IGT Shares Reach 18-Month High After Positive Financial Report

June 12, 2023

☀️Trending News

International Game Technology ($NYSE:IGT) (IGT) shares have surged to an 18-month peak after the company released an exceptionally positive financial report. IGT is a global leader in the design, development, and manufacture of gaming machines and other lottery and gaming products. Its cutting-edge technology has made it a preferred partner for lottery and gaming operators around the world. The company’s financial report revealed strong growth in its gaming operations despite the pandemic. The company is currently focusing on expanding its presence in regulated markets and launching new products to meet customer needs. IGT’s management has also taken steps to reduce costs and increase efficiency by streamlining operations and deploying advanced analytics. These positive financial results have been boosted by the company’s strong performance in the North American gaming market, fuelled by the launch of new products and strong customer engagement.

Over the past three months, IGT’s North American gaming revenues have increased by nearly 30%. IGT’s strong performance has been further bolstered by its strategic partnerships with leading sportsbook operators, such as MGM Resorts International and Caesars Entertainment. These partnerships are helping the company further expand its presence in the rapidly growing sports betting sector. Investors have responded positively to the news of IGT’s strong financial performance, as evidenced by its share price reaching an 18-month high. With the company continuing to focus on expanding its presence in regulated markets and deploying advanced analytics to increase efficiency, investors will likely remain bullish on IGT’s stock.

Share Price

On Thursday, shares of INTERNATIONAL GAME TECHNOLOGY (IGT) soared to an 18-month high after the company released a positive financial report. At the close of the trading day, IGT stock had opened at $30.0 and closed at $31.5, representing an impressive 14.3% increase from the prior closing price of $27.6. This marks one of the highest share prices IGT has achieved in the last 18 months. The positive financial report likely attributed to the surge in share prices, as investors responded favorably to the company’s outlook. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for IGT. More…

| Total Revenues | Net Income | Net Margin |

| 4.24k | 219 | 2.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for IGT. More…

| Operations | Investing | Financing |

| 1.02k | 139 | -1.1k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for IGT. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 10.51k | 8.64k | 7.1 |

Key Ratios Snapshot

Some of the financial key ratios for IGT are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -2.6% | 0.4% | 20.3% |

| FCF Margin | ROE | ROA |

| 16.1% | 37.7% | 5.1% |

Analysis

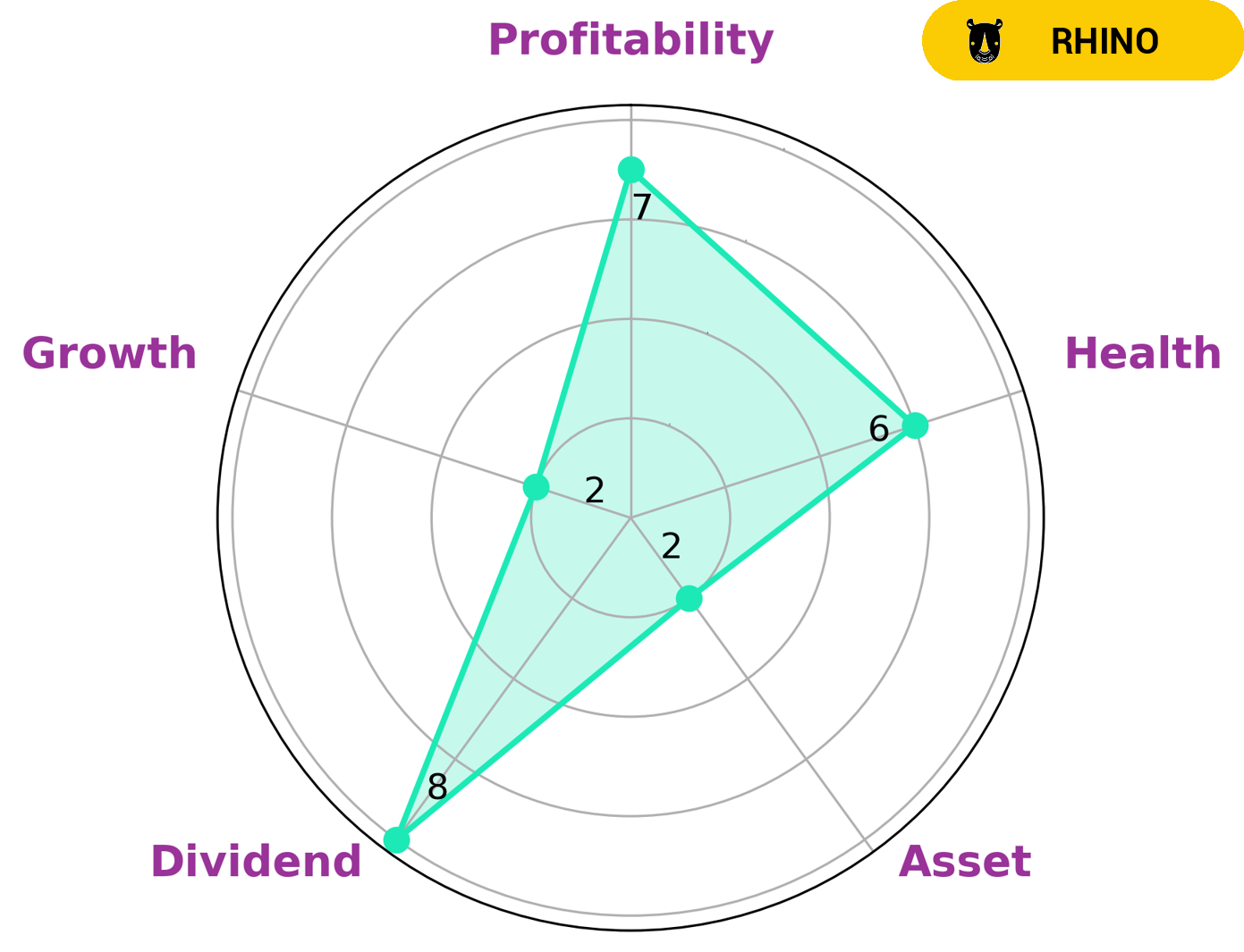

GoodWhale conducted an analysis of INTERNATIONAL GAME TECHNOLOGY’s financials. According to our Star Chart, INTERNATIONAL GAME TECHNOLOGY is classified as a ‘rhino’, which we believe suggests that the company has achieved moderate revenue or earnings growth. This makes INTERNATIONAL GAME TECHNOLOGY a possible attractive investment opportunity for investors that are looking for established companies that have a steady track record of success. Additionally, INTERNATIONAL GAME TECHNOLOGY has an intermediate health score of 6/10, indicating that the company has relatively healthy cashflows and debt and should be able to safely ride out any economic downturn without the risk of bankruptcy. We found that INTERNATIONAL GAME TECHNOLOGY is strong in terms of dividend and profitability, but weak in terms of assets and growth. Overall, INTERNATIONAL GAME TECHNOLOGY stands to be an attractive investment for those looking for a steady financial performance. More…

Peers

The competition between International Game Technology PLC and its competitors is fierce. Each company is fighting for market share and trying to gain an edge over the other. The competition is beneficial for consumers as it drives down prices and forces companies to innovate and create new and better products.

– Inspired Entertainment Inc ($NASDAQ:INSE)

Inspired Entertainment Inc is a global gaming technology company that provides virtual sports, mobile gaming and iLottery products to regulated lotteries, bookmakers and casinos. The company has a market cap of 246.77M as of 2022 and a Return on Equity of -56.33%. Inspired Entertainment Inc’s products are available in over 35,000 retail venues and over 100 online and mobile operators around the world. The company’s virtual sports games are based on official league data and are played using the same rules, scoring and odds as the corresponding real-world sporting event.

– Webis Holdings PLC ($LSE:WEB)

Webis Holdings PLC is a publicly traded company with a market capitalization of 6.49 million as of 2022. The company has a return on equity of 9.47%. Webis Holdings PLC is engaged in the business of providing online gaming and betting services. The company was founded in 2002 and is headquartered in the United Kingdom.

– Greek Organisation of Football Prognostics SA ($OTCPK:GRKZF)

As of 2022, the market cap for the Greek Organisation of Football Prognostics SA is 4.37B. The company’s ROE is 40.93%. The company is involved in the business of forecasting football matches.

Summary

International Game Technology (IGT) recently achieved an 18-month high in share prices. This is likely due to the company’s strong performance and potential for future growth. Analysts anticipate that IGT’s core business is well-positioned to benefit from the increasing demand for gaming products and services, including digital and physical gaming options. Its flagship interactive gaming platform, PlayDigital, provides a range of products, including online slots, bingo and gaming machines, as well as social gaming and sports betting. Moreover, IGT is also expanding into the mobile gaming market with its interactive gaming solutions. Investors are bullish on the stock because of the company’s experienced management, and its commitment to innovation and technological advancements.

Additionally, IGT’s strong balance sheet, combined with a healthy dividend payout ratio, makes it an attractive pick for investors.

Recent Posts