Newmont Corporation Stock Fair Value – Newmont Sweetens Deal, Raises Valuation of Newcrest Mining to $19.5 Billion

April 11, 2023

Trending News 🌥️

Newmont Corporation ($NYSE:NEM) is a leading gold producer, with operations stretching across the globe. Recently, the company has sweetened its deal and raised the valuation of Newcrest Mining to $19.5 billion. The offer is believed to be one of the most generous in recent times and is an indication of the confidence Newmont has in the future of the mining industry. Newmont has a successful track record of managing assets and seeing returns from investments in gold mines and related services. The current offer goes above and beyond their usual practices, setting a new standard for potential investments in the sector.

This marks a major change from their standard approach, as the company is known for its conservative investment decisions. The new agreement will bring significant returns to Newmont, as well as the shareholders of Newcrest Mining. The deal will provide a substantial boost to Newcrest’s share price, and it could prove to be a win-win scenario for both parties. This agreement will further strengthen the relationship between the two companies and could open up more opportunities for joint ventures in the future.

Price History

On Monday, Newmont Corporation sweetened the deal for its merger with Newcrest Mining, raising the combined company’s valuation to a staggering $19.5 billion. This move is an effort by Newmont to gain a larger foothold in the Australian gold mining industry. With this move, Newmont’s stock opened at $51.3 and closed at $51.1, representing a 1.8% drop from its prior closing price of $52.0.

The offer has been received positively by shareholders, as it is expected to create value for both companies and their shareholders. This new development undoubtedly indicates that Newmont is striving towards becoming even more of a major player in the gold mining industry. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Newmont Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 11.91k | -429 | 3.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Newmont Corporation. More…

| Operations | Investing | Financing |

| 3.22k | -2.98k | -2.36k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Newmont Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 38.48k | 18.95k | 24.41 |

Key Ratios Snapshot

Some of the financial key ratios for Newmont Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 6.9% | 0.6% | 1.5% |

| FCF Margin | ROE | ROA |

| 9.1% | 0.5% | 0.3% |

Analysis – Newmont Corporation Stock Fair Value

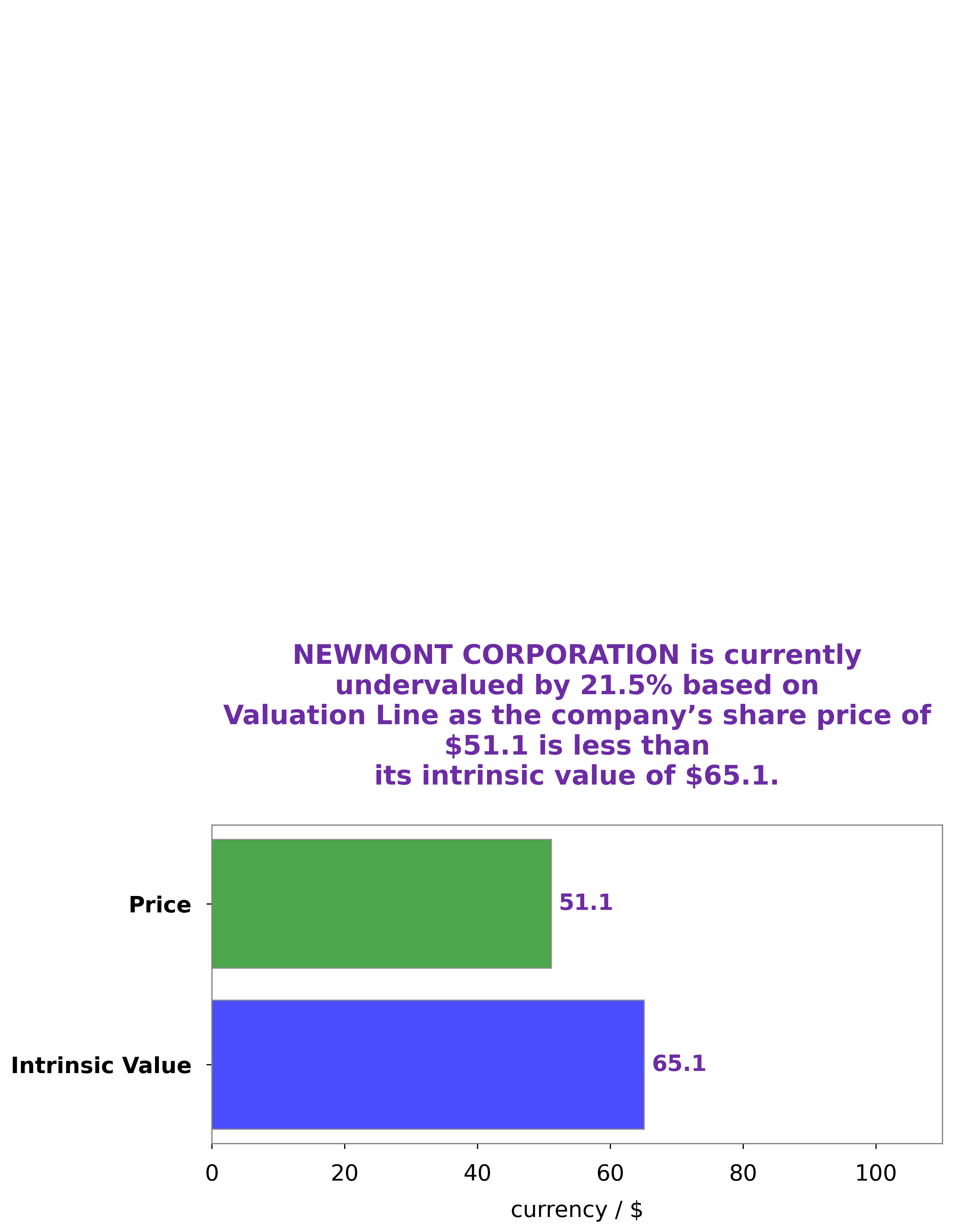

At GoodWhale, we have conducted an in-depth analysis of the wellbeing of Newmont Corporation. Through our proprietary Valuation Line, we have found that the fair value of Newmont Corporation shares is around $65.1. This means that the current stock price of $51.1 is undervalued by 21.5%. At GoodWhale, we take stock analysis seriously and strive to provide people with the most up-to-date and accurate information to help them make the best investment decisions. We are confident that our analysis of Newmont Corporation is accurate and can help people make a sound investment decision. More…

Peers

Newmont Corp is one of the world’s leading gold miners. Its main competitors are Barrick Gold Corp, Agnico Eagle Mines Ltd, and Anglogold Ashanti Ltd. Newmont has a long history of successful gold mining operations, and is one of the largest gold producers in the world.

– Barrick Gold Corp ($TSX:ABX)

Barrick Gold Corporation is a gold mining company that has operations in Argentina, Australia, Canada, Chile, the Dominican Republic, Papua New Guinea, Peru, Saudi Arabia, Tanzania, and the United States. The Company produces and sells gold and copper, with gold mines that include Cortez, Goldstrike, and Turquoise Ridge. Barrick also has a joint venture with Newmont Corporation. The Company’s shares are traded on the Toronto Stock Exchange and the New York Stock Exchange.

– Agnico Eagle Mines Ltd ($TSX:AEM)

Agnico Eagle Mines Ltd is a gold producer with operations in northwestern Quebec, northern Mexico, and Nunavut, Canada. The company has a market cap of 26.78 billion as of 2022 and a return on equity of 4.04%. Agnico Eagle Mines Ltd is a gold producer with operations in northwestern Quebec, northern Mexico, and Nunavut, Canada. The company has a market cap of 26.78 billion as of 2022 and a return on equity of 4.04%.

– Anglogold Ashanti Ltd ($LTS:0HFY)

Anglogold Ashanti Ltd is a gold mining company with a market cap of 5.28B as of 2022. The company has a return on equity of 15.08%. Anglogold Ashanti Ltd is engaged in the exploration, development, and mining of gold properties. The company was founded in 1944 and is headquartered in Johannesburg, South Africa.

Summary

Newmont Corporation is a leading gold mining company with operations in the U.S., Australia, Peru, Ghana, and Suriname. The company recently made a sweetened offer to acquire Newcrest Mining, which values the latter at $19.5 billion. This investment opportunity provides potential investors with access to Newmont’s considerable reserves and resources as well as a strong foothold in the gold mining industry. Newmont’s financials are also strong with robust cash flows, long-term debt/equity ratios and a high return on equity.

Additionally, the company has recently implemented cost-cutting measures and improved its operational efficiency. All in all, Newmont is well-positioned to continue its growth trajectory and provide investors with a stable and profitable investment opportunity.

Recent Posts