Becton, Dickinson Poised to Outperform 2023 Expectations

June 10, 2023

☀️Trending News

Becton ($NYSE:BDX), Dickinson (BD) is a leading medical technology company that produces and distributes a wide range of medical supplies, devices, laboratory equipment and diagnostic products. The company is well positioned to outperform investor expectations for the second half of 2023. BD is known for its innovative medical technologies and solutions that enable healthcare professionals to provide better care and improve patient outcomes. The company is expected to benefit from its strong track record of delivering consistent growth, financial strength, and strong cash flows.

Additionally, BD has a solid presence in the medical device and diagnostics market, with strong brand recognition globally. Additionally, BD has continued to invest in research and development to develop new products and services that will increase its market share. The company has also made strategic investments in new technologies that will help it expand its customer base and grow its market share. Furthermore, BD has a strong presence in emerging markets, with a focus on expanding its reach in these regions. All of these factors are expected to contribute to the company’s success in the coming years. Overall, investors should be encouraged by the prospects of BD in the second half of 2023 as the company is poised to exceed expectations. With its strong product portfolio, financial position, and strategic investments, BD is expected to continue to be a leader in the medical technology industry.

Stock Price

On Thursday, Becton, Dickinson saw their stock open at a healthy $250.3 and close at $249.5 – a decrease of 1.1% from its prior closing price of 252.2. Despite the small dip, analysts remain optimistic that this healthcare technology company will outperform 2023 expectations. Moving forward, investors can expect the company to continue to produce solid returns, as Becton, Dickinson looks to build off its recent momentum in the industry. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Becton. More…

| Total Revenues | Net Income | Net Margin |

| 18.27k | 1.53k | 9.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Becton. More…

| Operations | Investing | Financing |

| 2.1k | -2.77k | -562 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Becton. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 54.39k | 28.7k | 89.72 |

Key Ratios Snapshot

Some of the financial key ratios for Becton are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 1.6% | 3.3% | 10.7% |

| FCF Margin | ROE | ROA |

| 6.3% | 4.8% | 2.3% |

Analysis

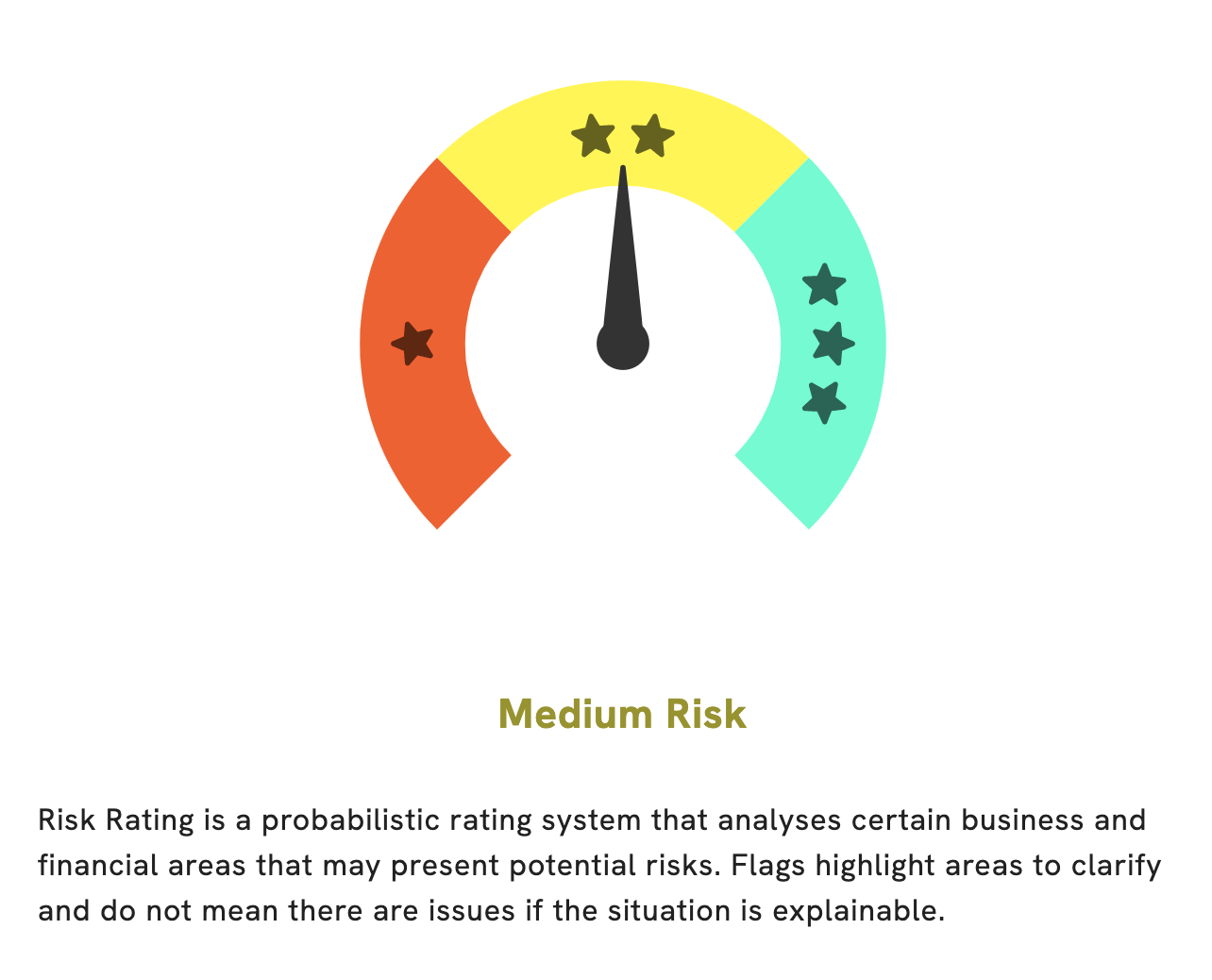

At GoodWhale, we have conducted an in-depth analysis of BECTON’s fundamentals. Our Risk Rating analysis shows that BECTON is a medium risk investment, when taking into account both financial and business aspects. We have identified two risk warnings in the income sheet and balance sheet. To gain access to the details of these warnings, you need to become a registered user of GoodWhale. With our detailed analysis, you can make informed decisions about investing in BECTON and minimize your risk exposure. Becton_Dickinson_Poised_to_Outperform_2023_Expectations”>More…

Peers

Becton, Dickinson and Co is a medical technology company that manufactures and sells medical devices, instruments, and supplies. The company operates in three segments: BD Medical, BD Biosciences, and BD Diagnostics. It offers a wide range of products, including syringes, needles, catheters, blood collection devices, IV administration and infusion products, safety products, and sharps disposal systems. The company competes with Penumbra Inc, Teleflex Inc, SheerVision Inc, and other medical technology companies.

– Penumbra Inc ($NYSE:PEN)

Founded in 2002, Umbra is a leading global provider of shading and decorative products. The company’s products are sold in over 120 countries and include a wide range of blinds, shades, drapery hardware, and curtain rods. Headquartered in Toronto, Canada, Umbra employs over 1,200 people worldwide.

Umbra’s market cap is 7.01B as of 2022. The company’s Return on Equity is -2.31%.

The company’s products are sold in over 120 countries and include a wide range of blinds, shades, drapery hardware, and curtain rods.

– Teleflex Inc ($NYSE:TFX)

Teleflex Incorporated is a diversified global provider of medical technologies designed to improve the health and quality of people’s lives. The Company provides solutions for critical care, anesthesia, surgical, urology and emergency medicine.

– SheerVision Inc ($OTCPK:SVSO)

SheerVision Inc is a US-based company that manufactures and sells ophthalmic surgical instruments and devices. The company has a market cap of 140.32k as of 2022 and a Return on Equity of -70.28%. SheerVision’s products are used by eye surgeons to correct vision problems such as nearsightedness, farsightedness, and astigmatism. The company’s products are sold through a network of distributors and retailers worldwide.

Summary

Becton, Dickinson (BD) stock has been on a steady rise in the past year. Analysts from multiple Wall Street firms have reaffirmed their bullish outlook on the company, expecting BD to beat its 2023 H2 expectations. Analysts believe that BD’s strong customer relationships, bolstered by data-driven product innovations, will drive increased sales and profitability. Furthermore, analysts note that BD’s expanding portfolio of medical products, combined with its low cost of debt, will power the company’s continued growth.

Additionally, analysts comment that the company’s financial position could be further strengthened by its recently announced share repurchase program. For investors, the consensus is that BD is an attractive buy due to its strong fundamentals and long-term growth prospects.

Recent Posts