Hologic Delivers Record-Breaking Quarter, Outperforming Expectations

May 2, 2023

Trending News 🌥️

Hologic ($NASDAQ:HOLX), Inc. is a global diversified medical device company with a focus on women’s health, diagnostics, and other medical device products. Recently, the company delivered record-breaking results in their quarterly report, outperforming expectations. Hologic reported Non-GAAP EPS of $1.06, which exceeded estimates by $0.18. At the same time, revenue of $1.03B surpassed expectations by $72.47M.

The strong results were driven by robust performance across the company’s key product lines. Overall, Hologic delivered a record-breaking quarter, surpassing market expectations. Moving forward, the company is focused on further expanding its product portfolio and leveraging its strong product pipeline to continue driving growth and profitability.

Market Price

The impressive quarter was reflected in HOLOGIC stock performance as well; the stock opened at $85.8 and closed at $87.7, up by 1.9% from its prior closing price of $86.0. Analysts pointed to the company’s strong showing in the imaging segment for the higher than expected financial performance. Overall, investors can be encouraged by the impressive quarter delivered by HOLOGIC and look forward to what’s in store for the company in the future. Hologic_Delivers_Record-Breaking_Quarter_Outperforming_Expectations”>Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Hologic. More…

| Total Revenues | Net Income | Net Margin |

| 4.47k | 990.2 | 22.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Hologic. More…

| Operations | Investing | Financing |

| 1.81k | -73.8 | -726 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Hologic. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 9.29k | 4.2k | 20.65 |

Key Ratios Snapshot

Some of the financial key ratios for Hologic are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 9.7% | 69.7% | 29.2% |

| FCF Margin | ROE | ROA |

| 38.0% | 16.3% | 8.8% |

Analysis

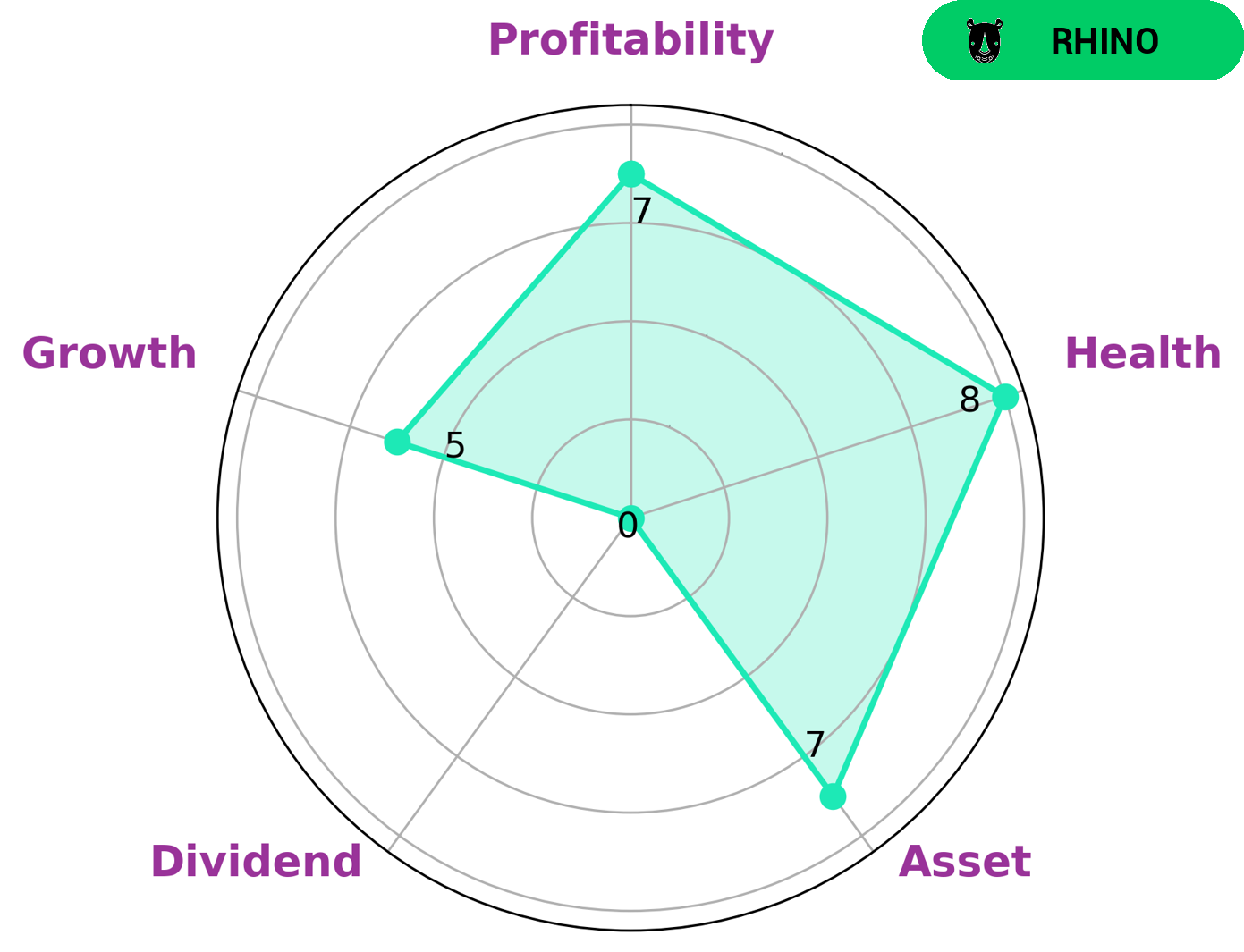

GoodWhale has conducted an analysis of HOLOGIC’s wellbeing. We found that HOLOGIC has a high health score of 8/10 when considering its cashflows and debt, meaning they are capable to pay off debt and fund future operations. Furthermore, based on our Star Chart, HOLOGIC has been classified as a ‘rhino’ type of company, which we conclude has achieved moderate revenue or earnings growth. This type of company may be attractive to investors who prioritize asset strength, profitability and have a medium appetite for growth. However, investors seeking dividend yield will likely not be interested in HOLOGIC as our analysis shows this area to be weak. Hologic_Delivers_Record-Breaking_Quarter_Outperforming_Expectations”>More…

Peers

The company’s products are used in a variety of settings, including hospitals, clinics, and physician offices. Hologic also provides a range of services, including support, training, and education. The company has a strong presence in the United States and international markets, and its products are backed by a large body of scientific research. ALR Technologies Inc, G Medical Innovations Holdings Ltd, and Omega Diagnostics Group PLC are all competitors of Hologic Inc.

– ALR Technologies Inc ($OTCPK:ALRT)

ALR Technologies Inc is a publicly traded company with a market capitalization of $19.32 million as of 2022. The company has a return on equity of 17.26%. ALR Technologies is a leading provider of enterprise software solutions. The company’s products are used by organizations of all sizes to manage their businesses. ALR Technologies’ products are used by companies in a variety of industries, including healthcare, manufacturing, retail, and government.

– G Medical Innovations Holdings Ltd ($NASDAQ:GMVD)

As of 2022, Aetna’s market cap was 5.58M and its ROE was 783.79%. Aetna is a diversified healthcare benefits company that offers a broad range of traditional and consumer-directed health insurance products and related services, including medical, pharmacy, dental, behavioral health, group life and disability plans, and medical management capabilities and health care management services for Medicaid plans.

– Omega Diagnostics Group PLC ($LSE:ODX)

Omega Diagnostics Group PLC is a medical diagnostics company. The company develops, manufactures, and supplies diagnostic test kits and instruments. It offers tests for the detection of allergies, food intolerances, infectious diseases, and hormones. The company sells its products through a network of distributors in the United Kingdom, Europe, the United States, Asia, Australia, and Africa.

Summary

Hologic is a medical technology company that specializes in diagnostic and medical imaging systems, surgical systems, healthcare information technology, and other related products and services. The company recently released its non-GAAP earnings per share (EPS) of $1.06, which was higher than the expected number by $0.18.

Additionally, their revenue came in at $1.03 billion, which beat the expectations by $72.47 million. This strong performance has led some to feel positive about the prospects of investing in Hologic. Analysts are recommending investors consider Hologic as a potential long-term opportunity since their products and services are used by healthcare providers worldwide and have the potential for increased demand in the coming years.

Recent Posts