Xponential Fitness Intrinsic Value – Investors: Don’t Miss Out on Xponential Fitness (NYSE:XPOF)

April 4, 2023

Trending News ☀️

Investors looking to diversify their portfolios should take note of Xponential Fitness ($NYSE:XPOF) Inc. (NYSE:XPOF). With a strong focus on innovation and customer service, Xponential Fitness has become one of the fastest-growing companies in the health and fitness sector. Xponential Fitness offers a diverse portfolio of brands, including Club Pilates, Pure Barre, CycleBar, StretchLab, AKT, YogaSix, Row House, and STRIDE. The company also has strong partnerships in place with leading technology companies such as Apple and Fitbit to provide customers with a seamless digital experience.

In addition, Xponential Fitness has several strategic initiatives in place to enhance the customer experience while driving revenue growth. The combination of a strong brand portfolio, innovative products, and customer-oriented initiatives have allowed Xponential Fitness to become one of the leading health and fitness companies. With a strong track record of success and an impressive global footprint, XPONENTIAL FITNESS presents a unique opportunity for investors seeking to capitalize on the growing health and fitness trend.

Price History

Investors looking for a great opportunity should take a closer look at Xponential Fitness Inc. (NYSE:XPOF). On Friday, XPONENTIAL FITNESS stock opened at $29.6 and closed at $30.4, up by 3.8% from prior closing price of 29.3. This significant increase in the stock price shows that there is strong potential for investors to benefit from Xponential Fitness.

With its impressive performance, investors can expect to see continued growth in the company’s share value, providing them with a solid return on their investment. Don’t miss out on this chance to increase your portfolio’s returns – invest in Xponential Fitness today! Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Xponential Fitness. More…

| Total Revenues | Net Income | Net Margin |

| 244.95 | -22.03 | 9.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Xponential Fitness. More…

| Operations | Investing | Financing |

| 51.67 | -14.61 | -21.01 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Xponential Fitness. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 482.69 | 690.75 | -4.61 |

Key Ratios Snapshot

Some of the financial key ratios for Xponential Fitness are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 23.8% | – | 6.7% |

| FCF Margin | ROE | ROA |

| 14.5% | -7.3% | 2.1% |

Analysis – Xponential Fitness Intrinsic Value

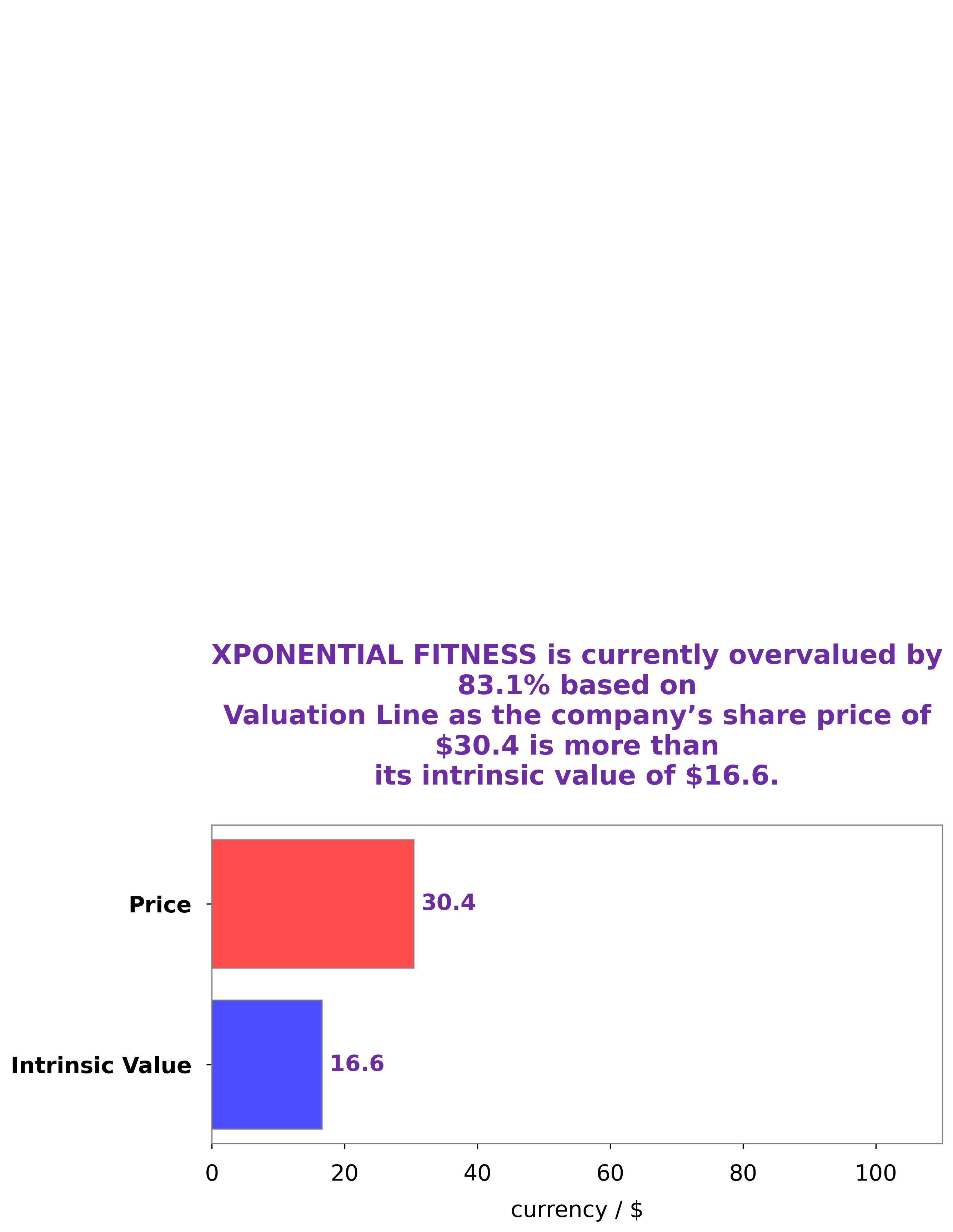

At GoodWhale, we have conducted an analysis of XPONENTIAL FITNESS‘s fundamentals. Our proprietary Valuation Line has calculated XPONENTIAL FITNESS’s intrinsic value to be around $16.6. However, the stock is currently being traded at $30.4, which is overvalued by 83.1%. It is likely that the stock may not continue to remain at this rate and will revert to its actual value over time. Therefore, investors should be aware that the stock may be overvalued and should be cautious when considering investing in it. More…

Peers

The fitness industry is a competitive one, with many companies vying for a share of the market. Xponential Fitness Inc is one such company, and it competes with others such as Gambling.com Group Ltd, F45 Training Holdings Inc, and Fit After Fifty Inc. Each company has its own strengths and weaknesses, and it is up to the consumer to decide which one is the best fit for their needs.

– Gambling.com Group Ltd ($NASDAQ:GAMB)

The Gambling.com Group Ltd is a publicly traded company with a market capitalization of 267.87 million as of 2022. The company has a return on equity of 8.07%. The Gambling.com Group Ltd is an online gambling and gaming company. The company operates a number of gambling and gaming websites, including gambling.com, sportsbook.com, and poker.com. The company also offers a range of other services, including online gaming, online casino, online sports betting, and online poker.

– F45 Training Holdings Inc ($NYSE:FXLV)

F45 Training Holdings Inc is a fitness company that offers group training classes. The company has a market cap of 293.47M and a ROE of -60.11%. The company offers a variety of fitness classes, including strength training, cardio, and HIIT classes.

Summary

XPONENTIAL FITNESS Inc. (NYSE:XPOF) is an attractive stock for investors at the moment. Its share price has risen steadily over recent weeks and is expected to continue trending upwards. The company is well-positioned in the fitness industry, with a large customer base and significant opportunities for growth. Its financials are healthy and the company has been delivering positive earnings growth in the last quarter.

Additionally, XPONENTIAL FITNESS is investing heavily in marketing and research initiatives to further expand its reach. The stock also benefits from low volatility, meaning it is unlikely to experience significant drops or volatile swings in price. As such, investors can expect long-term appreciation in this stock.

Recent Posts