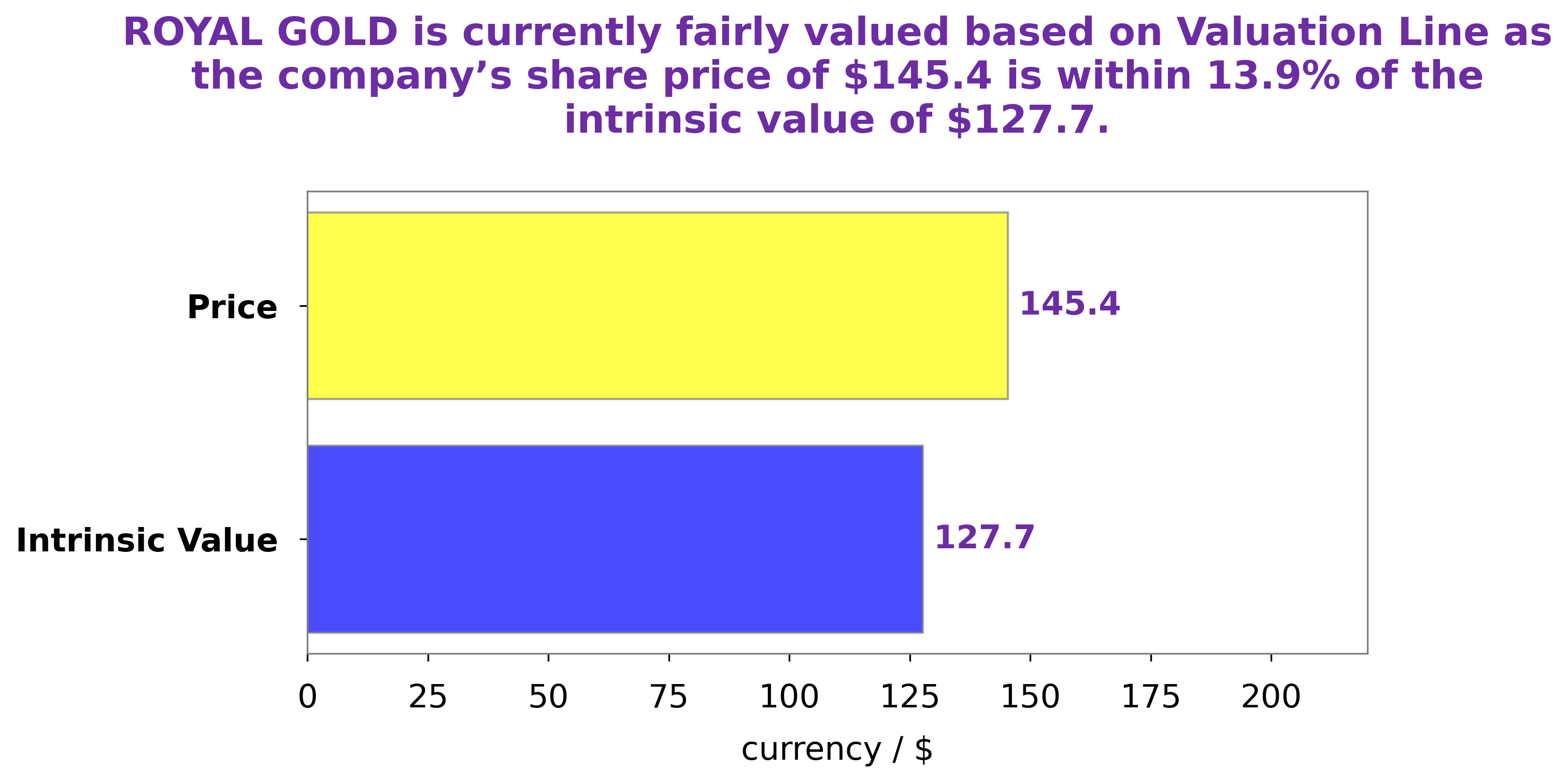

At GoodWhale, we conducted an in-depth analysis of ROYAL GOLD‘s financials and were able to identify a fair value of the shares around $114.1. This is the value we determined using our proprietary Valuation Line, which takes into account various factors such as the company’s growth potential and risk. However, the current market price for ROYAL GOLD stock is $123.4, which indicates that it is currently trading at a fair price that is overvalued by 8.1%. We believe this may be due to positive sentiment around the company and its prospects. Although the stock is trading at a premium right now, we believe that investors should take a closer look at the fundamentals of ROYAL GOLD before making any decisions. More…

Peers

The competition is fierce, but Royal Gold Inc. has managed to stay ahead of the pack thanks to its experienced team and cutting-edge technology.

– Rover Metals Corp ($TSXV:ROVR)

Rover Metals Corp is a Canadian company engaged in the exploration and development of mineral properties. The company has a market capitalization of $2.23 million and a return on equity of -21.65%. Rover Metals Corp is focused on the exploration and development of its mineral properties in Canada. The company’s primary asset is the Lac de Gras diamond property located in the Northwest Territories.

– Euro Ressources SA ($LTS:0JSG)

Euro Ressources S.A. is a France-based company engaged in the mining sector. The Company, through its subsidiaries, is engaged in the exploration and production of gold in Guyana and Suriname. The Company operates the Rosebel gold mine in Suriname. The Company also owns the Rouyn and Malartic properties located in Quebec, Canada.

– Alamos Gold Inc ($TSX:AGI)

Alamos Gold Inc is a gold mining company with operations in North America. The company has a market capitalization of $4.09 billion and a return on equity of 2.28%. Alamos Gold is engaged in the exploration, development, and production of gold. The company’s mines are located in Canada, Mexico, and Turkey. Alamos Gold also has a minority interest in a gold mine in Greece.

Summary

Royal Gold, Inc. is a precious metals streaming and royalty company engaged in the acquisition and management of precious metal streams, royalties, and similar production-based interests. Analysts have given Royal Gold an average rating of “Hold”. Investors should note that Royal Gold is dependent on the gold price and overall strength of the precious metals markets, as most of its revenue is derived from selling gold and silver.

Royal Gold also faces competition from its peers and the potential for political and regulatory risk. For those looking to invest in Royal Gold, they should understand the risks and rewards associated with investing in precious metals, as well as conduct thorough due diligence on the company’s portfolio of assets.

Recent Posts