HR Stock Intrinsic Value – Don’t Miss Out On Healthcare Realty Trust’s 7% Yield – A Smart Investment!

June 2, 2023

☀️Trending News

Investors should take notice of Healthcare Realty Trust ($NYSE:HR) (NYSE: HR), a real estate investment trust (REIT) that operates in the healthcare sector. The company owns and leases healthcare-related properties such as medical office buildings, outpatient treatment centers, medical service facilities and other properties related to healthcare services. HEALTHCARE REALTY TRUST is committed to offering investors a secure and reliable income stream through its high-quality portfolio, disciplined capital allocation, and strong management team. Given its strong financial position, stable income stream, and attractive dividend yield, HEALTHCARE REALTY TRUST is an ideal investment for income-seeking investors who are looking for reliable returns. With its track record of strong performance and attractive dividend yield, Healthcare Realty Trust is a smart investment opportunity not to be missed.

Analysis – HR Stock Intrinsic Value

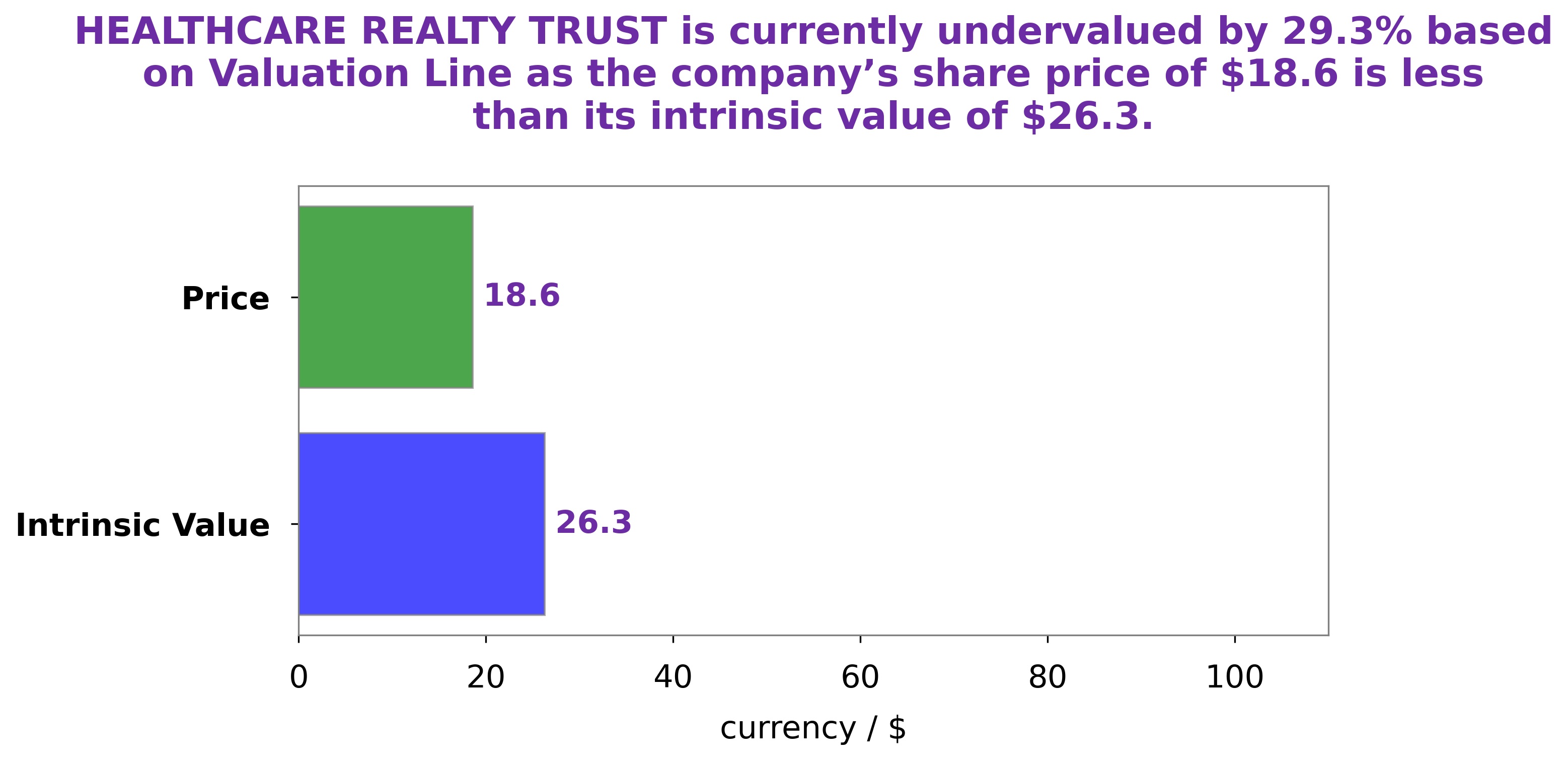

At GoodWhale, we analyzed the wellbeing of HEALTHCARE REALTY TRUST with our powerful tools. Our proprietary Valuation Line estimated the fair value of HEALTHCARE REALTY TRUST to be around $26.3. However, at the time of writing, the stock is traded at $18.6, meaning it is undervalued by 29.4%. This presents an opportunity for investors to buy the stock and potentially gain from an appreciation of the share price. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for HR. More…

| Total Revenues | Net Income | Net Margin |

| 731 | 95.91 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for HR. More…

| Operations | Investing | Financing |

| 189.03 | 1.23k | -1.38k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for HR. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 14.2k | 6.36k | 20.3 |

Key Ratios Snapshot

Some of the financial key ratios for HR are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 11.5% |

| FCF Margin | ROE | ROA |

| – | – | – |

Peers

The company’s properties include hospitals, medical office buildings, senior housing facilities, and other healthcare-related facilities. The company’s portfolio is diversified across the United States, with properties in 26 states. Healthcare Realty Trust Inc’s competitors include Sabra Health Care REIT Inc, Omega Healthcare Investors Inc, and LTC Properties Inc. These companies are also involved in the ownership and operation of healthcare-related properties.

– Sabra Health Care REIT Inc ($NASDAQ:SBRA)

Sabra Health Care REIT Inc has a market cap of 2.97B as of 2022. The company is a real estate investment trust that focuses on the healthcare sector. Sabra owns and leases properties across the United States and Canada. The company’s portfolio includes skilled nursing facilities, assisted living facilities, senior housing, hospitals, and other healthcare-related properties.

– Omega Healthcare Investors Inc ($NYSE:OHI)

Omega Healthcare Investors is a real estate investment trust that specializes in the ownership and leasing of long-term care facilities. As of December 31, 2020, the company owned 1,527 skilled nursing and assisted living facilities located in the United States, the United Kingdom, and India.

– LTC Properties Inc ($NYSE:LTC)

LTC Properties Inc is a real estate investment trust that primarily invests in senior housing and long-term care properties. As of December 31, 2020, the company owned a portfolio of 431 properties in 37 states. The company has a market cap of $1.54 billion as of March 2021.

Summary

Healthcare Realty Trust is an attractive investment opportunity for income-seeking investors due to its attractive 7% dividend yield. The company owns and develops real estate properties across the United States dedicated to the healthcare industry, including medical office buildings, healthcare facilities, and outpatient centers. Its balance sheet is strong and it has a history of steadily increasing its dividend for the past six years. With low debt levels, proactive portfolio management, and an established track record of increasing profits and dividends, Healthcare Realty Trust is an attractive investment for income investors seeking a reliable and growing dividend payment.

Recent Posts