Tenet Healthcare Intrinsic Value – Tenet Healthcare Shares Undervalued Despite Q1 Beat And Raise

May 17, 2023

Trending News ☀️

Recently, Tenet ($NYSE:THC)’s stock has been undervalued despite the company’s strong Q1 results, which exceeded expectations. The company reported an increase in revenue and raised its full-year guidance, leading to a bullish outlook from analysts. Despite these positive results, Tenet’s stock is still trading at a discount compared to the industry average. This could be due to the uncertain economic outlook, as well as the recent volatility in healthcare stocks. Tenet has been actively working to reduce costs and improve efficiency, which are key to its long-term success. The company has implemented cost-cutting measures such as reducing labor costs and reorganizing operations. These measures have helped Tenet to lower its expenses, while also increasing its revenue.

The company has also been investing in new technology and expanding its services in order to capitalize on new opportunities in the healthcare sector. Tenet is focused on providing quality care to its patients, while also staying ahead of the competition. Given Tenet’s strong Q1 results, increased guidance, and cost-cutting measures, many analysts are optimistic about the company’s future prospects. If Tenet continues to perform well, its stock could significantly appreciate and reward investors. As such, Tenet’s stock is worth considering for those looking for a value buy in the healthcare sector.

Stock Price

Tenet Healthcare shares have been seen as undervalued despite the company’s impressive first quarter results, which beat analysts’ expectations and prompted a revenue and earnings raise. On Tuesday, Tenet Healthcare stock opened at $71.2 and closed at $71.5, up by a modest 0.6% from its previous closing price of $71.1. This small increase in share price suggests that investors remain unsure of the company’s performance despite its first quarter successes. Analysts are divided on the future of Tenet Healthcare, with some predicting that the company will continue to have strong growth, while others fear that its stock may soon begin to decline. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Tenet Healthcare. More…

| Total Revenues | Net Income | Net Margin |

| 19.45k | 414 | 3.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Tenet Healthcare. More…

| Operations | Investing | Financing |

| 1.3k | -1.03k | -909 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Tenet Healthcare. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 27.07k | 22.26k | 11.92 |

Key Ratios Snapshot

Some of the financial key ratios for Tenet Healthcare are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 1.8% | 12.3% | 11.5% |

| FCF Margin | ROE | ROA |

| 2.4% | 117.4% | 5.1% |

Analysis – Tenet Healthcare Intrinsic Value

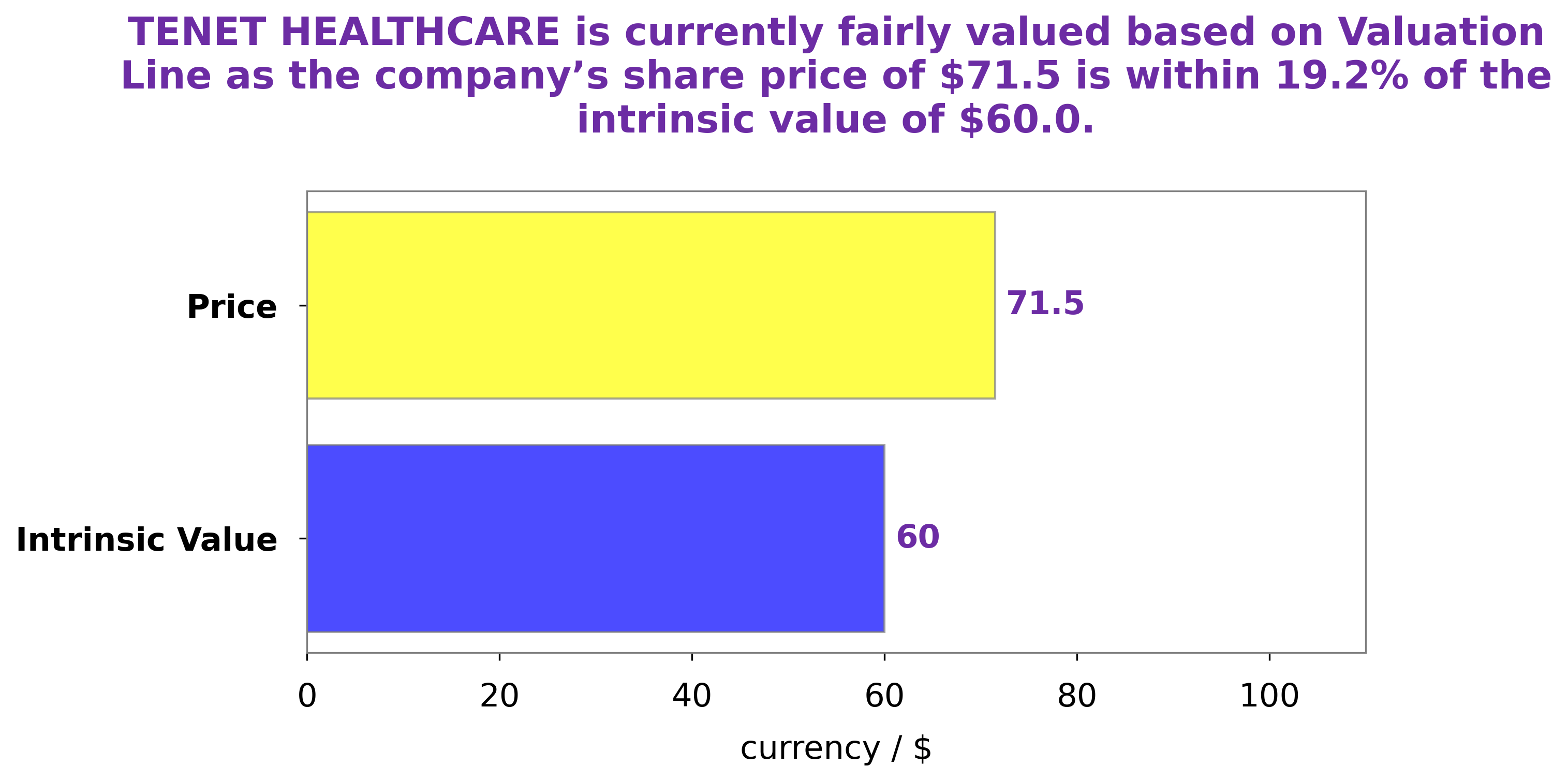

At GoodWhale, we strive to provide the most up-to-date and accurate analysis of TENET HEALTHCARE‘s fundamentals. After careful assessment and analysis, our proprietary Valuation Line estimates a fair value of $60.0 per share for TENET HEALTHCARE. As of now, the stock is trading at $71.5, which is 19.1% above its fair value. More…

Peers

Tenet Healthcare Corp is one of the leading healthcare services providers in the United States. The company offers a wide range of services including hospitals, clinics, and other health care facilities. The company has a strong presence in the US with over 80 hospitals and more than 500 outpatient centers. The company also has a strong international presence with operations in over 30 countries. The company’s main competitors are Medicover AB, Aashka Hospitals Ltd, and Life Healthcare Group Holdings Ltd.

– Medicover AB ($LTS:0RPS)

Medicover AB is a Swedish company that provides healthcare and medical services. It has a market cap of 20.62B as of 2022 and a Return on Equity of 13.71%. The company has a wide range of services including primary care, specialist care, medical examinations, and home care. It also offers a variety of insurance plans.

– Aashka Hospitals Ltd ($BSE:543346)

Aashka Hospitals Ltd is a healthcare company based in India. The company is engaged in the business of hospital operations, diagnostic services, and healthcare IT services. As of March 31, 2019, the company operated a network of 22 hospitals with a total capacity of 2,941 beds.

– Life Healthcare Group Holdings Ltd ($OTCPK:LTGHY)

The company has a market cap of 1.48B as of 2022 and a Return on Equity of 10.41%. The company focuses on providing healthcare services to patients in China. The company operates hospitals, clinics, and medical centers in China. The company offers a wide range of healthcare services, including general surgery, cardiology, oncology, and obstetrics and gynecology. The company has a strong focus on providing high-quality healthcare services to its patients. The company is headquartered in Shenzhen, China.

Summary

The company reported higher-than-expected revenues and raised its guidance for the full year. This has caused the stock price to climb, but analysts still feel that it is undervalued and has potential for further growth. Tenet’s core business, hospital operations, has continued to be resilient despite the pandemic, and they have also found success in key strategic areas such as acquisitions and cost cutting initiatives.

With a strong balance sheet and growing cash flows, Tenet is in a good position to take advantage of any opportunities that may arise in the near future. Investors should consider Tenet when making decisions about their portfolio.

Recent Posts