Kinross Gold Stock Intrinsic Value – Kinross Gold Corporation Stock Price Up 2.11% on Friday, 03/24/23, With Bullish Outlook for 2023.

March 30, 2023

Trending News 🌥️

Investors in Kinross Gold ($TSX:K) Corporation saw their stock price increase by 2.11% on Friday, 03/24/23, leading to a bullish outlook for the market’s outlook of the company’s performance in the coming year of 2023. This suggests that the stock price will continue to move higher over the next year, likely due to investors feeling confident in the company’s potential. The increase in stock price was likely driven by investors’ confidence in the company’s near-term outlook, as well as their expectations for strong performance in the upcoming year. The company has recently released positive financial results and news, leading to a more positive sentiment among investors.

Furthermore, investors have also taken into account Kinross Gold Corporation’s strategic plans for growth, which have been well received in the market. Overall, it appears that investors are feeling optimistic about Kinross Gold Corporation’s future prospects. This could lead to further gains in Kinross Gold Corporation’s share price over the course of the coming year.

Share Price

The bullish outlook suggests that in the coming year the stock will continue to rise. At the time of writing, news regarding the stock was mostly positive. On Monday, KINROSS GOLD opened at CA$5.8 and closed at CA$6.0, up by 0.7% from its prior closing price of CA$6.0. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Kinross Gold. More…

| Total Revenues | Net Income | Net Margin |

| 3.46k | -605.2 | 0.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Kinross Gold. More…

| Operations | Investing | Financing |

| 1.05k | -1.6k | 437.5 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Kinross Gold. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 10.4k | 4.51k | 4.77 |

Key Ratios Snapshot

Some of the financial key ratios for Kinross Gold are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -0.4% | -50.3% | 5.8% |

| FCF Margin | ROE | ROA |

| 7.0% | 2.1% | 1.2% |

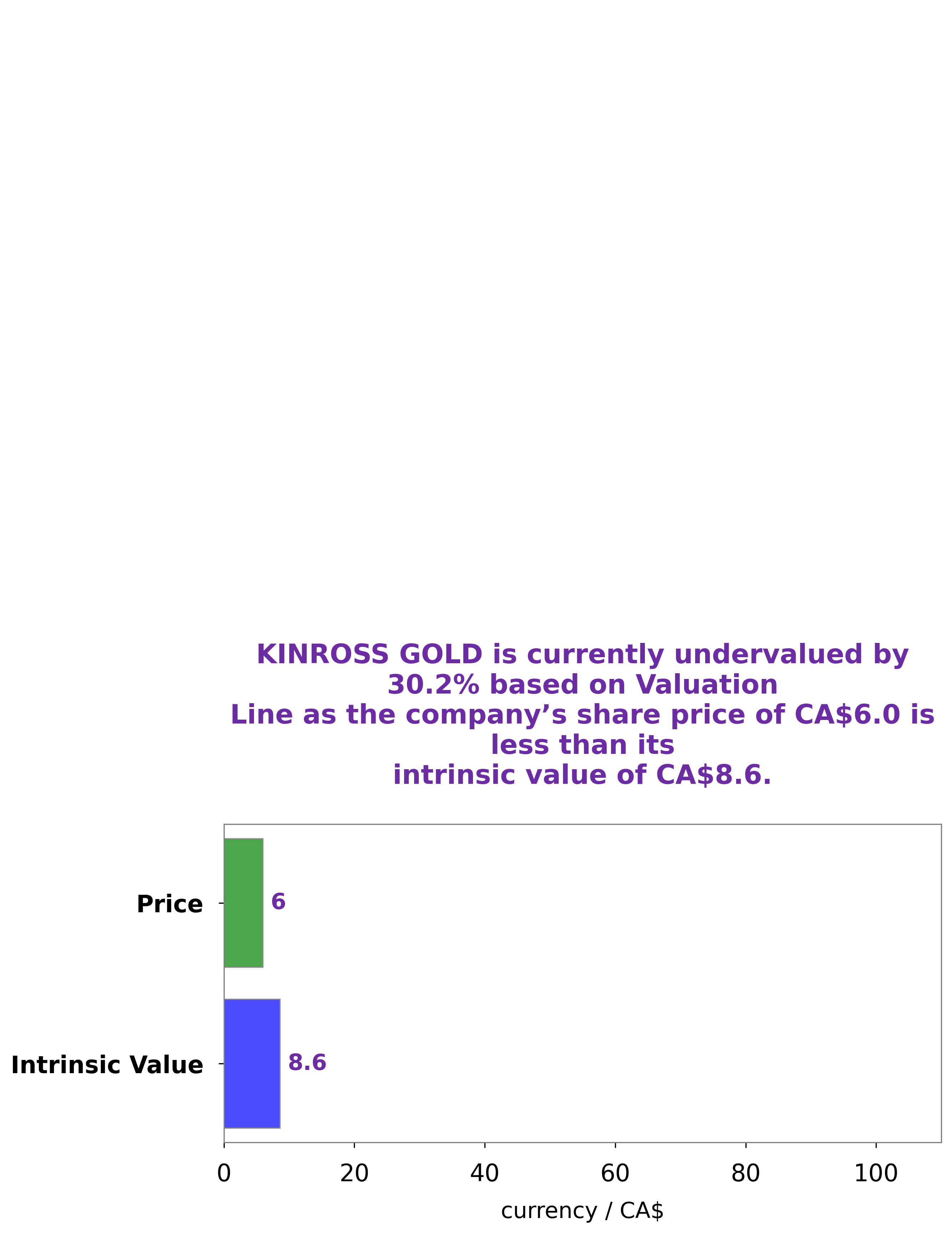

Analysis – Kinross Gold Stock Intrinsic Value

GoodWhale has analyzed KINROSS GOLD‘s fundamentals and found that the intrinsic value of its share is around CA$8.6. This is calculated by our proprietary Valuation Line, which takes into account a number of factors such as the company’s current cash flow, future earnings potential, and dividend payments. At the current price of CA$6.0, KINROSS GOLD is undervalued by 30.6%. We believe there is an opportunity for investors to buy KINROSS GOLD shares at a discount, and potentially benefit from future returns. More…

Peers

The company is headquartered in Toronto, Canada. Kinross was founded in 1993, and it is one of the world’s largest gold mining companies. The company’s competitors include Agnico Eagle Mines Ltd, Angus Gold Inc, and Cache Exploration Inc.

– Agnico Eagle Mines Ltd ($TSX:AEM)

Agnico Eagle Mines Ltd. is a Canadian gold mining company with mines and projects in Canada, Finland, Mexico and the United States. The company has a market capitalization of $25.73 billion as of 2022 and a return on equity of 4.04%. Agnico Eagle is one of the world’s largest gold producers, with a diversified portfolio of mines and projects. The company’s primary business is gold mining, and it also has significant operations in base metals mining and exploration.

– Angus Gold Inc ($TSXV:GUS)

Angus Gold Inc is a Canadian gold mining company with operations in Nunavut and Saskatchewan. It has a market capitalization of $31.14 million and a return on equity of -129.48%. The company primarily explores for and develops gold properties. It also holds interests in platinum and palladium properties.

– Cache Exploration Inc ($OTCPK:CEXPF)

The company’s market cap is 5.16k as of 2022, and its ROE is -53.68%. The company is engaged in the exploration and development of oil and gas properties.

Summary

Kinross Gold Corporation saw its stock price rise 2.11% on Friday, 03/24/23, giving investors hope for a strong return in the coming year. Analysts have been optimistic over the company’s outlook for 2023, due to their versatility in the gold mining industry and their ability to quickly adapt to changing market conditions. The company has a history of prudent management and sound capital allocation, making them well-positioned to benefit from a resurgent gold market.

The company has a strong balance sheet and an experienced management team at the helm, allowing them to make smart investments as they expand. With gold prices continuing to climb and the gold market showing signs of stability, Kinross Gold is an attractive stock to watch in the months ahead.

Recent Posts