Accel Entertainment Reports Missed Earnings, But Revenue Beats Expectations

May 4, 2023

Trending News ☀️

Today, they provide a variety of gaming solutions, such as slot machines, interactive redemption games, and digital gaming solutions. Despite this, their efforts have paid off and their financial results show it. The additional revenue brought in from their digital gaming solutions and other innovative products has helped to boost their quarterly earnings. Overall, Accel Entertainment ($NYSE:ACEL) has had a positive first quarter as they have managed to outperform expectations despite the difficult economic climate.

This is a positive sign for investors, as it shows that the company is adapting well to the changing environment and still managing to remain profitable. It will be interesting to see if they can continue this trend going forward.

Market Price

On Wednesday, ACCEL ENTERTAINMENT reported earnings that fell short of expectations, but revenue that beat forecasts. Their stock opened at $8.8 and closed at $8.5, down by 2.5% from the previous closing price of 8.8. Despite missing on earnings, the company reported record revenue across all its business segments, including its gaming and entertainment divisions. The company attributed their missed earnings to challenges posed by the pandemic, as well as higher labor costs and increased investment in technology and innovation.

Despite these headwinds, ACCEL ENTERTAINMENT’s commitment to customer satisfaction, product portfolio expansion, and strategic investments in new technologies enabled them to achieve record growth in their core businesses. ACCEL ENTERTAINMENT’s CEO expressed optimism for the future, stating that the company was well-positioned to capitalize on the strong demand for gaming and entertainment services in the current environment. The CEO also expressed confidence that the company would be able to adjust to the changing market conditions in order to continue to meet consumer needs and generate value for shareholders. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Accel Entertainment. More…

| Total Revenues | Net Income | Net Margin |

| 969.8 | 74.1 | 6.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Accel Entertainment. More…

| Operations | Investing | Financing |

| 108 | -189.26 | 106.59 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Accel Entertainment. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 862.77 | 684.18 | 2.06 |

Key Ratios Snapshot

Some of the financial key ratios for Accel Entertainment are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 31.7% | 93.7% | 12.0% |

| FCF Margin | ROE | ROA |

| 6.3% | 40.5% | 8.4% |

Analysis

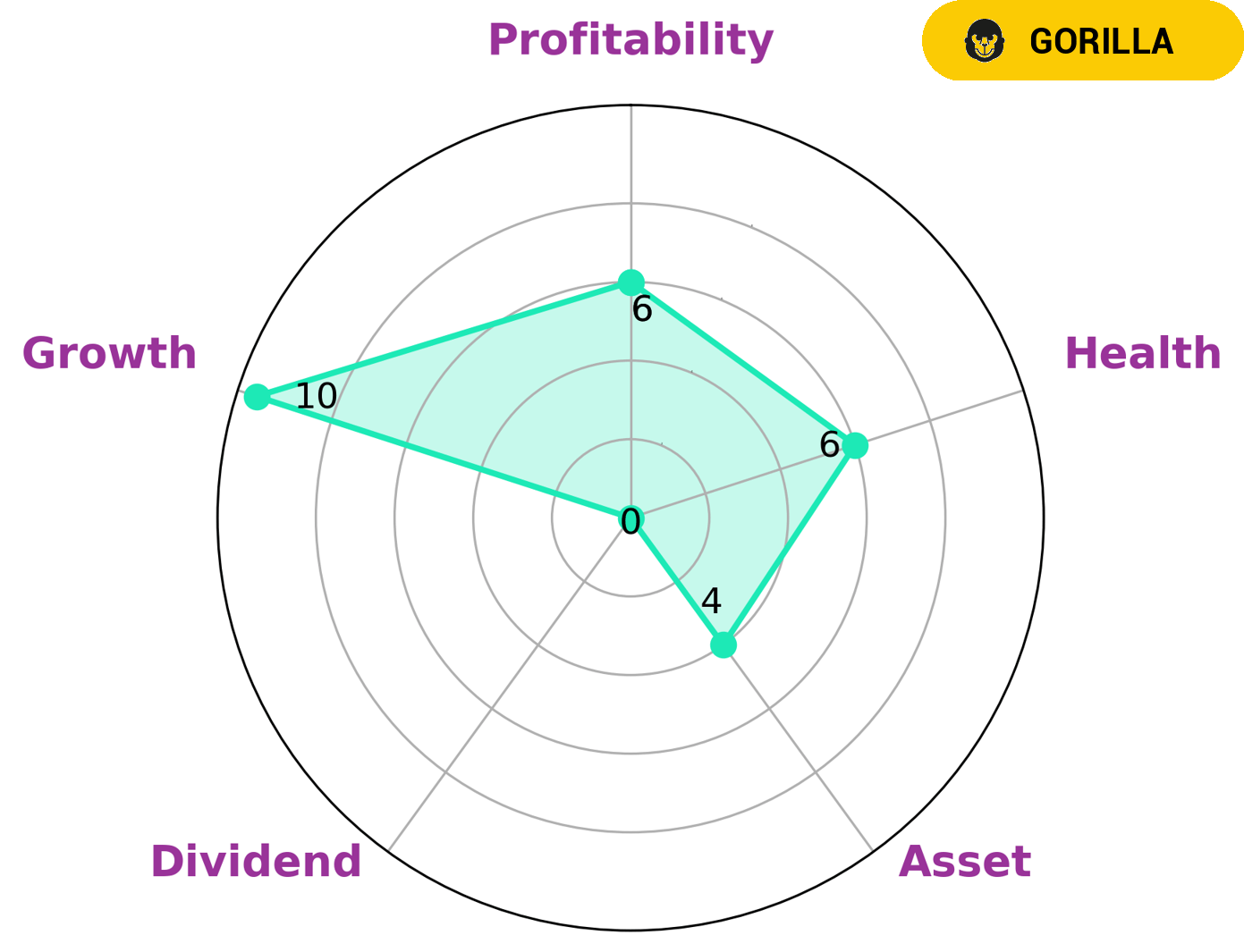

At GoodWhale, we recently conducted an analysis of ACCEL ENTERTAINMENT‘s wellbeing. Our Star Chart revealed that ACCEL ENTERTAINMENT is strong in growth, medium in asset, profitability and weak in dividend. Our conclusion is that ACCEL ENTERTAINMENT is classified as a ‘gorilla’ type of company that has achieved stable and high revenue or earning growth due to its strong competitive advantage. We believe that this company may be of interest to a variety of investors, including those that focus on dividend-producing investments, asset-based investments, and growth investments. As a result, we believe ACCEL ENTERTAINMENT has a broad appeal to many investors. Additionally, due to its intermediate health score of 6/10 considering its cashflows and debt, it is likely to safely ride out any crisis without the risk of bankruptcy. All in all, we believe ACCEL ENTERTAINMENT is a great investment opportunity. More…

Peers

The company offers video gaming devices through licensed truck stop and convenience stores, bars, restaurants, and other locations. Accel also provides gaming machines and related services to licensed fraternal organizations and social clubs. The company was founded in 2002 and is based in Chicago, Illinois. Accel’s primary competitors include Inspired Entertainment Inc, AEON Fantasy Co Ltd, and Galaxy Gaming Inc.

– Inspired Entertainment Inc ($NASDAQ:INSE)

Inspired Entertainment Inc is a publicly traded gaming company. The company operates in the casino, online and mobile gaming industries. The company was founded in 2001 and is headquartered in New York, New York. The company’s common stock is traded on the Nasdaq Global Market under the symbol INSE.

– AEON Fantasy Co Ltd ($TSE:4343)

Aeon Fantasy Co., Ltd. is a Japanese company that develops and operates video game arcades. The company was founded in 1992 and is headquartered in Osaka, Japan. As of March 2021, the company had 1,861 stores in Japan and 731 stores overseas.

Aeon Fantasy’s market cap is 61.48B as of 2022. The company has a Return on Equity of 1.72%.

Aeon Fantasy Co., Ltd. develops and operates video game arcades. The company was founded in 1992 and is headquartered in Osaka, Japan. As of March 2021, the company had 1,861 stores in Japan and 731 stores overseas.

– Galaxy Gaming Inc ($OTCPK:GLXZ)

Galaxy Gaming Inc is a gaming company that develops, manufactures, and sells gaming products and services worldwide. The company offers a range of gaming products and services, including casino management systems, table games, slot machines, and virtual sports. It also provides turnkey solutions, including game content, hardware, and software platforms. The company was founded in 1995 and is based in Las Vegas, Nevada.

Summary

This outperformance was mainly driven by strong sales across core product segments and higher online sales volumes.

Recent Posts