Laurion Mineral Exploration Retains Precision Geosurveys for 882 Line-Km Gradient Magnetic Survey in Ishkoday

May 25, 2023

Trending News ☀️

Laurion Mineral Exploration ($TSXV:LME) has retained Precision Geosurveys to conduct an 882 Line-Km Gradient Magnetic Survey at Ishkoday. Laurion Mineral Exploration is a Canadian based mineral exploration company focused on the acquisition, exploration and development of mineral properties in Canada. The company is listed on the TSX Venture Exchange and is committed to discovering world class mineral properties. Precision Geosurveys is a leading provider of surveying services for the mining industry.

With a team of experienced geophysicists and engineers, Precision Geosurveys is able to provide comprehensive and reliable surveying services for clients. Once complete, Laurion Mineral Exploration will be able to assess the potential of the area with more accuracy and confidence. The results of the survey will be used to direct their exploration activities and help guide their decision making as they move forward with their exploration efforts.

Share Price

This survey is intended to help provide an overall understanding of the local geology and to aid in the discovery of new mineral resources. In response to this news, LAURION stock opened at CA$0.3 and closed at CA$0.3, down 2.8% from the previous closing price of 0.4. The goal of the survey is to improve our understanding of the geological features and structures at depth and to help guide exploration going forward. It also aims to identify any untapped mineral resources that may exist in the area. The survey will be conducted over an 882 line-km area, with the majority of the survey lines running north-south.

The survey will be conducted using a helicopter-borne sensor system that will measure the variations in the Earth’s magnetic field across a wide area. This data will then be used to create a detailed 3D image of the subsurface geology. Overall, the survey is expected to provide valuable insight into the geological characteristics of Ishkoday and ultimately aid in the discovery of new mineral resources. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for LME. More…

| Total Revenues | Net Income | Net Margin |

| 0 | -4.65 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for LME. More…

| Operations | Investing | Financing |

| -4.44 | 0.05 | 3.79 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for LME. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 9.21 | 0.11 | 0.04 |

Key Ratios Snapshot

Some of the financial key ratios for LME are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 0.0% | – | – |

| FCF Margin | ROE | ROA |

| – | -31.6% | -32.0% |

Analysis

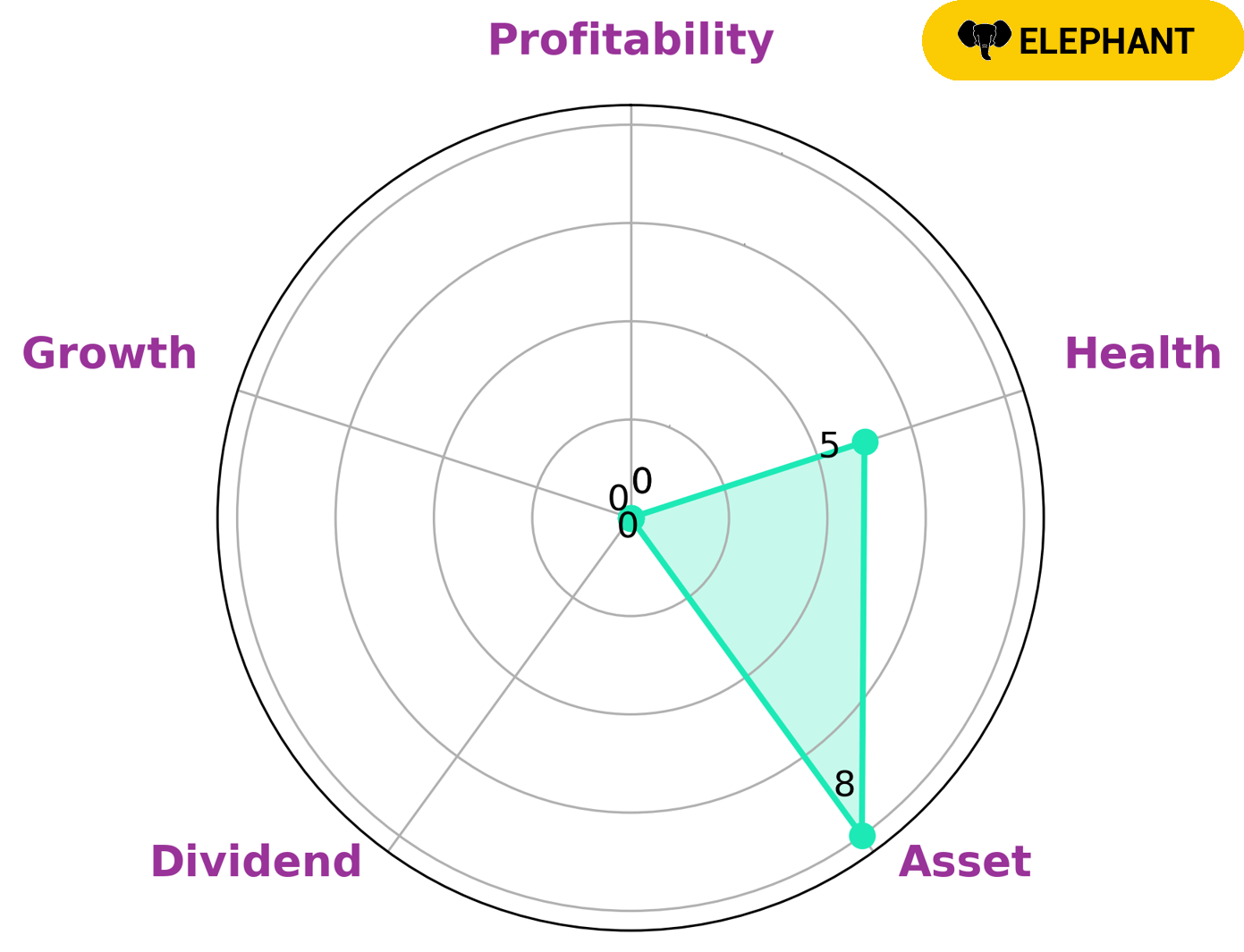

GoodWhale has performed an analysis of LAURION MINERAL EXPLORATION’s wellbeing, and the results are in. According to our Star Chart, LAURION MINERAL EXPLORATION is strong in terms of assets, but weak in dividend, growth, and profitability. Based on this analysis, we classify LAURION MINERAL EXPLORATION as an ‘elephant’—a type of company that is rich in assets after deducting liabilities. This would make it attractive to investors looking for more robust portfolios and a higher yield on their investments. Finally, LAURION MINERAL EXPLORATION has an intermediate health score of 5/10 with regard to its cashflows and debt. This may indicate that the company might be able to pay off debt and fund future operations. More…

Peers

The company’s primary focus is on gold properties located in the Abitibi Greenstone Belt in Ontario and Quebec, Canada. Laurion’s competitors include Galway Gold Inc, 79North Inc, Slam Exploration Ltd, among others.

– Galway Gold Inc ($TSXV:GLW)

Galway Gold Inc is a Canadian company that primarily focuses on the exploration and development of gold properties in the Republic of Ireland. The company’s flagship project is the Tynagh-Clontuskert property, which is located in County Galway, Ireland. As of 2022, the company has a market cap of 3.54M and a ROE of -77.06%. Despite its negative ROE, the company’s market cap indicates that investors are still confident in its future prospects. Galway Gold is currently in the process of advancing its Tynagh-Clontuskert property towards production, which is expected to begin in 2023.

– 79North Inc ($OTCPK:SVNTF)

79North Inc is a publicly traded company with a market capitalization of $1.61 million as of 2022. The company has a negative return on equity of 272.05%. 79North Inc is engaged in the business of providing management and consulting services to businesses and individuals.

– Slam Exploration Ltd ($TSXV:SXL)

Slam Exploration Ltd is a Canadian-based exploration and development company with a focus on gold properties in the Atlantic provinces of Canada. The company has a market capitalization of $2.69 million and a return on equity of -21.02%. Slam Exploration Ltd is engaged in the exploration and development of gold properties in the Atlantic provinces of Canada. The company’s flagship property is the Tintamarre Property, located in the Baie Verte mining district of Newfoundland and Labrador, Canada.

Summary

Laurion Mineral Exploration has recently retained Precision Geosurveys to conduct a 882 line-km survey of gradient magnetic survey in Ishkoday. The survey will provide valuable insight into the subsurface geology of the Ishkoday area, aiding investors in exploring the potential mineral resources. The results will be used in mineral exploration assessments, helping investors gain a better understanding of the estimated production costs for potential ore deposits.

This information will be a key factor in determining whether or not it is worth investing in Laurion Mineral Exploration. The survey results are expected to be available within the next few months, allowing investors to make informed decisions on investment opportunities.

Recent Posts