Healthpeak Properties Boosts 2023 Guidance After Q2 Beat

July 29, 2023

☀️Trending News

Healthpeak Properties ($NYSE:PEAK), a real estate investment trust, is one of the largest owners and operators of healthcare real estate in the U.S. Following its impressive second quarter performance, the company has raised its 2023 guidance for funds from operations, as adjusted, and cash net operating income growth. The company attributed its strong second quarter performance to its portfolio of diversified healthcare assets which includes medical office buildings, outpatient medical centers, ambulatory care centers, and life science properties. In light of this success, Healthpeak plans to acquire additional assets in order to continue boosting its 2023 guidance.

Overall, Healthpeak Properties’ second quarter results have proven that the company is well-positioned for future growth. With its new guidance for funds from operations and cash net operating income growth, Healthpeak is set to see even more success in 2023.

Price History

On Friday, Healthpeak Properties (HPP) released its second-quarter results, which came in better than analysts’ expectations. This resulted in the company raising its 2023 guidance. HPP’s stock opened at $22.3 and closed at $21.7, down by 0.4% from its last closing price of $21.8.

The company also saw increased occupancy rate and total portfolio value. With its new guidance, HPP is now well positioned to capitalize on the current market conditions and continue to deliver strong returns in the coming years. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Healthpeak Properties. More…

| Total Revenues | Net Income | Net Margin |

| 2.12k | 529.55 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Healthpeak Properties. More…

| Operations | Investing | Financing |

| 880 | -876.34 | -116.53 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Healthpeak Properties. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 15.6k | 8.48k | 11.95 |

Key Ratios Snapshot

Some of the financial key ratios for Healthpeak Properties are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 17.4% |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis

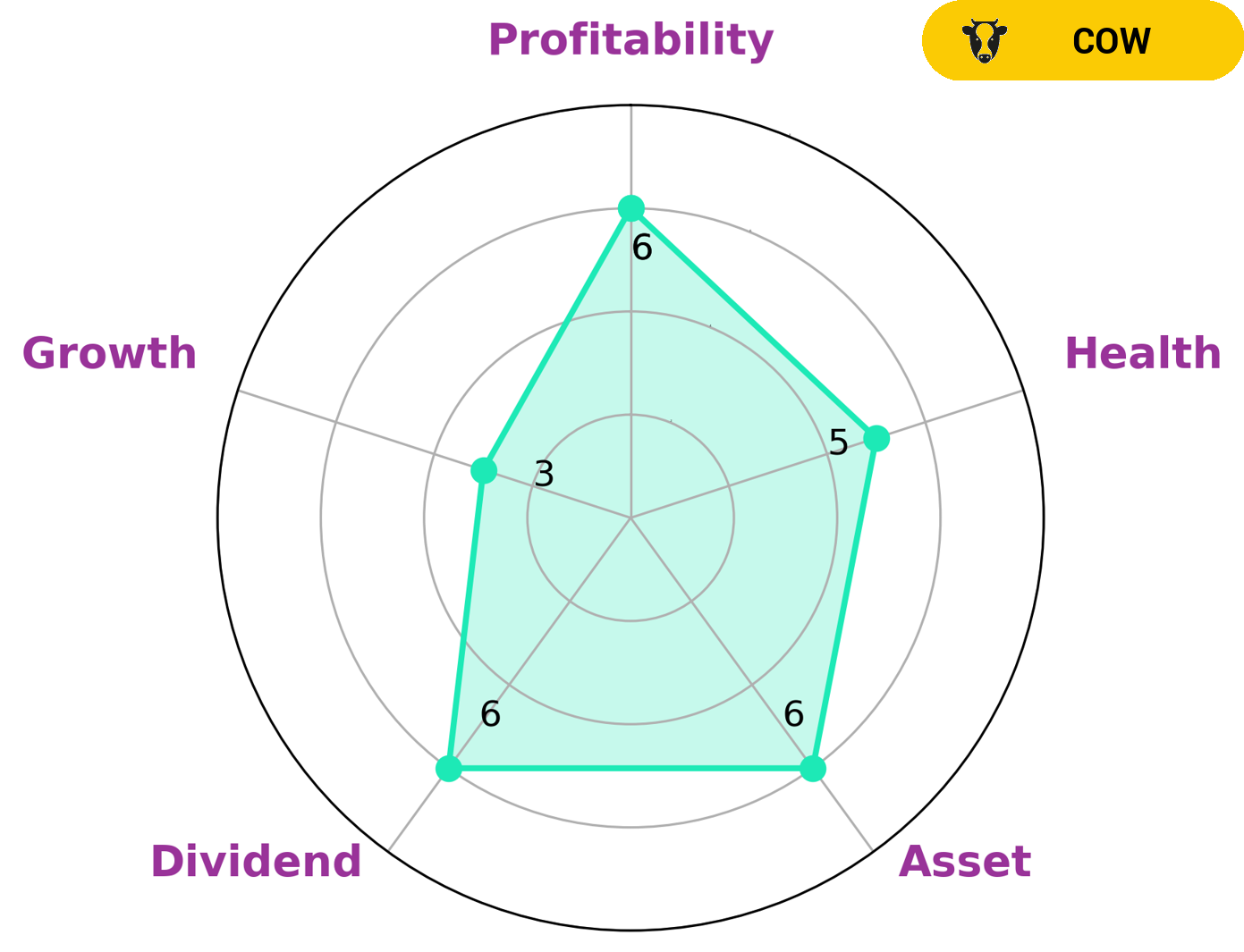

As an investor looking for a steady stream of income, HEALTHPEAK PROPERTIES is a great option to consider. Our GoodWhale Star Chart has classified the company as a “cow” – companies with the track record of paying out consistent and sustainable dividends. Taking a deeper look at HEALTHPEAK PROPERTIES, our analysis shows an intermediate health score of 6/10 with regard to its cashflows and debt. This means that investors can trust that HEALTHPEAK PROPERTIES has the capacity to pay off debt and fund future operations. Additionally, our analysis highlights that HEALTHPEAK PROPERTIES is strong in asset, dividend, and profitability, but weak in growth. For those seeking a steady income stream, HEALTHPEAK PROPERTIES is worth considering. Our analysis highlights its potential to provide investors with reliable dividend payments. More…

Peers

Its competitors are Medical Properties Trust Inc, Welltower Inc, and Omega Healthcare Investors Inc.

– Medical Properties Trust Inc ($NYSE:MPW)

Medical Properties Trust is a real estate investment trust that focuses on healthcare-related properties. The company’s portfolio includes hospitals, nursing homes, and other medical facilities. Medical Properties Trust is headquartered in Birmingham, Alabama.

– Welltower Inc ($NYSE:WELL)

Welltower Inc. is a real estate investment trust that invests in healthcare real estate. The company has a market capitalization of $26.82 billion as of 2022. Welltower owns and operates senior housing, skilled nursing, and other healthcare properties in the United States, Canada, and the United Kingdom.

– Omega Healthcare Investors Inc ($NYSE:OHI)

Omega Healthcare Investors is a publicly traded real estate investment trust that specializes in investing in the long-term care industry. The company’s market cap as of 2022 is 7.18 billion. The company has a portfolio of over 1,200 properties in the United States, the United Kingdom, and Canada. Omega Healthcare Investors is one of the largest owners and operators of skilled nursing and assisted living facilities in the United States.

Summary

.

Recent Posts