Centerra Gold Stock Intrinsic Value – Investors of Centerra Gold Investigated by Pomerantz LLP on May 28, 2023

May 31, 2023

🌥️Trending News

On May 28, 2023, Pomerantz LLP announced that they have launched an investigation on behalf of investors in Centerra Gold ($TSX:CG) Inc., a Toronto-based gold mining company. Centerra Gold is dedicated to producing and selling gold and other precious metals, as well as other minerals. It operates across the globe, primarily in Canada, the United States, Kyrgyzstan, and Armenia. The investigation from Pomerantz LLP follows reports that Centerra Gold Inc. may have engaged in fraudulent activities in relation to their investors. It is unclear at this time what these activities are or if they are accurate.

Pomerantz LLP is now looking into these allegations to ensure that investors have not been taken advantage of. Pomerantz LLP is a well-respected firm and will be providing valuable information on the situation as it unfolds. The investigation could prove to be beneficial for Centerra Gold Inc. or for its investors depending on the findings. It is important to remain informed and keep up to date on the proceedings of this case.

Price History

The stock opened at CA$6.9 and closed at CA$7.0, an increase of 1.0% from its prior closing price of 6.9. It was the first time in months that the stock had risen, and this news provided a glimmer of hope for investors who have been waiting for a recovery in the price of the stock. It is unclear at this point what the investigation will uncover and whether or not it will have any long-term effect on the stock value. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Centerra Gold. More…

| Total Revenues | Net Income | Net Margin |

| 781.5 | -240.06 | -19.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Centerra Gold. More…

| Operations | Investing | Financing |

| -130.05 | -69.71 | -156.61 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Centerra Gold. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.22k | 495.84 | 7.88 |

Key Ratios Snapshot

Some of the financial key ratios for Centerra Gold are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -18.0% | -9.7% | -28.8% |

| FCF Margin | ROE | ROA |

| -25.3% | -8.0% | -6.3% |

Analysis – Centerra Gold Stock Intrinsic Value

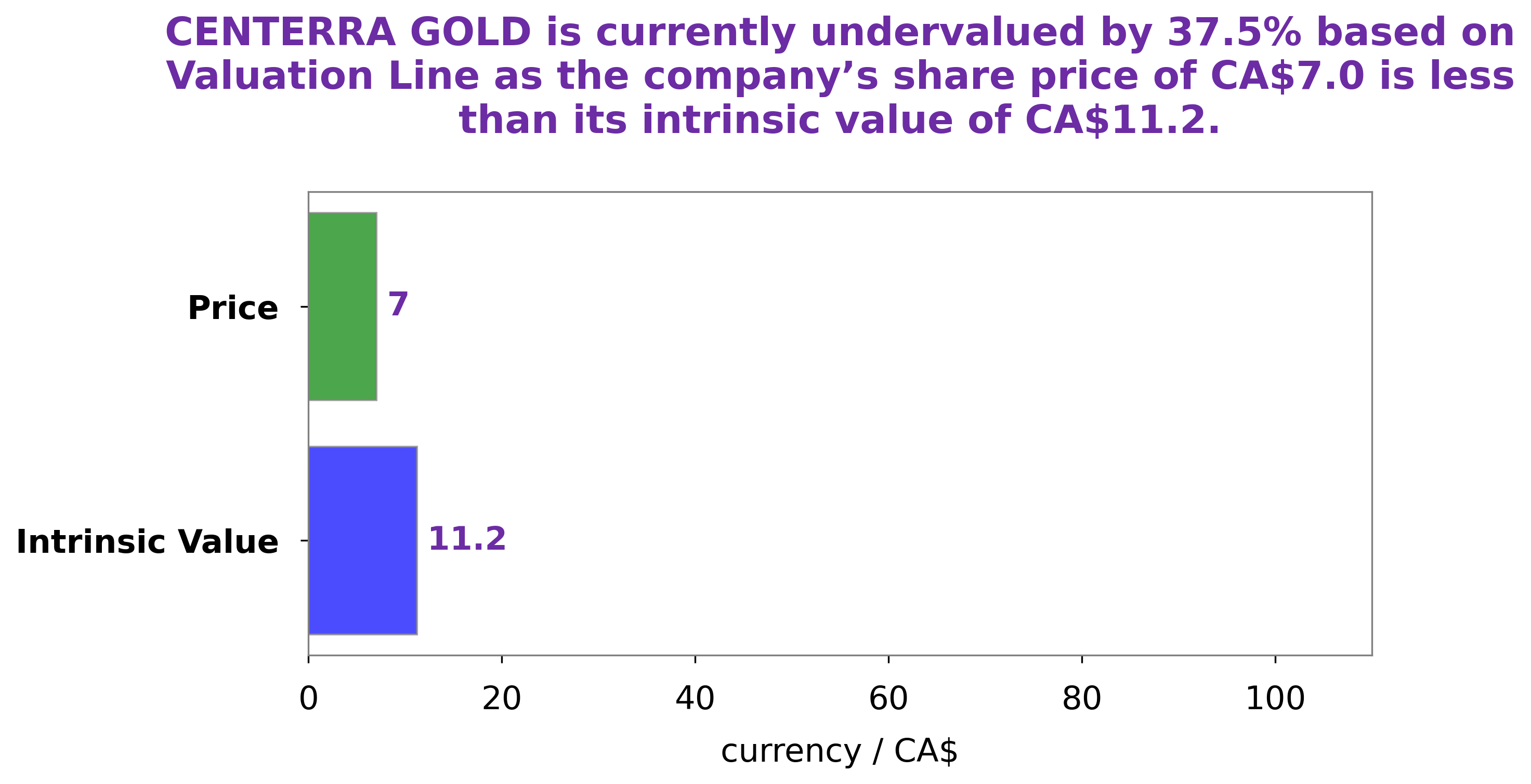

At GoodWhale, we recently conducted an analysis of CENTERRA GOLD‘s fundamentals. Based on our proprietary Valuation Line, we determined that the fair value of a share of CENTERRA GOLD is around CA$11.2. This means that the current stock price of CA$7.0 represents an undervaluation of 37.5%. This presents an attractive opportunity for investors looking for good value in the market. We believe that investing in CENTERRA GOLD at its current price is a wise financial decision and could result in significant returns in the future. More…

Peers

The competition between Centerra Gold Inc and its competitors is fierce. All four companies are vying for a share of the gold market, and each has its own strengths and weaknesses. Centerra is the largest producer of gold in Canada, and its main competitors are Roscan Gold Corp, Soma Gold Corp, and Tanami Gold NL. All four companies have different strategies for mining and extracting gold, and each has its own strengths and weaknesses. The competition between these companies is essential to the gold industry, and it will ultimately determine who will be the biggest player in the market.

– Roscan Gold Corp ($TSXV:ROS)

Roscan Gold Corp. is a Canadian gold exploration company. The company has a market capitalization of $62.54 million as of 2022 and a negative return on equity of 1069.64%. Roscan Gold Corp. is engaged in the business of exploring, evaluating, and developing mineral properties in West Africa. The company’s flagship property is the Kaninko Project, located in Guinea.

– Soma Gold Corp ($TSXV:SOMA)

Soma Gold Corp is a Canadian precious metals mining company with a focus on gold and silver projects in Colombia. The company has a market capitalization of $26.41 million and a return on equity of 168.84%. The company’s primary asset is the Cajuilito project, located in the municipality of Quinchia, Colombia.

– Tanami Gold NL ($ASX:TAM)

Tanami Gold NL is an Australian gold mining company with a market capitalisation of $45.83 million as of 2022. The company has a return on equity of 11.77%. Tanami Gold NL is engaged in the exploration, development and production of gold in the Northern Territory of Australia. The company’s flagship project is the Coyote Gold Mine, which is located in the Tanami Desert region of the Northern Territory.

Summary

Investors of Centerra Gold Inc. may have experienced losses due to potential violations of federal securities laws. Pomerantz LLP is conducting an investigation to determine whether the company or its officers or directors have engaged in securities fraud or other violations of law. Factors being examined include the accuracy of financial statements, disclosure issues, and potential insider trading. Investors are strongly encouraged to contact Pomerantz LLP if they have any questions or would like to discuss their legal rights and remedies.

Recent Posts