Newmont Mining Presents a Wealth of Opportunities for Investors

May 6, 2023

Trending News ☀️

Newmont Mining presents a wealth of opportunities for investors. As one of the largest gold producers in the world and the largest gold producer in North America, Newmont Mining has been delivering a steady flow of profits for more than a century. With a proven track record of reliable performance, Newmont Mining is an excellent choice for investors looking to diversify their portfolios. NEWMONT CORPORATION ($NYSE:NEM) is a leading gold mining company with operations in many countries, including Australia, Peru, Ghana, Canada, Indonesia, and the United States. The company is engaged in the exploration and production of gold, copper, and silver. Newmont’s portfolio of operations, both in terms of geography and product mix, provides investors with a great deal of flexibility and diversification. The company has a wide range of gold mining operations spanning multiple continents.

Through its presence in various countries, it is well-positioned to take advantage of changes in gold prices and is able to capitalize on local opportunities. In addition to gold mining, Newmont also produces copper and silver, giving investors an even greater range of options to invest in. The company’s consistent performance over an extended period of time makes Newmont Mining an attractive investment for both long-term and short-term investors. With its proven track record and strong potential for future growth, Newmont Mining presents an excellent opportunity for investors who are looking to diversify their portfolios with a reliable and profitable investment.

Share Price

As an investor, one of the most attractive opportunities in the market today may be NEWMONT CORPORATION. On Friday, the stock opened at $48.6 and closed at $48.7, a slight 1.4% dip from its previous closing price of 49.4. This stock presents investors with an opportunity to gain exposure to a mining company that has a long history of success and industry leadership. NEWMONT CORPORATION offers investors access to a wide range of minerals, including gold, copper, zinc and nickel. The company is well established and its operations span across numerous countries, giving investors exposure to a diverse portfolio of resources.

Furthermore, NEWMONT CORPORATION has a strong track record of delivering consistent returns, making it an attractive option for those looking for consistent, reliable returns from the mining sector. Overall, NEWMONT CORPORATION provides investors with an excellent opportunity to gain access to a solid mining firm with a strong presence in the industry and a history of delivering solid returns. Investors should consider the potential benefits of investing in this stock as it continues to provide attractive opportunities for those looking to diversify their portfolio and gain exposure to the mining sector. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Newmont Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 11.57k | -526 | 2.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Newmont Corporation. More…

| Operations | Investing | Financing |

| 3.01k | -2.81k | -1.81k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Newmont Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 38.37k | 18.82k | 24.44 |

Key Ratios Snapshot

Some of the financial key ratios for Newmont Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 3.2% | -9.1% | 0.8% |

| FCF Margin | ROE | ROA |

| 6.8% | 0.3% | 0.1% |

Analysis

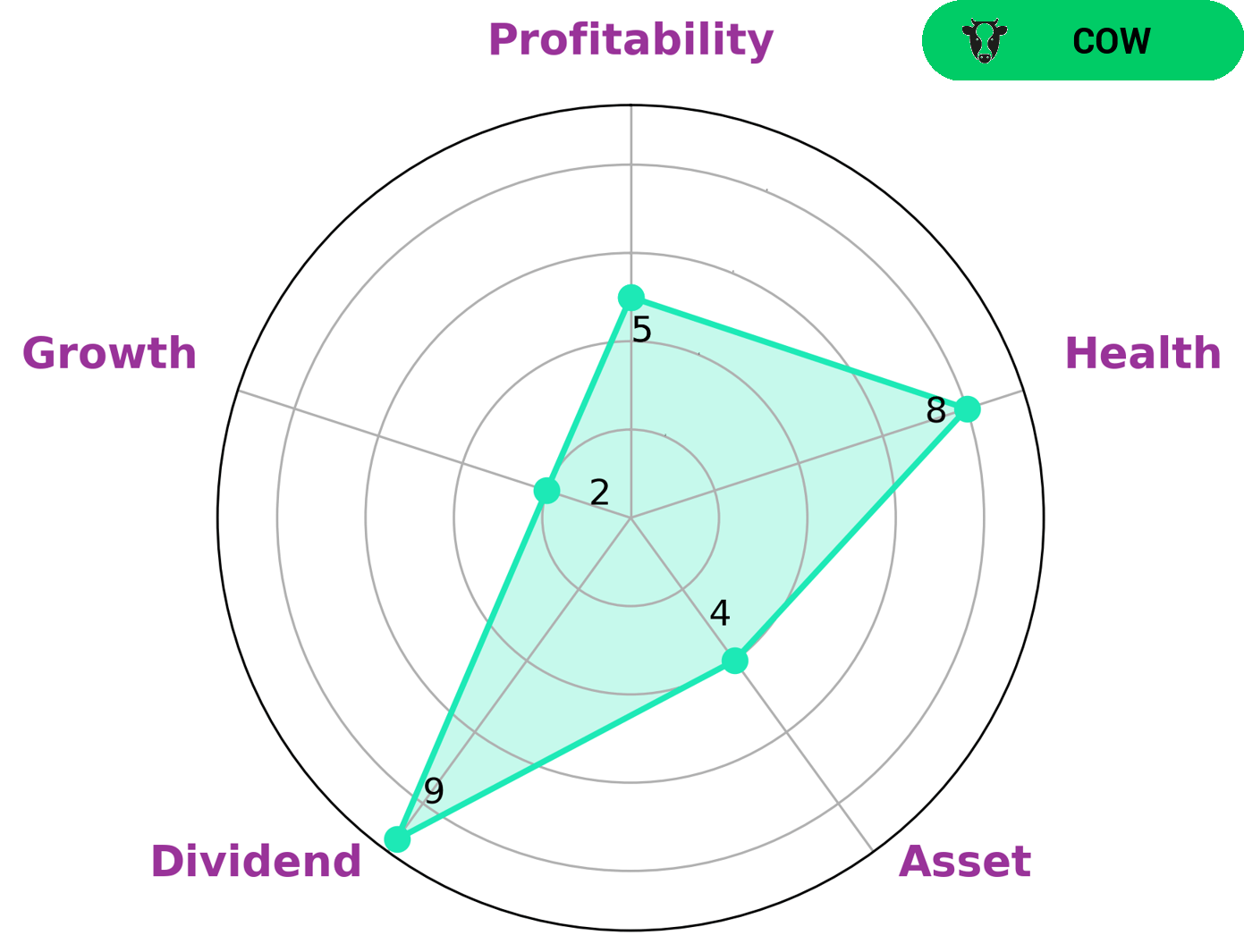

As GoodWhale, we have conducted an analysis of the financial information of NEWMONT CORPORATION. Our star chart shows that NEWMONT CORPORATION is classified as a ‘cow’, which we interpret as a company with a track record of paying out consistent and sustainable dividends. Therefore, this type of business may be attractive to investors who value dividend payments over capital growth. NEWMONT CORPORATION is strong in dividend, but medium in asset, profitability and growth. Despite this, they still have a high health score of 8/10 with regard to their cashflows and debt, indicating that they are capable of sustaining their operations even in times of economic crisis. More…

Peers

Newmont Corp is one of the world’s leading gold miners. Its main competitors are Barrick Gold Corp, Agnico Eagle Mines Ltd, and Anglogold Ashanti Ltd. Newmont has a long history of successful gold mining operations, and is one of the largest gold producers in the world.

– Barrick Gold Corp ($TSX:ABX)

Barrick Gold Corporation is a gold mining company that has operations in Argentina, Australia, Canada, Chile, the Dominican Republic, Papua New Guinea, Peru, Saudi Arabia, Tanzania, and the United States. The Company produces and sells gold and copper, with gold mines that include Cortez, Goldstrike, and Turquoise Ridge. Barrick also has a joint venture with Newmont Corporation. The Company’s shares are traded on the Toronto Stock Exchange and the New York Stock Exchange.

– Agnico Eagle Mines Ltd ($TSX:AEM)

Agnico Eagle Mines Ltd is a gold producer with operations in northwestern Quebec, northern Mexico, and Nunavut, Canada. The company has a market cap of 26.78 billion as of 2022 and a return on equity of 4.04%. Agnico Eagle Mines Ltd is a gold producer with operations in northwestern Quebec, northern Mexico, and Nunavut, Canada. The company has a market cap of 26.78 billion as of 2022 and a return on equity of 4.04%.

– Anglogold Ashanti Ltd ($LTS:0HFY)

Anglogold Ashanti Ltd is a gold mining company with a market cap of 5.28B as of 2022. The company has a return on equity of 15.08%. Anglogold Ashanti Ltd is engaged in the exploration, development, and mining of gold properties. The company was founded in 1944 and is headquartered in Johannesburg, South Africa.

Summary

Newmont Corporation, the world’s second-largest gold producer, is a great investment opportunity. Its stock has been on an upward trend this year and its profits have grown significantly. The company has solid fundamentals and a strong balance sheet. Its portfolio of mines and projects are located all over the world, which offers diversification and reduces risk.

Newmont also has an aggressive strategy for expanding production, increasing efficiency and reducing costs. With a long-term focus and planned investments, Newmont is well positioned to be a major player in the gold industry for years to come.

Recent Posts