Healthcare Realty Trust Q4 2023 FFO Beats Estimate by $0.02

March 3, 2023

Trending News ☀️

Healthcare Realty Trust ($NYSE:HR) (HR) reported its fourth quarter financial results for the 2023 fiscal year, delivering strong earnings that exceeded expectations. According to data from the earnings release, HR reported an FFO of $0.42 per share for the quarter, topping consensus estimates by $0.02. This marks the third consecutive quarter of year-on-year growth for the company. The results demonstrate HR’s success in repositioning its portfolio to capitalize on emerging trends in the healthcare real estate sector. This includes a focus on properties in rural areas and non-traditional medical office strategies.

The company has also continued to invest in their portfolio and strengthen their management team, driving strong returns and maximizing efficiency. Looking ahead, HR expects to continue this trend of strong performance through a disciplined strategy that focuses on quality assets, diversification, and strategic partnerships. They anticipate further growth in the coming quarters and will continue to seek out opportunities to take advantage of the increasing demand for healthcare space in the industry.

Share Price

Healthcare Realty Trust has been experiencing positive media coverage in light of the company’s Q4 2023 financial results. On Wednesday, the stock opened at $19.4 and closed at $19.4, a slight decrease of 0.8% from the previous closing price. This was despite the company exceeding earnings estimates for the quarter by two cents, a small but growing indication of the company’s overall financial success. Investors remain optimistic that Healthcare Realty Trust will be able to capitalize on the current upward trend and continue to produce positive results in the coming quarters. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for HR. More…

| Total Revenues | Net Income | Net Margin |

| 731 | 95.91 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for HR. More…

| Operations | Investing | Financing |

| 189.03 | 1.23k | -1.38k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for HR. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 14.2k | 6.36k | 20.3 |

Key Ratios Snapshot

Some of the financial key ratios for HR are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 11.5% |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis

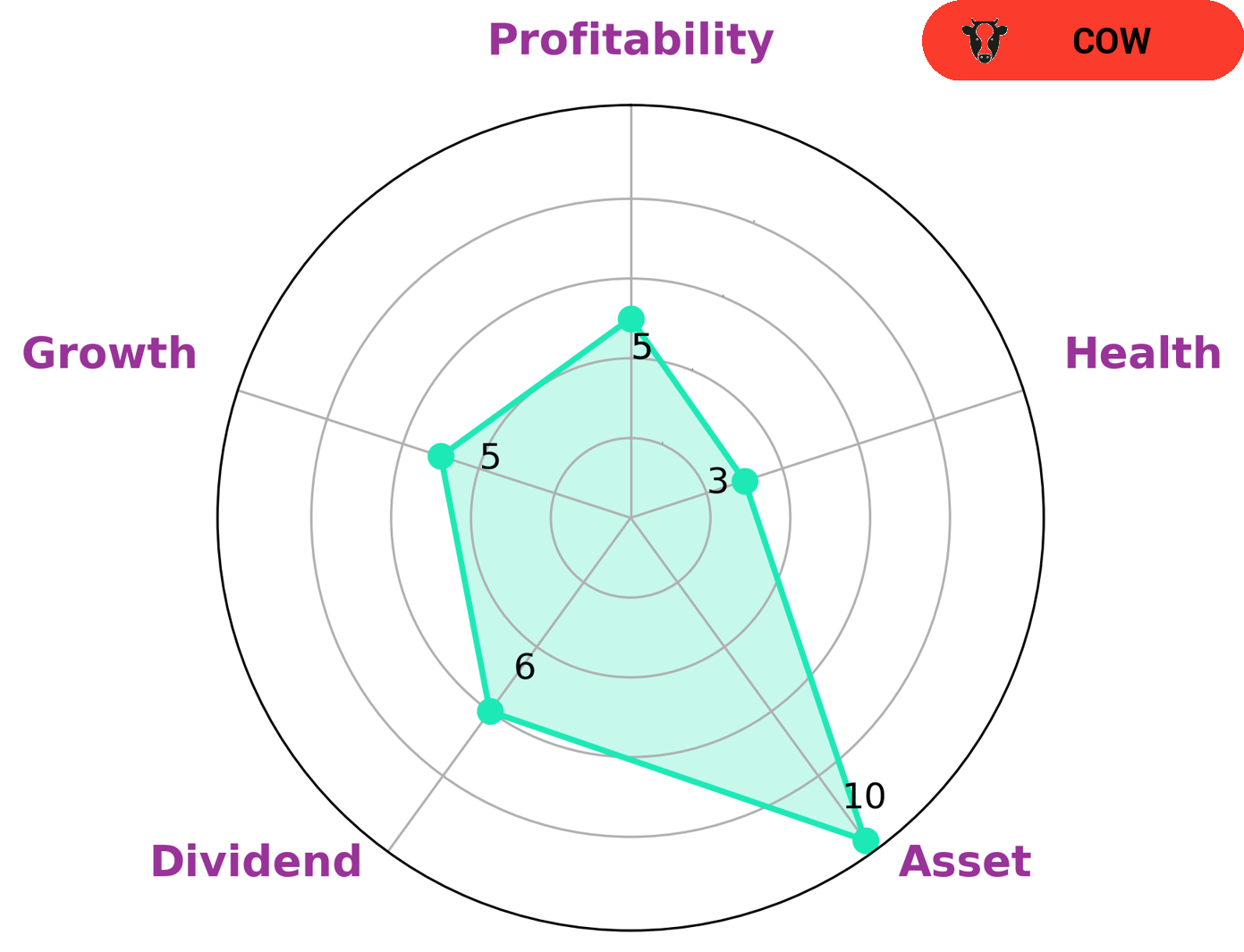

GoodWhale recently conducted an analysis of HEALTHCARE REALTY TRUST’s wellbeing. According to our Star Chart, HEALTHCARE REALTY TRUST is classified as a ‘cow’ – a type of company that has the track record of paying out consistent and sustainable dividends. This means that HEALTHCARE REALTY TRUST is an attractive investment for those looking for steady income and strong returns regardless of fluctuations in the stock market. However, HEALTHCARE REALTY TRUST has a low health score of 3/10 with regard to its cashflows and debt, which may make it less likely to safely ride out any crisis without the risk of bankruptcy. While HEALTHCARE REALTY TRUST is strong in asset, and medium in dividend, growth, and profitability, investors should consider their risk tolerance before investing in this type of company. With this in mind, investors that are more conservative and focusing on steady income should find HEALTHCARE REALTY TRUST to be an attractive option. More…

Peers

The company’s properties include hospitals, medical office buildings, senior housing facilities, and other healthcare-related facilities. The company’s portfolio is diversified across the United States, with properties in 26 states. Healthcare Realty Trust Inc’s competitors include Sabra Health Care REIT Inc, Omega Healthcare Investors Inc, and LTC Properties Inc. These companies are also involved in the ownership and operation of healthcare-related properties.

– Sabra Health Care REIT Inc ($NASDAQ:SBRA)

Sabra Health Care REIT Inc has a market cap of 2.97B as of 2022. The company is a real estate investment trust that focuses on the healthcare sector. Sabra owns and leases properties across the United States and Canada. The company’s portfolio includes skilled nursing facilities, assisted living facilities, senior housing, hospitals, and other healthcare-related properties.

– Omega Healthcare Investors Inc ($NYSE:OHI)

Omega Healthcare Investors is a real estate investment trust that specializes in the ownership and leasing of long-term care facilities. As of December 31, 2020, the company owned 1,527 skilled nursing and assisted living facilities located in the United States, the United Kingdom, and India.

– LTC Properties Inc ($NYSE:LTC)

LTC Properties Inc is a real estate investment trust that primarily invests in senior housing and long-term care properties. As of December 31, 2020, the company owned a portfolio of 431 properties in 37 states. The company has a market cap of $1.54 billion as of March 2021.

Summary

The positive news has been widely covered in the media, with most reports containing a favorable outlook on the company’s future prospects. Analysts note that the company’s focus on acquisition opportunities, expansion of private-public partnerships and cost containment strategies have kept it ahead of competition. HRT is a promising investment opportunity as its portfolio consists of healthcare-related real estate assets located across the United States.

The company offers attractive rental yields and is well-positioned to benefit from increased demand for quality healthcare services. Investors should keep an eye out for further updates, as Healthcare Realty Trust continues to remain competitive within the healthcare real estate sector.

Recent Posts