WillScot Reports Impressive Q2 Results, Surpassing Expectations by a Wide Margin

April 27, 2023

Trending News ☀️

WILLSCOT ($NASDAQ:WSC): WillScot’s GAAP EPS of $1.00 comfortably beat the projections of $0.71, while revenue of $565.5M was substantially higher compared to the expected $31.78M. This impressive performance is a testament to the strength of the company’s business. WillScot Mobile Mini is a leading provider of integrated space solutions and services specializing in modular space, portable storage, and mobile offices. The company offers a wide range of services, including sales, rentals, and transportation of mobile offices, storage containers, and office trailers.

In addition, WillScot provides logistics and installation services, as well as customized pre-fabricated and mobile office buildings. WillScot’s impressive results are likely due to its innovative and efficient business model, which has allowed it to capitalize on the demand for modular space solutions and services. The company has been able to expand its market share by providing superior customer service and delivering cost-effective and convenient solutions.

Stock Price

The company’s stock opened at $43.0 and closed at $42.8, down 1.2% from the previous day’s closing price of 43.3. Despite the overall market decline, WillScot Mobile Mini showed strong performance in its core businesses, including rental solutions for businesses, construction equipment and specialty vehicles. These impressive results demonstrate the success of WillScot Mobile Mini’s ongoing strategy to diversify its business and capitalize on its global reach in order to maximize value for its customers. Going forward, the company is well-positioned to continue to outpace its competitors and deliver even stronger performance in the coming quarters. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for WSC. More…

| Total Revenues | Net Income | Net Margin |

| 2.14k | 339.54 | 12.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for WSC. More…

| Operations | Investing | Financing |

| 744.66 | -309.33 | -429.37 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for WSC. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 5.83k | 4.26k | 7.53 |

Key Ratios Snapshot

Some of the financial key ratios for WSC are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 26.3% | 57.1% | 23.9% |

| FCF Margin | ROE | ROA |

| 12.0% | 19.7% | 5.5% |

Analysis

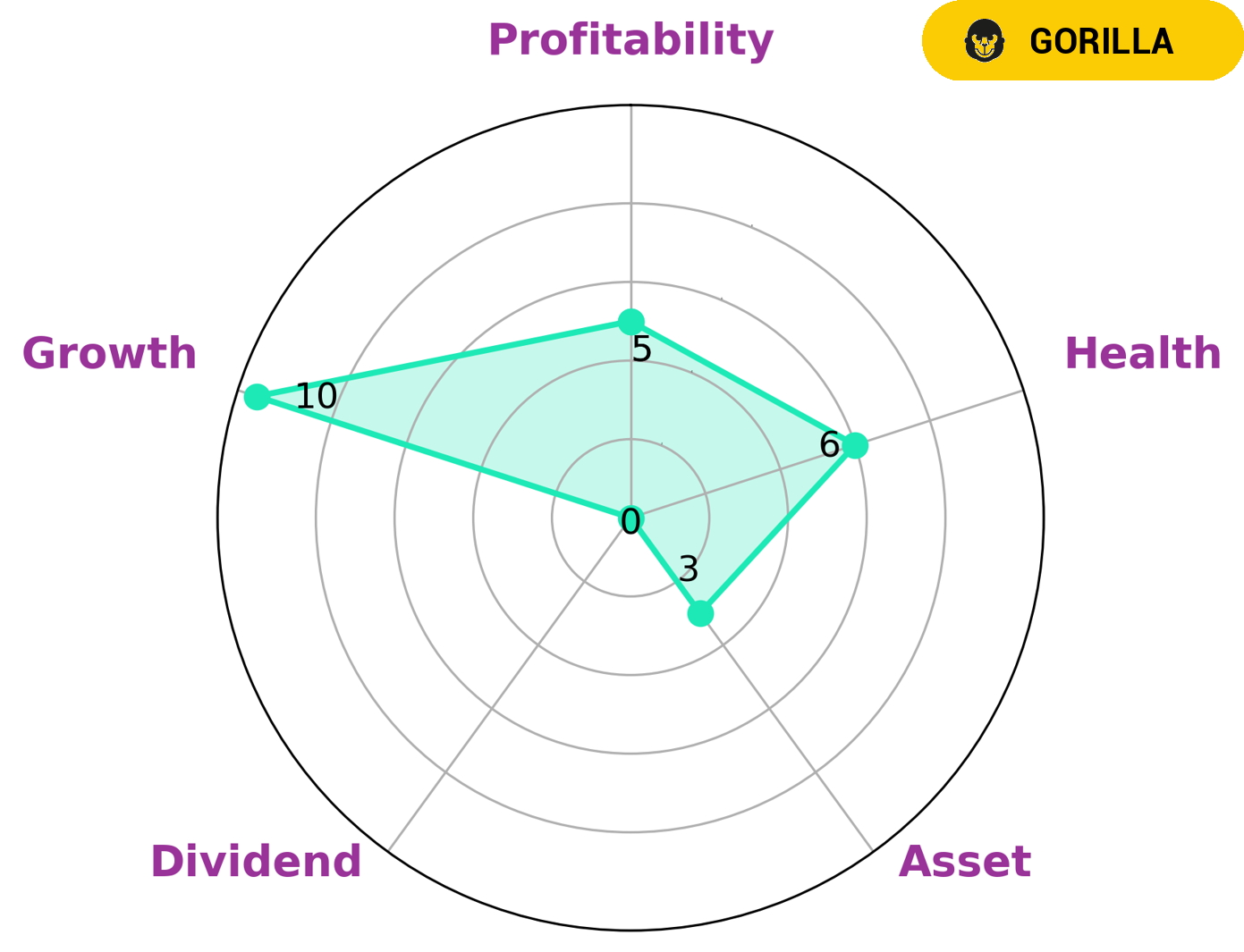

GoodWhale has recently conducted an analysis of WILLSCOT MOBILE MINI’s performance, using our own proprietary Star Chart. Our analysis reveals that WILLSCOT MOBILE MINI is strong in terms of growth, but only medium in terms of profitability and weak in terms of asset and dividend. Our overall health score for WILLSCOT MOBILE MINI is 6/10. It is considered to be at an intermediate state, meaning that it is likely able to pay off its debt and fund future operations. Additionally, we have classified this company as a ‘gorilla’—a type of company that has achieved both stable and high revenue or earnings growth due to its strong competitive advantage. Given the company’s strengths and stability, we believe that WILLSCOT MOBILE MINI may be particularly attractive to value-oriented investors who are looking for steady, moderate returns. It may also be of interest to those who invest in stocks with the potential for long-term growth and those who appreciate the stability that comes with a well-established competitive advantage. More…

Peers

The competition between WillScot Mobile Mini Holdings Corp and its competitors, The Brink’s Co, Touax, and Groupe CRIT SA, has become increasingly fierce in recent years. These companies are all vying for a greater share of the mobile storage and modular building solutions market, with each of them bringing their own strengths and strategies to the table. With the stakes so high, it is an exciting time to see who will come out on top.

– The Brink’s Co ($NYSE:BCO)

The Brink’s Co is a global leader in security-related services and cash handling. With a market cap of 2.71 billion as of 2022 and a Return on Equity of 103.48%, the company is well-positioned to continue its success in the industry. The Brink’s Co provides secure transportation, cash management services, and security-related services to customers in over 100 countries around the world. Their services are designed to help customers protect their assets from theft and fraud. In addition, their services also help customers increase efficiency, reduce costs, and improve customer satisfaction. With its market cap and ROE, the Brink’s Co is well-prepared to continue its success in the industry.

– Touax ($LTS:0IXN)

Touax is a leading global provider of modular buildings and containers. With a market cap of 60.12M as of 2022, Touax is a well-respected player in the industry and its Return on Equity (ROE) of 20.2% demonstrates its strong financial performance. The company is known for its excellent customer service, great value for money and reliable products. The company’s focus on creating innovative solutions has enabled it to maintain its competitive edge in the market. With a strong presence in Europe and North America, Touax is well-positioned to continue to grow and expand its operations in the future.

– Groupe CRIT SA ($LTS:0DZJ)

Groupe CRIT SA is a French-based group of companies that specialize in temporary staffing. As of 2022, Groupe CRIT SA has a market cap of 665.91M, making it one of the largest staffing companies in France. The company also has a Return on Equity (ROE) of 9.1%, indicating that it has been able to effectively generate profits and return value to shareholders. Groupe CRIT SA focuses primarily on temporary staffing solutions, with a particular focus on the industrial, medical, and administrative sectors. The company has offices in France, Spain, Italy, Switzerland, Germany, the United Kingdom, and Belgium. Groupe CRIT SA is well-positioned for continued success in the staffing industry.

Summary

The company reported GAAP earnings per share of $1.00, beating analyst expectations by $0.71 and revenue of $565.5 million, beating analyst expectations by $31.78 million. Investors are optimistic about WillScot Mobile Mini’s future prospects as its business is expected to continue to benefit from the increasing demand for its services.

Recent Posts