Don’t Miss Out: Get the Latest on Newegg Commerce Stock This Week!

January 31, 2023

Trending News ☀️

Don’t miss out on the latest news regarding Newegg Commerce ($NASDAQ:NEGG) Inc. stock this week! This week, investors and interested parties alike should keep their eyes on the stock market to get a better understanding of the company’s current performance. Newegg Commerce Inc. is an online retailer that specializes in offering products related to computer hardware, electronics, gaming and more. The company is based in California, USA and is a well-established name in the e-commerce industry. Reports from financial analysts have indicated that the company’s stock price has been steadily increasing over the past few months. Investors have been taking advantage of this trend by buying more shares and increasing their holdings in the company. Other news that investors should be aware of is the company’s earnings reports which have been released this week. These reports have highlighted the company’s strong financial performance and have provided investors with insight into the company’s future prospects.

Additionally, shareholders have been given a glimpse into the company’s strategic plans for the coming year which could prove beneficial to those who are looking to invest in the company. In conclusion, now is the time to stay up to date with the latest news and developments concerning Newegg Commerce Inc. stock. The company has recently reported strong earnings and its stock price has been steadily increasing, making it an attractive investment for those looking for a long-term return on their investments. Additionally, shareholders have been given an insight into the company’s future plans which could provide further evidence of how successful the company may be in the near future.

Stock Price

At the time of writing, news coverage of the company is mostly mixed. On Tuesday, Newegg Commerce Inc. stock opened at $1.8 and closed at $1.9, for a 3.9% increase from the prior closing price of $1.8. While the increase is not a huge one, it is still a sign that the company is on the upswing. It’s important to note, however, that the stock price could change quickly due to factors outside of the company’s control. Therefore, it’s important to stay abreast of news coverage and any updates on the company’s financial performance.

For investors looking to gauge the company’s performance this week, analysts are keeping a close eye on how well Newegg Commerce Inc. is able to weather any market volatility. They are also watching to see if the company is able to continue its upward trend or if its stock price will begin to decline. Overall, this week is an important one for those who are interested in staying informed about Newegg Commerce Inc. stock. Make sure you don’t miss out on any of the latest news and updates this week so you can make the most informed decisions about your investments. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Newegg Commerce. More…

| Total Revenues | Net Income | Net Margin |

| 1.87k | -21.14 | -1.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Newegg Commerce. More…

| Operations | Investing | Financing |

| -34.79 | -6.94 | 2.82 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Newegg Commerce. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 488.02 | 313.15 | 0.47 |

Key Ratios Snapshot

Some of the financial key ratios for Newegg Commerce are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | -1.9% |

| FCF Margin | ROE | ROA |

| -2.5% | -12.5% | -4.5% |

VI Analysis

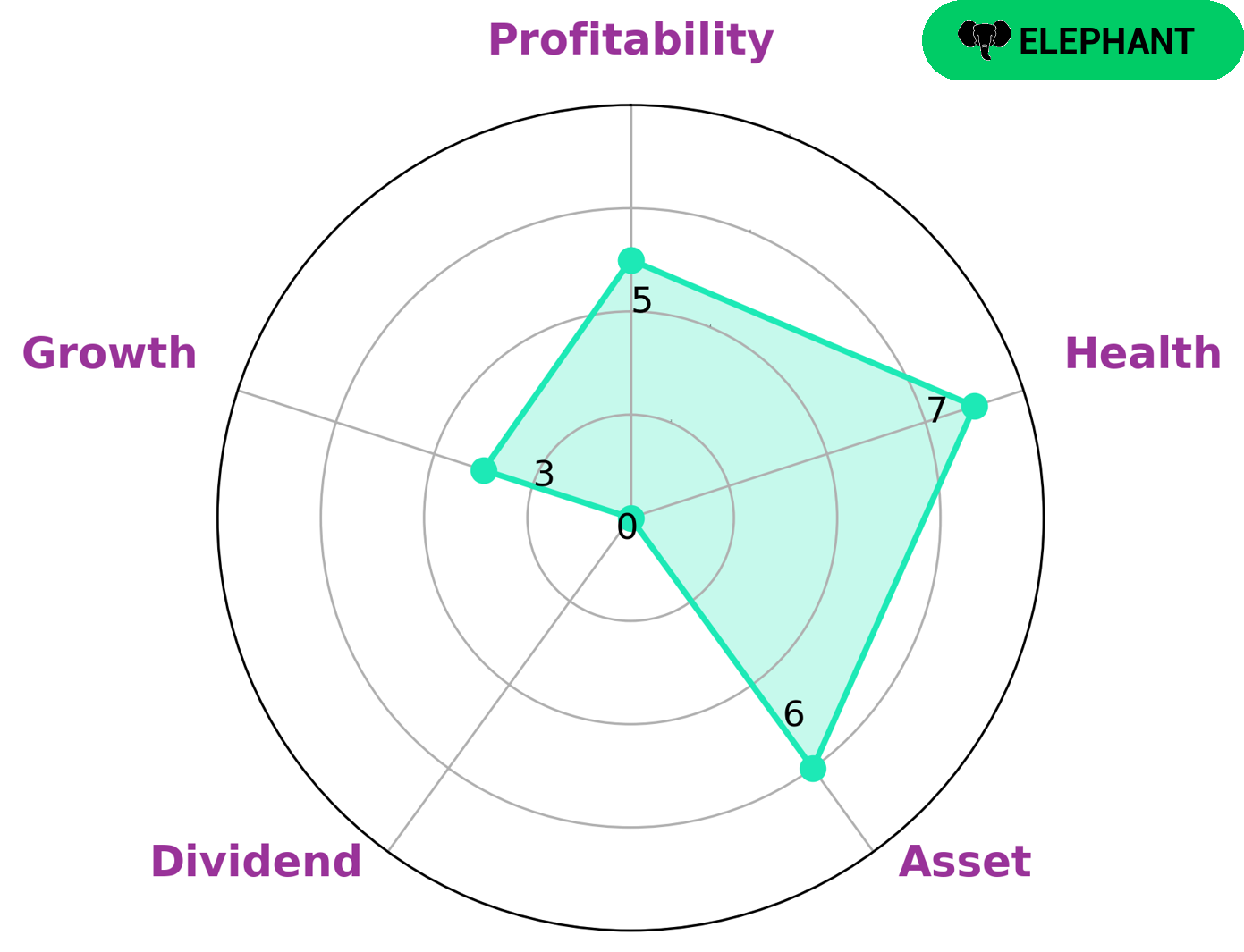

The VI app simplifies the analysis of NEWEGG COMMERCE‘s fundamentals, which reflect its long-term potential. Using the VI Star Chart, NEWEGG COMMERCE is classified as an ‘elephant’ – companies that are rich in assets once liabilities are deducted. Such companies may be of interest to investors looking for a long-term, stable investment with a good return. NEWEGG COMMERCE is also performing well according to its health score, which is 7/10 with regard to its cashflows and debt. This shows that the company is likely to be able to sustain future operations through times of crisis. The company’s performance against each of the five pillars is also strong. It is particularly strong in asset and profitability, medium in asset and weak in dividend and growth. This suggests that NEWEGG COMMERCE is currently in a good position to generate returns for its investors. In conclusion, the VI app has provided a comprehensive overview of NEWEGG COMMERCE’s performance and long-term potential. The company has a strong balance sheet, is performing well according to its health score and its performance against each of the five pillars is also strong. This makes it an attractive investment for investors looking for a long-term, stable investment with a good return. More…

VI Peers

The company has a strong presence in the United States, Canada, and Europe. Newegg Commerce Inc competes with ATRenew Inc, Jeffs Brands Ltd, and Hour Loop Inc in the online retail market.

– ATRenew Inc ($NYSE:RERE)

Based in Atlanta, Georgia, CATRenew Inc is a publicly traded company that provides environmental remediation services. The company’s market cap as of 2022 was 372.79M, and its ROE was -5.98%. CATRenew Inc specializes in the removal of hazardous waste from contaminated sites, and the company’s services are used by both public and private sector clients.

– Jeffs Brands Ltd ($NASDAQ:JFBR)

Jeffs Brands Ltd is a holding company that operates in the food and beverage industry. The company has a market capitalization of 12.84 million as of 2022 and a return on equity of -103.49%. The company’s primary operations are in the United Kingdom and Ireland. Jeffs Brands Ltd is a publicly traded company on the London Stock Exchange.

– Hour Loop Inc ($NASDAQ:HOUR)

Loop Inc is a company that provides software for businesses. Its market cap is $93.56 million and its ROE is 20.34%. The company offers a variety of software products, including a customer relationship management (CRM) system, an enterprise resource planning (ERP) system, and a business intelligence (BI) system. Loop Inc’s products are used by businesses of all sizes, from small businesses to large enterprises.

Summary

NEWEGG COMMERCE is a stock worth watching this week. The news coverage is mostly mixed, but the stock price has moved up on the same day. Investors should do their own research and make their own decisions about whether to invest in the company. They should consider factors such as the company’s financials, market conditions, and potential risks.

Analysts suggest that investors should consider the long-term potential of NEWEGG COMMERCE, as it has been gaining momentum in recent months. Investors should also be aware of the potential risks, such as the potential for changes in the economy or technology.

Recent Posts