AEM Intrinsic Value – Agnico Eagle Mines Limited Stock Goes Ex-Dividend in Just Four Days – Time to Cash In!

May 27, 2023

Trending News 🌧️

Agnico Eagle Mines ($TSX:AEM) Limited (TSE: AEM) is an established gold producer operating nine mines in Canada, Finland, and Mexico with exploration and development activities in each of these regions, as well as in the United States and Sweden. In just four days, Agnico Eagle Mines Limited (TSE: AEM) will go ex-dividend, which is great news for dividend enthusiasts like us at Simply Wall St! The company has one of the highest dividend yields among gold producers in the industry. This is a great opportunity for investors to cash in on the stock’s potential. Agnico Eagle Mines also has a strong track record of increasing its dividend payments. This is a testament to its commitment to providing shareholders with a steady stream of income.

Additionally, the company’s stock price has been steadily increasing over the past five years, making it an attractive pick for growth-oriented investors. All things considered, Agnico Eagle Mines Limited (TSE: AEM) is a great option for both dividend investors and growth investors. With its ex-dividend date just four days away, now is the perfect time to cash in on its potential.

Dividends

The company has been issuing annual dividends per share over the last three years, amounting to 1.6 USD, 1.6 USD and 1.4 USD respectively. Currently, their dividend yields from 2021 to 2023 are 2.28%, 2.25% and 1.8%, resulting in an average dividend yield of 2.11%. If you’re looking for a dividend stock, AGNICO EAGLE MINES could be a great option to consider. Be sure to take advantage of these great returns in just four days!

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for AEM. More…

| Total Revenues | Net Income | Net Margin |

| 5.93k | 2.37k | 21.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for AEM. More…

| Operations | Investing | Financing |

| 2.24k | -2.64k | 89.44 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for AEM. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 29.65k | 9.86k | 40.03 |

Key Ratios Snapshot

Some of the financial key ratios for AEM are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 31.0% | 48.2% | 49.7% |

| FCF Margin | ROE | ROA |

| 10.3% | 10.2% | 6.2% |

Price History

On Friday, the stock opened at CA$70.7 and closed at CA$69.4, down by 0.3% from last closing price of 69.7. This could be an opportunity for investors to cash in before the ex-dividend date. Investors should take into consideration other factors such as the earnings outlook for the company before deciding to invest in the stock. Live Quote…

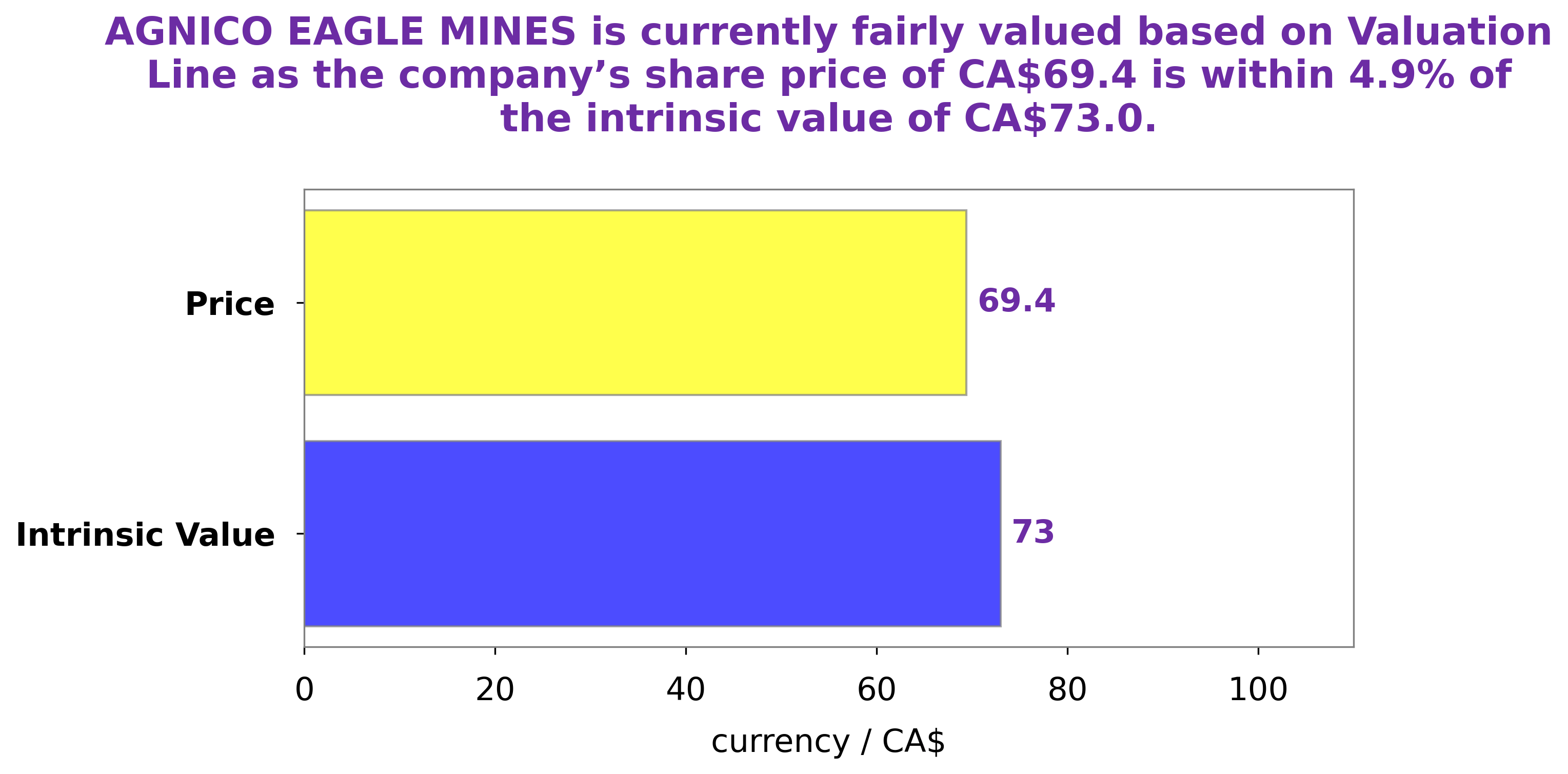

Analysis – AEM Intrinsic Value

At GoodWhale, we have conducted an analysis of AGNICO EAGLE MINES’s wellbeing. The results of this analysis have revealed that the current fair value of an AGNICO EAGLE MINES share is around CA$73.0, as calculated by our proprietary Valuation Line. This figure is slightly higher than the current market price of CA$69.4, meaning that AGNICO EAGLE MINES stock is undervalued by approximately 5.0%. More…

Peers

The company has mines and projects in Canada, Finland, Mexico and the United States. Agnico Eagle is the world’s largest primary silver producer and also produces gold, zinc, lead and copper. The company’s shares are listed on the Toronto Stock Exchange and the New York Stock Exchange. Agnico Eagle’s main competitors in the gold mining industry are Kinross Gold Corp, Equinox Gold Corp and Angus Gold Inc. All three companies are based in Canada and have operations in North and South America. Kinross Gold is the second largest gold mining company in Canada and has mines and projects in the United States, Russia, Brazil, Chile, Ghana and Mauritania. Equinox Gold is a mid-tier gold producer with mines and projects in Brazil, Canada and the United States. Angus Gold is a gold exploration and development company with projects in Canada and Argentina.

– Kinross Gold Corp ($TSX:K)

Kinross Gold Corporation is a Canadian-based gold mining company with mines and projects in the United States, Brazil, Russia, Ghana, Mauritania and Chile. The Company’s primary business is gold mining. It also produces silver, copper and zinc. As of December 31, 2019, the Company had proven and probable gold reserves of approximately 38.9 million ounces and an aggregate land position of approximately 71,000 square kilometers.

– Equinox Gold Corp ($TSX:EQX)

Equinox Gold Corp is a Canadian gold producer with operations in Brazil, Canada, and Mexico. The company has a market capitalization of $1.41 billion as of 2022 and a return on equity of 1.24%. Equinox Gold is focused on producing gold from its flagship asset, the Aurizona Gold Mine in Brazil, and its new Santa Luz Mine in Mexico. The company also has several development projects in Brazil and Canada.

– Angus Gold Inc ($TSXV:GUS)

Angus Gold Inc is a gold mining company with a market cap of 31.14M as of 2022. The company has a Return on Equity of -129.48%. Angus Gold Inc operates in the gold mining industry. The company explores for, develops, and produces gold properties. Angus Gold Inc is headquartered in Reno, Nevada.

Summary

Agnico Eagle Mines Limited is an attractive opportunity for investors, as its stock goes ex-dividend in just four days. Overall, AGNICO is an attractive stock for long-term investors looking for a high yield dividend stock and potential capital appreciation.

Recent Posts