Kestra Private Wealth Services LLC Invests Heavily in Coeur Mining,

April 26, 2023

Trending News ☀️

Kestra Private Wealth Services LLC recently made a notable investment in Coeur Mining ($NYSE:CDE), Inc., a gold and silver production company with extensive operations in North America and Mexico. According to Defense World, Kestra holds a stake of $96,000 in the company. Coeur Mining, Inc. is a rapidly growing mining corporation with mines located throughout North America and Mexico. The company specializes in the production of both gold and silver, as well as other precious metals.

With such a large stake held by Kestra, it is likely that the company will continue to experience growth in the near future. This could be an exciting opportunity for investors looking to benefit from the success of one of the leading mining companies in the world.

Price History

On Monday, Coeur Mining, Inc. saw their stock open at $3.6 and close at $3.6, a 0.6% increase from the previous closing price of $3.6. This increase was a result of Kestra Private Wealth Services LLC investing heavily in Coeur Mining, Inc. The details of the investment have not yet been disclosed, but it is expected to be a significant contribution to Coeur Mining’s operations. Kestra Private Wealth Services LLC has a long history of successfully investing in a wide range of companies and this investment is further proof of their commitment to the success of Coeur Mining, Inc. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Coeur Mining. More…

| Total Revenues | Net Income | Net Margin |

| 785.64 | -78.11 | -10.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Coeur Mining. More…

| Operations | Investing | Financing |

| 25.62 | -146.16 | 125.03 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Coeur Mining. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.85k | 957.13 | 3.01 |

Key Ratios Snapshot

Some of the financial key ratios for Coeur Mining are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 3.4% | 27.0% | -5.3% |

| FCF Margin | ROE | ROA |

| -41.6% | -3.0% | -1.4% |

Analysis

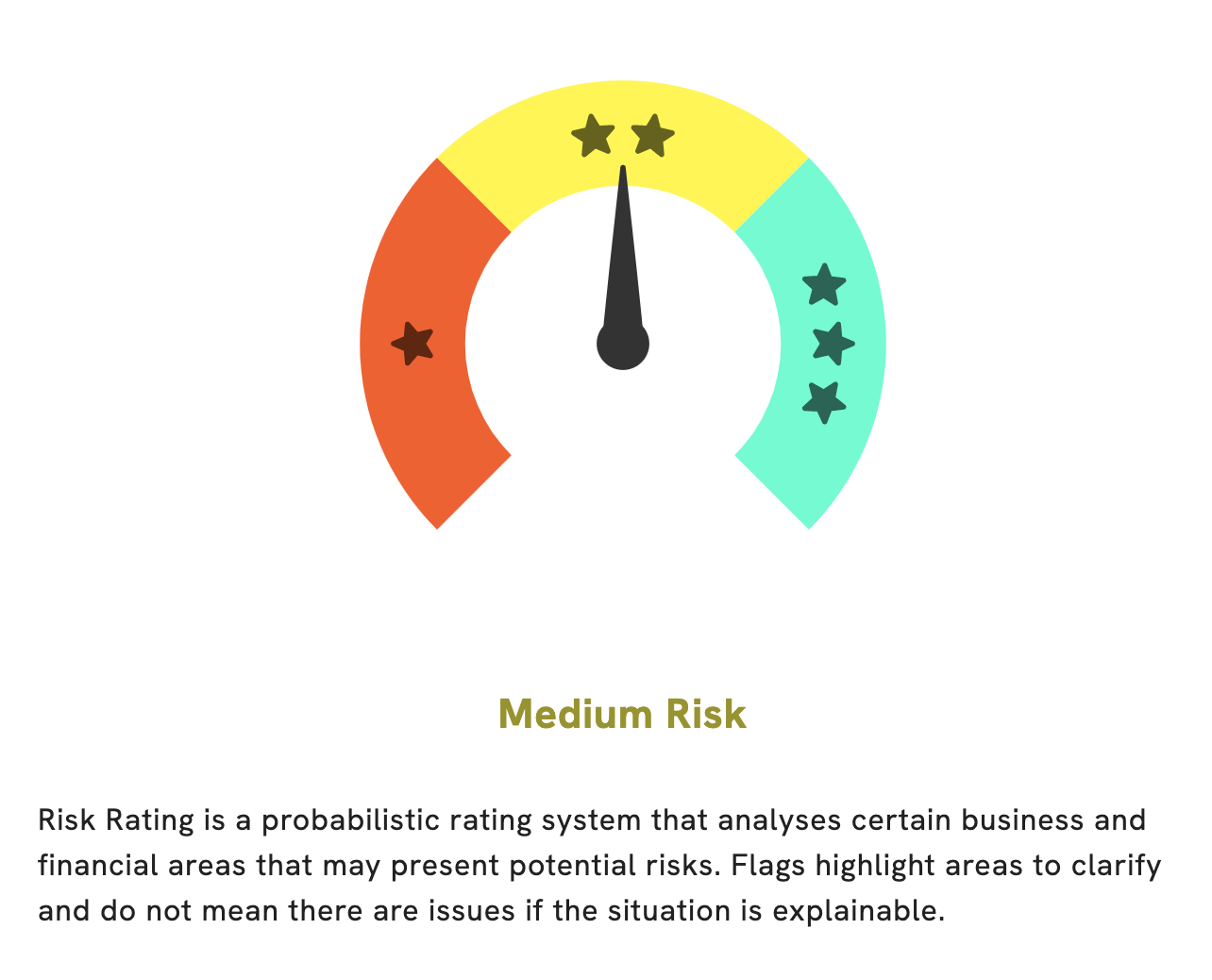

At GoodWhale, we recently conducted an analysis of COEUR MINING‘s financials. Based on our Risk Rating, we have determined that COEUR MINING is a medium risk investment in terms of financial and business aspects. We have also detected two risk warnings in the income sheet and balance sheet. If you would like to learn more about these warnings and understand the associated risks, please sign up with GoodWhale for more detailed information. Our team of experts is here to provide you with the necessary insights and advice for making a sound investment decision. More…

Peers

The company operates mines and projects in the United States, Mexico, Bolivia, and Argentina. The company’s primary competitors in the gold mining industry are Mining Global Inc, Hochschild Mining PLC, and Metals Exploration PLC.

– Mining Global Inc ($OTCPK:MNGG)

Mining Global Inc is a Canadian company that is engaged in the business of mineral exploration and development. The company has a market capitalization of 5.78 million as of 2022 and a return on equity of 3.18%. Mining Global Inc is focused on the exploration and development of gold and silver projects in the Americas. The company’s primary asset is the San Juan Silver Property, located in the San Juan Mountains of Colorado, USA.

– Hochschild Mining PLC ($LSE:HOC)

Hochschild Mining PLC is a precious metals mining company with a focus on silver production. The company has a market capitalization of 298.56 million as of 2022 and a return on equity of 6.23%. Hochschild Mining PLC operates mines in Peru, Mexico, and Argentina. The company was founded in 1911 and is headquartered in London, the United Kingdom.

– Metals Exploration PLC ($LSE:MTL)

Metals Exploration PLC is a UK-based company engaged in the exploration, development, and production of minerals, primarily gold. The company has a market capitalization of 17.23 million as of 2022 and a return on equity of 130.94%. Metals Exploration is focused on the development of its flagship property, the Runruno Gold-Molybdenum Project in the Philippines. The company also has several other exploration projects in the Philippines, as well as in Papua New Guinea, Indonesia, and Fiji.

Summary

Coeur Mining, Inc. (CDE) has recently seen rising investor interest, with Kestra Private Wealth Services LLC reporting a $96,000 stake in the company. Analysts suggest that this is due to the company’s low cost production and strong operational performance. Furthermore, Coeur Mining Inc has established itself as an experienced leader in the silver and gold mining industry and has continued to expand into new markets. Its operations are spread across the United States, Mexico, Bolivia, and Argentina.

Investors are also encouraged by the company’s commitment to environmental stewardship, with their focus on responsible mining practices and its active engagement with local communities. Overall, Coeur Mining Inc appears to be a strong investment opportunity for those looking to diversify their portfolio with a thriving mining stock.

Recent Posts