Reliance Steel & Aluminum Outperforms Q1 Expectations and Sets Positive Outlook for Q2

April 28, 2023

Trending News ☀️

Reliance Steel & Aluminum ($NYSE:RS) Co. (RS & A) is one of the world’s leading metals service centers and a major supplier of steel, aluminum, and other specialty metals. The large increase in revenue and earnings was attributed to strong demand for the company’s services across its North American, European, and Asian operations. The company was also able to benefit from higher selling prices due to the rising cost of raw materials. Overall, the results for the first quarter and positive outlook for the second quarter demonstrate that Reliance Steel & Aluminum is well-positioned to take advantage of the current economic environment and increase its market share.

Stock Price

Reliance Steel & Aluminum Co. (NYSE: RS) reported its first-quarter earnings on Thursday, and the results exceeded expectations. The strong performance of Reliance Steel & Aluminum during its first quarter was reflected in its stock price. The stock opened at $241.8 and closed at $256.5, representing a 6.7% increase from its previous closing price of $240.3. Reliance Steel & Aluminum is well-positioned to benefit from the current macroeconomic environment, with record-high steel prices and ongoing infrastructure investment supporting the company’s long-term fundamentals. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for RS. More…

| Total Revenues | Net Income | Net Margin |

| 17.02k | 1.84k | 10.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for RS. More…

| Operations | Investing | Financing |

| 2.12k | -348.5 | -892.6 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for RS. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 10.33k | 3.23k | 120.56 |

Key Ratios Snapshot

Some of the financial key ratios for RS are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 15.8% | 35.5% | 15.2% |

| FCF Margin | ROE | ROA |

| 10.4% | 23.2% | 15.6% |

Analysis

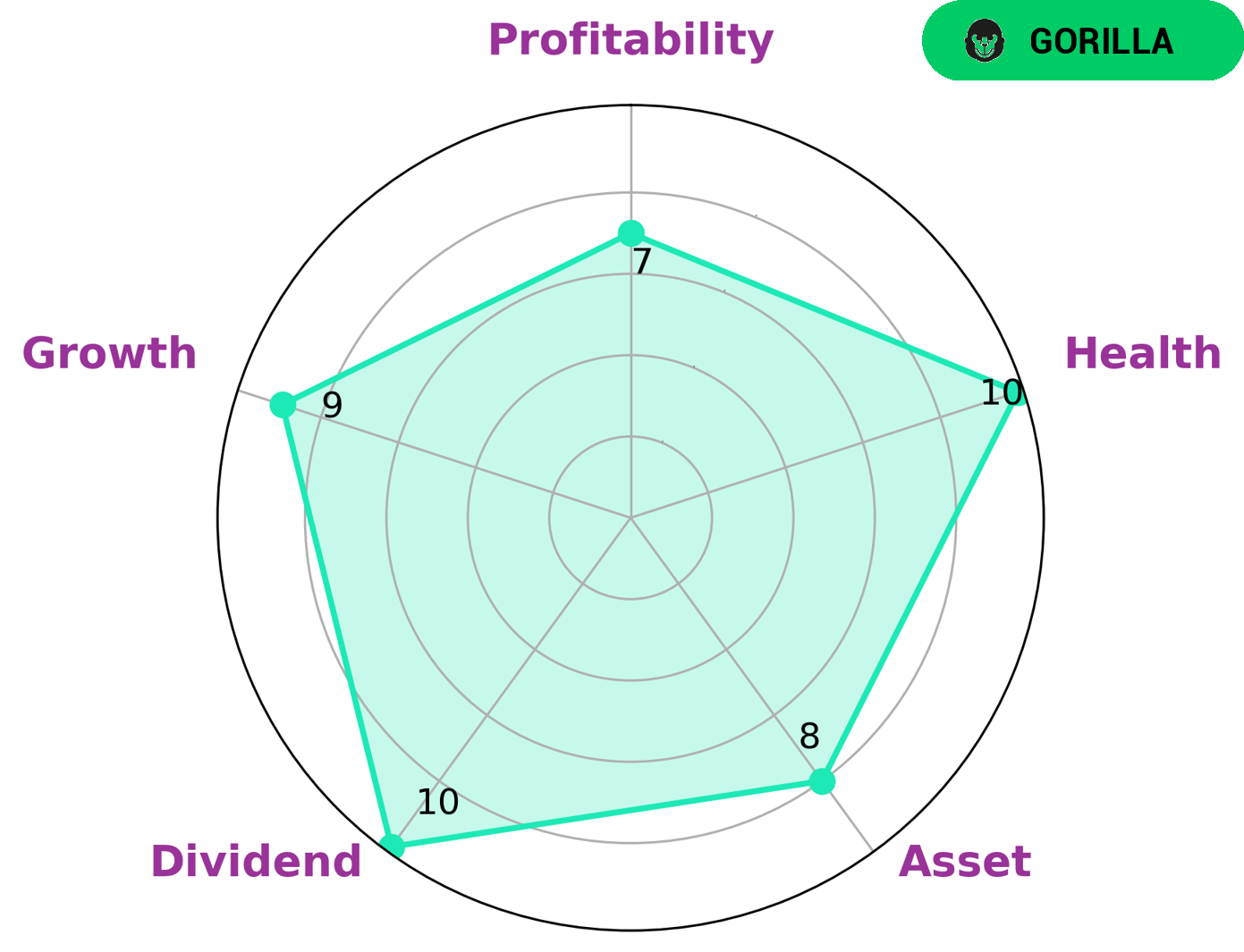

GoodWhale is proud to analyze the wellbeing of RELIANCE STEEL & ALUMINUM. According to our Star Chart, this company has a very high health score of 10/10 due to its strong cashflows and debt. This means it can safely ride out any crisis without the risk of bankruptcy. RELIANCE STEEL & ALUMINUM is also strong in terms of assets, dividend, growth and profitability. To put it simply, this company is classified as a ‘gorilla’, meaning it has achieved stable and high revenue or earnings growth due to its strong competitive advantage. For this reason, RELIANCE STEEL & ALUMINUM is an attractive company for investors who are looking for a stable and profitable investment option. Investors may be interested in this company due to its strong financials and promising future prospects. In addition, its strong competitive advantage ensures that it will continue to grow and remain profitable in the coming years. More…

Peers

Reliance Steel & Aluminum Co., Universal Stainless & Alloy Products Inc., Jiangsu Shagang Co Ltd, and Xinjiang Ba Yi Iron & Steel Co Ltd are all steel and aluminum companies. They all have their own unique offerings, but they compete with each other in the market.

– Universal Stainless & Alloy Products Inc ($NASDAQ:USAP)

Universal Stainless & Alloy Products Inc is a company that manufactures and sells stainless steel and nickel alloy mill products. The company has a market cap of 65.99M as of 2022 and a Return on Equity of -1.12%. Universal Stainless & Alloy Products Inc is a publicly traded company on the NASDAQ Stock Market under the ticker symbol “USAP”.

– Jiangsu Shagang Co Ltd ($SZSE:002075)

Jiangsu Shagang Co., Ltd. is a Chinese state-owned steel producer. The company is based in Zhangjiagang, Jiangsu Province, and is listed on the Shanghai Stock Exchange. Jiangsu Shagang is one of the largest private steel companies in China, with an annual output of over 20 million tons of steel. The company produces a wide range of steel products, including hot and cold rolled coils, galvanized sheets, and stainless steel products. In addition to its steel operations, Jiangsu Shagang also has businesses in coal mining, power generation, and real estate development.

– Xinjiang Ba Yi Iron & Steel Co Ltd ($SHSE:600581)

Xinjiang Ba Yi Iron & Steel Co Ltd has a market cap of 5.58B as of 2022, a Return on Equity of -24.16%. The company is engaged in the production and sale of iron and steel products. It is one of the largest iron and steel companies in China. The company’s products are used in a variety of industries, including construction, automotive, machinery manufacturing, and shipbuilding.

Summary

Reliance Steel & Aluminum reported a successful first quarter, with both top and bottom line estimates beating expectations. This resulted in an immediate increase in the stock price. Moving forward, the company has initiated a positive outlook for the upcoming quarter. Investors should take note of the strong performance and anticipate further growth in the near future.

Reliance Steel & Aluminum has demonstrated a strong market position, and its share price potential is likely to continue. With its successful financials and stable outlook, this company is likely to be a profitable addition to any investor’s portfolio.

Recent Posts