Kennede Electronics MFG Stock Drops 10% as Expected Returns Fall Short

January 17, 2023

Trending News 🌥️

Kennede ($SZSE:002723) Electronics MFG is one of the leading companies in the electronics manufacturing industry. The company has been around for decades, and its stock has been a popular choice for investors looking for long-term investments.

However, recent news of Kennede’s expected returns falling short have caused its stock to drop by 10%. Investors had expected the company to post a good return on their investments in the upcoming quarter, but unfortunately this did not happen. With the company’s stock price falling, many investors are now panicking and looking to sell their shares. This has caused a further downward spiral in Kennede’s stock price. The reasons behind Kennede’s disappointing returns are numerous. Firstly, the company is facing increased competition from other manufacturers in the market, which is causing it to lose market share. Secondly, its products are not as innovative as those of its rivals, meaning customers are not as likely to be interested in them. Finally, its supply chain is less efficient than its competitors, causing profits to fall. The news of Kennede’s stock price dropping has made many investors nervous, but the company is determined to turn things around. It is investing heavily in research and development to create more innovative products and improve its supply chain. It is also working to expand its customer base by targeting new markets and creating more marketing campaigns. By doing these things, Kennede hopes to improve its returns and get its stock price back up. In the meantime, investors should be aware that Kennede’s stock price may remain volatile for some time, and they should consider any investments carefully before making a decision.

Price History

On Friday, the stock of KENNEDE ELECTRONICS MFG dropped by 10.0% from its prior closing price of ¥14.4 to ¥13.0. The stock opened at ¥14.3 and closed at the lower amount, resulting in a significant decrease in value. At the time of writing, the news sentiment is generally positive. Analysts had expected returns to be lower than initially forecasted, which could explain the drop in stock price.

However, it is unclear what other factors may have contributed to the sudden drop. The KENNEDE ELECTRONICS MFG stock had been steadily increasing over the past few weeks, making the sudden drop quite surprising. Investors are now cautiously watching the stock to see if it will rebound or continue to decline. Many experts believe that the stock will recover in the near future due to the company’s strong fundamentals and long-term prospects. KENNEDE ELECTRONICS MFG has a solid track record of innovation and profitability, as well as a loyal customer base. The recent drop in stock price does not necessarily reflect the overall health of the company, but rather the current market sentiment. In the long run, KENNEDE ELECTRONICS MFG is expected to remain a strong and reliable company. Investors should take this into account when deciding whether or not to invest in the company’s stock. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Kennede Electronics Mfg. More…

| Total Revenues | Net Income | Net Margin |

| 1.45k | 25.73 | 2.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Kennede Electronics Mfg. More…

| Operations | Investing | Financing |

| -74.49 | -315.48 | 657 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Kennede Electronics Mfg. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.45k | 1.2k | 3.89 |

Key Ratios Snapshot

Some of the financial key ratios for Kennede Electronics Mfg are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 21.3% | 801.6% | 4.1% |

| FCF Margin | ROE | ROA |

| -17.4% | 3.0% | 1.5% |

VI Analysis

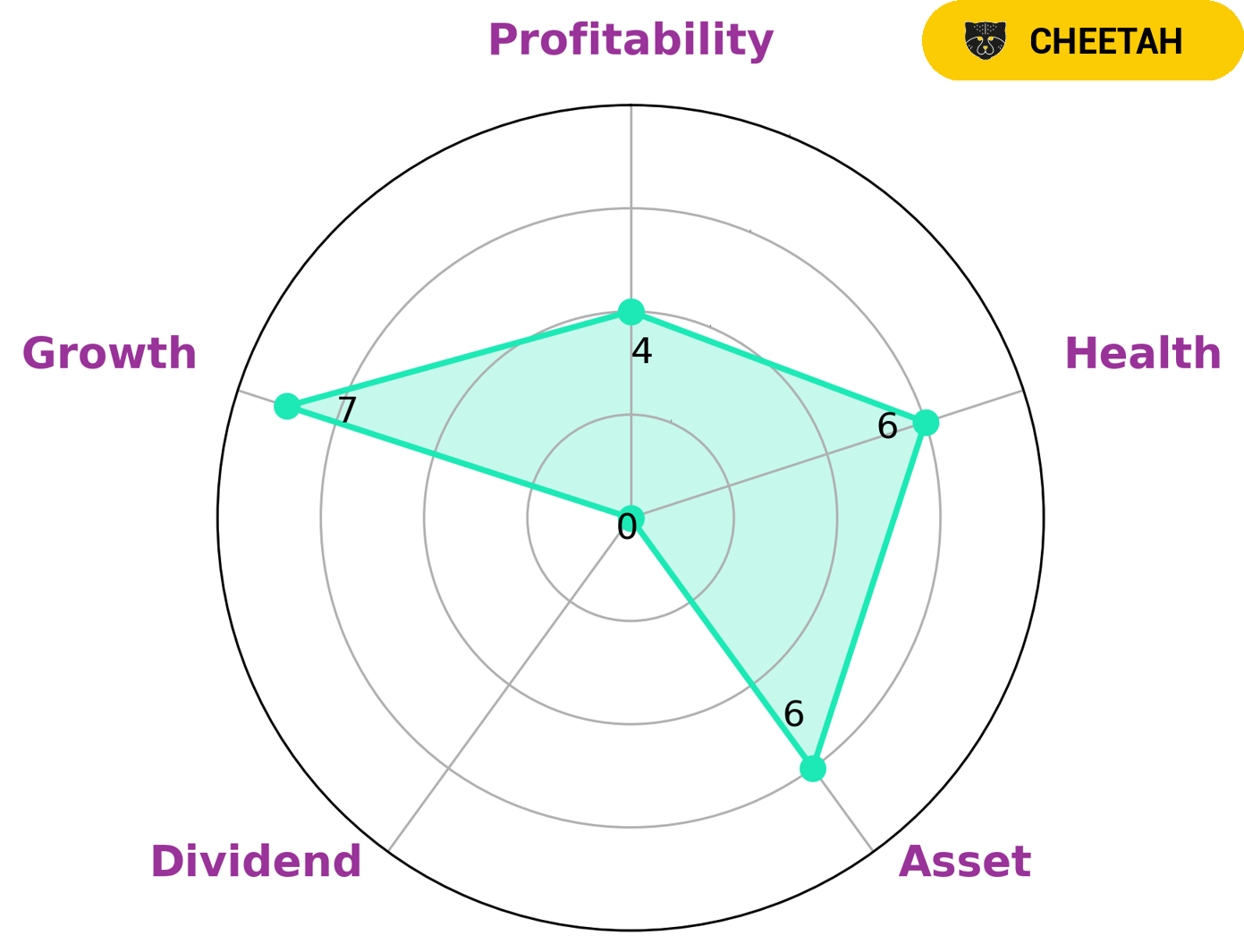

Kennede Electronics Mfg’s long term potential can be assessed through its fundamentals, which are evaluated by the VI app. This company is classified as a ‘cheetah’ based on the VI Star Chart, meaning it has achieved high revenue or earnings growth, but is considered less stable due to lower profitability. Investors who are willing to take on higher risk may be interested in such a company. Kennede Electronics Mfg is rated intermediate in terms of health, meaning the cashflows and debt are adequate to ride out any crisis without the risk of bankruptcy. However, their dividend is weak in comparison to the other areas, such as growth, asset and profitability. The company’s fundamentals give insight into its long-term potential, and can be used to identify whether it is a suitable investment for certain investors. By understanding its strengths and weaknesses, investors can make more informed decisions about whether to invest in the company. In addition, looking at the overall health score can help investors determine if Kennede Electronics Mfg is a safe bet. More…

VI Peers

Kennede Electronics MFG Co Ltd is in fierce competition with its rivals, Elec-tech International Co Ltd, Yotrio Group Co Ltd and Energy Focus Inc. All four companies are vying for dominance in the electronics manufacturing industry, pushing each other to innovate and create better products for consumers. With the latest advances in technology and materials, the competition between these four companies is only heating up as each one strives to come out on top.

– Elec-tech International Co Ltd ($SZSE:002005)

Elect-tech International Co Ltd is a leading global electronics manufacturing company. The company specializes in the production of consumer electronics, home appliances, and industrial products. As of 2023, the company has a market capitalization of 2.49 billion dollars, making it one of the largest publicly traded companies in its industry. Despite its impressive size, their Return on Equity (ROE) is -25.78%, indicating that the company is not generating strong returns on the investments of its shareholders.

– Yotrio Group Co Ltd ($SZSE:002489)

Yotrio Group Co Ltd is a Chinese-based company that specializes in the manufacture, installation, and maintenance of outdoor leisure and sports products. With a market cap of 7.64 billion as of 2023, Yotrio Group Co Ltd is a large publicly traded company. The company’s Return on Equity (ROE) is -1.47%, indicating that the company has not been able to use its equity efficiently to generate profits. This can be due to a number of factors, including high levels of debt or low levels of profitability. Despite this, Yotrio Group Co Ltd continues to be a major player in the outdoor leisure and sports industry.

– Energy Focus Inc ($NASDAQ:EFOI)

Energy Focus Inc is a publicly traded company that specializes in LED lighting products and lighting control technologies. As of 2023, the company has a market cap of 5.39M, which is a measure of the company’s overall value and its potential for future growth. Additionally, the company has a Return on Equity of -211.73%, indicating that it is currently losing money on equity investments. Despite this, the company has continued to expand its product offerings, making it an attractive investment for those looking to diversify their portfolio.

Summary

Kennede Electronics MFG recently experienced a 10% drop in stock price due to lower than expected returns. At the time of writing, the overall sentiment surrounding the company remains mostly positive. This recent decrease in value has resulted in investors needing to reassess their investing strategies with KENNEDE ELECTRONICS MFG.

Analysts are suggesting that investors should be aware of the risks associated with investing in the company and consider diversifying their portfolios with other stocks. It is also important for investors to keep an eye on the company’s performance and any potential changes in the market that may affect their investments.

Recent Posts