PlayAGS Strikes Deal with DraftKings to Provide Slots Content for Online Casino.

February 8, 2023

Trending News 🌧️

PLAYAGS ($NYSE:AGS): PlayAGS, a gaming device manufacturer, has announced that it has struck a deal with DraftKings to provide the latter with online slots content. It designs, manufactures, and supplies a wide range of gaming machines and digital gaming content to both casino operators and players. This includes popular titles such as Thundering Buffalo and Money Ball as well as other top-performing games like Zeus Unleashed and Pink Diamond. PlayAGS is already making a name for itself in the gaming industry with its expanding range of game cabinets and digital products, including its latest offering: the PlayVision cabinet.

In addition, PlayAGS also offers a range of online games, including slots, table games, and video poker. This deal is expected to help both companies expand their reach further and gain more customers. With the addition of PlayAGS’ library of slots content, DraftKings’ online casino platform will be even more appealing for casino players looking for an exciting gaming experience. Meanwhile, PlayAGS will benefit from the increased exposure and reach that comes with supplying content to one of the leading online gaming companies in the US. Both PlayAGS and DraftKings are sure to benefit from this deal as it will allow them to reach new markets and acquire more customers in the process. It is expected that this partnership will drive further growth for both companies in the near future.

Price History

This move marks the first time that PlayAGS has signed a major agreement with a digital sportsbook operator. The company expects the agreement to expand its reach in the digital gaming and sports betting markets, as well as help to drive additional revenue and profits. The agreement will allow DraftKings to access PlayAGS’ library of games and other content, allowing them to offer a larger variety of slots titles to their customers. This will allow players to have a more varied gaming experience, as well as access to new and exciting titles. The news of the agreement sent PlayAGS stock down by 2.8%, as it opened at $6.8 and closed at $6.6 on Tuesday.

This deal is seen as a major win for PlayAGS, as it allows them to break into the digital sportsbook market and expand their reach beyond their traditional casino operations. It also gives them access to a larger audience, giving them the opportunity to increase their revenue and profits significantly. Overall, this new agreement is seen as a major win for PlayAGS and is expected to bring many benefits to the company. With its increased reach and access to larger audiences, the company is hoping to capitalize on its new partnership with DraftKings and drive even more profits in the near future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Playags. More…

| Total Revenues | Net Income | Net Margin |

| 297.92 | -19.67 | -2.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Playags. More…

| Operations | Investing | Financing |

| 76.71 | -68.43 | -62.68 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Playags. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 685.42 | 641.2 | 1.17 |

Key Ratios Snapshot

Some of the financial key ratios for Playags are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -0.1% | -0.2% | 6.0% |

| FCF Margin | ROE | ROA |

| 3.9% | 27.8% | 1.6% |

Analysis

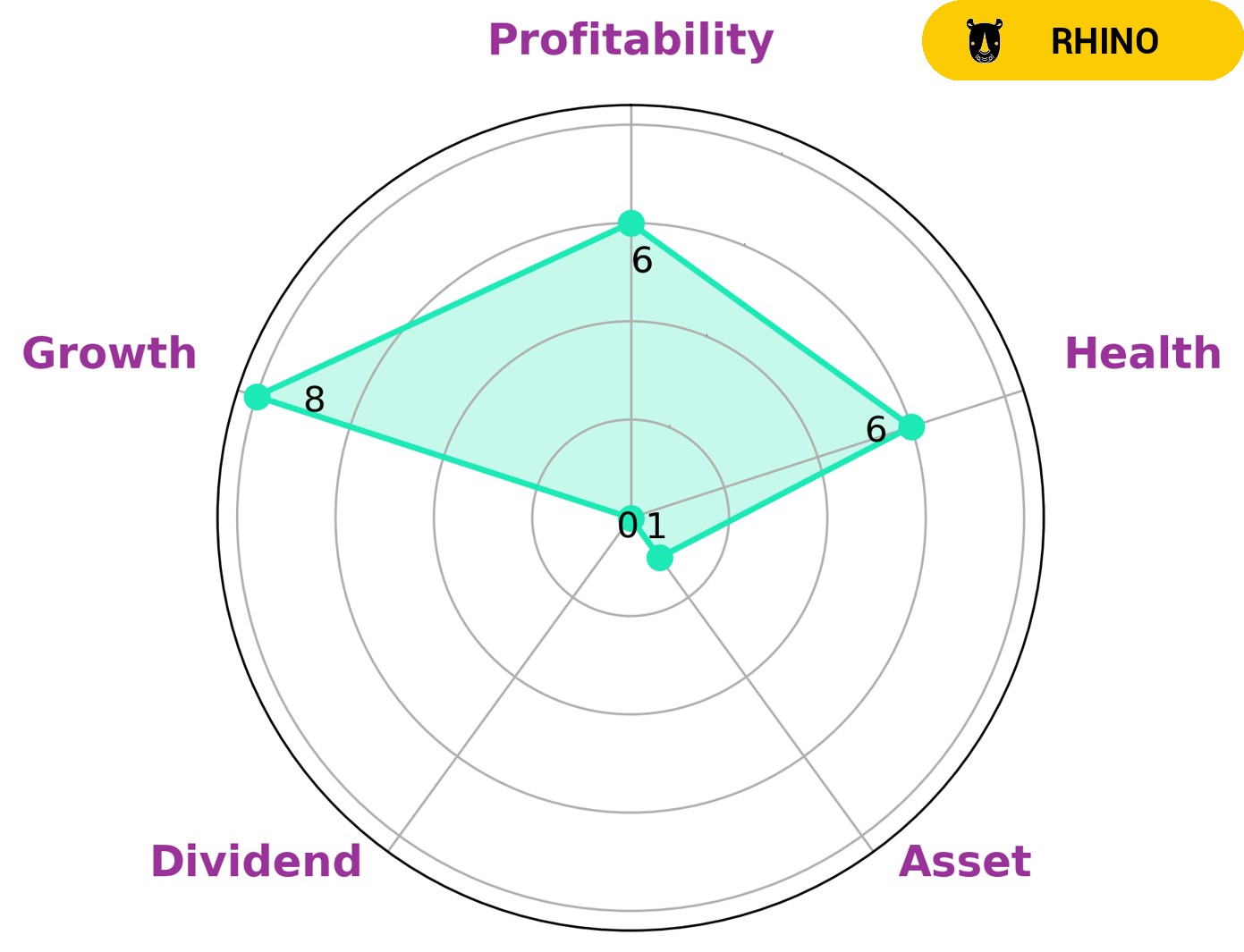

GoodWhale’s analysis of PLAYAGS’s fundamentals concluded that the company has an intermediate health score of 6/10 based on its cashflows and debt. This indicates the company is likely to have the resources to pay off its debt and fund future operations. With regards to the different areas of performance, PLAYAGS is strong in growth and medium in profitability, but weak in asset and dividend. The company is classified as ‘rhino’ which means it has achieved moderate revenue or earnings growth. Investors interested in such a company may be looking for steady, moderate growth rather than big, high-risk returns. This type of investor may be comfortable with a lower-growth stock as long as it does not come with high levels of risk. They may also be attracted to the company’s low debt levels, which could provide stability and reduce their risk. Furthermore, investors who are looking for moderate growth with a low level of risk may be attracted by PLAYAGS’s potential for future operations, as its cash flows indicate that it is likely to have the resources to pay off debt and fund such operations. Overall, PLAYAGS may be an interesting option for investors seeking moderate, steady growth with lower risk. More…

Peers

In the gambling and gaming industry, PlayAGS Inc. faces stiff competition from Inspired Entertainment Inc, Galaxy Gaming Inc, and Scientific Games Corp. These companies are all large and well-established in the industry, with a long history of success. While the competition is fierce, PlayAGS Inc. is confident in its ability to continue to grow and succeed in the market.

– Inspired Entertainment Inc ($NASDAQ:INSE)

Inspired Entertainment is a global gaming technology company that provides virtual sports and iGaming products to regulated markets around the world. The Company’s virtual sports products are delivered through its Virtual Sports product line, which offers a portfolio of over 30 games, including football, horse racing, greyhound racing, motor racing, speedway, cycling, baseball, basketball, cricket, rugby union, rugby league, darts and more. The Company’s iGaming products are delivered through its GamING platform, which offers a portfolio of casino games, including slots, table games, bingo and more. The Company also offers a suite of supporting services, including customer relationship management, customer intelligence, marketing and retention tools, payment processing and more.

– Galaxy Gaming Inc ($OTCPK:GLXZ)

Galaxy Gaming, Inc. develops, manufactures, and distributes casino table games, related equipment, and software products worldwide. The company offers a portfolio of proprietary table games, including side bets, progressives, and multi-hand games. It also provides casino table products, such as bases, chip trays, and casino chairs; and gaming peripheral products that include dice, roulette balls, and shufflers. The company sells its products through a network of sales representatives and distributors. Galaxy Gaming, Inc. was founded in 2000 and is headquartered in Las Vegas, Nevada.

Summary

PLAYAGS has recently announced a deal with DraftKings, the sports betting and daily fantasy sports operator, to provide slot content for its online casino. This agreement is set to increase PLAYAGS’ presence in the online gaming market and could prove to be a lucrative investment opportunity. The company has already established itself as a leader in the gaming industry with its innovative games, and this recent move will likely increase its market share and investor confidence.

It has also created new opportunities for players to access its content, which may further solidify PLAYAGS’ position as a leading provider of gaming content. Investors should consider the potential upside from this agreement before making any final decisions.

Recent Posts