Whirlpool Corporation Intrinsic Value – Goldman Sachs Upgrades Whirlpool Stock to Buy

April 13, 2023

Trending News 🌥️

Whirlpool Corporation ($NYSE:WHR) is a leading home appliance manufacturer and one of the world’s leading providers of major home and kitchen appliances. Recently, Goldman Sachs has upgraded its rating of Whirlpool’s stock from Neutral to Buy. This positive assessment has resulted in a surge in the stock price of the company. Goldman Sachs analyst Matthew Fassler said that the upgrade was based on the company’s strong returns in the market and its relative outperformance against other companies in the home appliance sector. He also noted that the company’s latest product initiatives have led to increased demand and better margins.

Going forward, Goldman Sachs is optimistic that Whirlpool’s market share will continue to increase, especially with the recent launch of its suite of smart home appliances. The firm believes that the company’s strong product lineup and its focus on innovation will be key drivers of future growth. Overall, Goldman Sachs has upgraded its rating of Whirlpool’s stock to Buy, signaling a positive outlook for the company’s success in the future. With its innovative products and strong market share, the company is well-positioned to continue to thrive in an increasingly competitive space.

Market Price

Goldman Sachs upgraded their rating on WHIRLPOOL CORPORATION stock to “Buy” on Tuesday. The stock opened at $133.5 and closed at $134.0, representing a 3.8% increase from its prior closing price of 129.1. This move comes amidst analysts noting the company’s strong business fundamentals and robust balance sheet.

Investors responded favorably to the news, driving up the stock price. This is the latest demonstration of Whirlpool’s financial strength and stability and investor confidence in the company’s long-term prospects. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Whirlpool Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 19.72k | -1.52k | -0.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Whirlpool Corporation. More…

| Operations | Investing | Financing |

| 1.39k | -3.57k | 1.21k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Whirlpool Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 17.12k | 14.62k | 43.26 |

Key Ratios Snapshot

Some of the financial key ratios for Whirlpool Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -1.1% | -2.7% | -5.3% |

| FCF Margin | ROE | ROA |

| 4.2% | -19.9% | -3.8% |

Analysis – Whirlpool Corporation Intrinsic Value

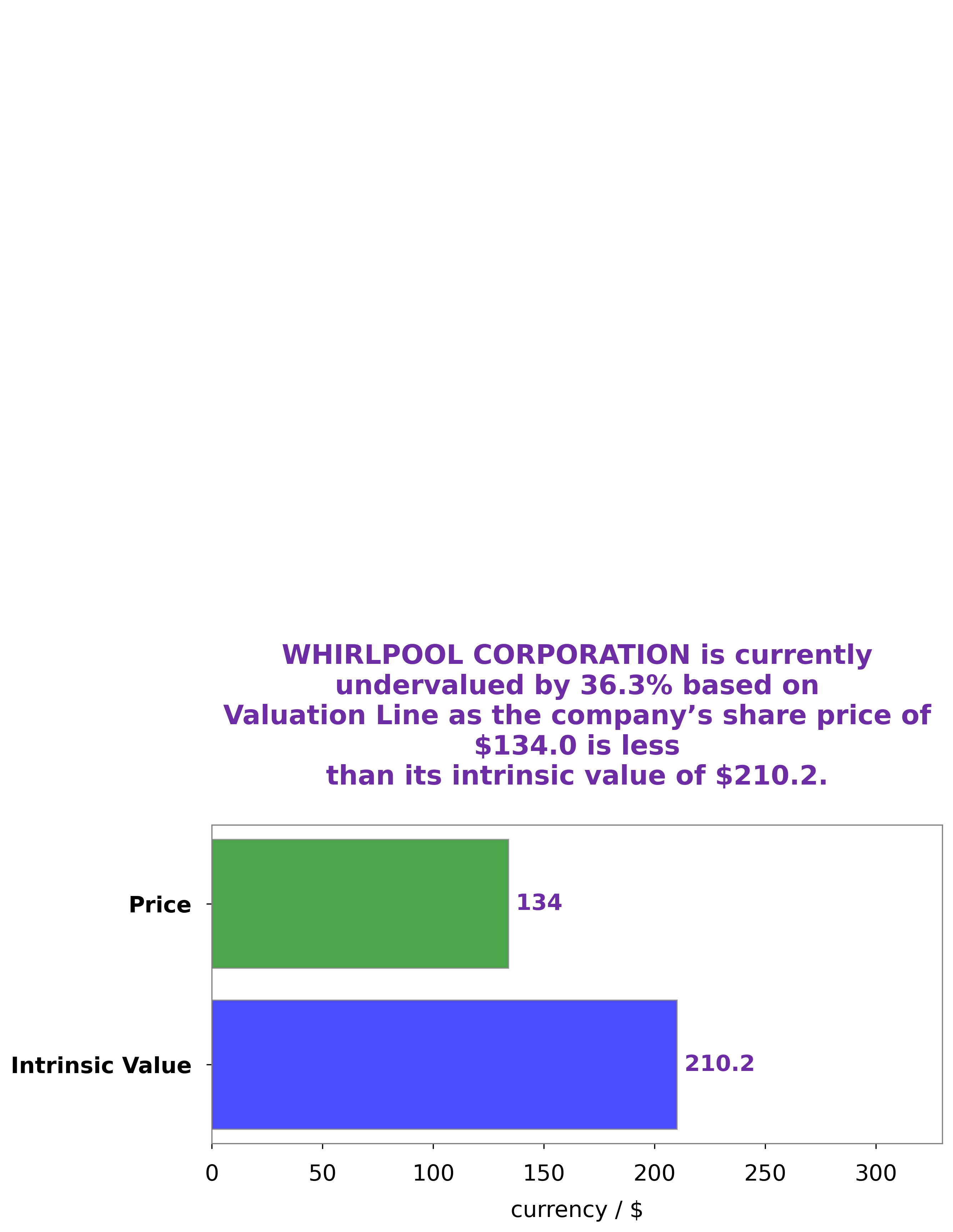

At GoodWhale, we recently conducted an analysis of WHIRLPOOL CORPORATION‘s wellbeing. Through our proprietary Valuation Line, we determined that the fair value of WHIRLPOOL CORPORATION’s shares to be around $210.2. However, the current price of WHIRLPOOL CORPORATION stock is around $134.0, indicating that it is 36.2% below its actual value. This suggests that WHIRLPOOL CORPORATION is currently undervalued and may be a good investment opportunity. More…

Peers

The competition in the home appliance industry is fierce. Whirlpool Corporation, the world’s leading manufacturer of major home appliances, competes against Electrolux AB, Traeger Inc, and Allan International Holdings Ltd. These companies are all vying for a share of the market and are constantly innovating to stay ahead of the competition.

– Electrolux AB ($OTCPK:ELRXF)

Electrolux AB is a Swedish multinational home appliance manufacturer, headquartered in Stockholm. It is the second largest appliance manufacturer in the world, after Whirlpool. The company also makes appliances for professional use. The company has a market cap of 3.07B as of 2022 and a Return on Equity of 14.67%. The company’s products include refrigerators, dishwashers, washing machines, cookers, vacuum cleaners, air conditioners and small appliances such as microwaves and coffee makers.

– Traeger Inc ($NYSE:COOK)

Traeger Inc, a leading manufacturer of grilling products, has a market cap of 351.16M as of 2022. The company’s Return on Equity is -26.37%. Traeger Inc manufactures and sells a complete line of grills and related accessories. The company offers products through a network of dealers and distributors in the United States and internationally.

– Allan International Holdings Ltd ($SEHK:00684)

Allan International Holdings Ltd is a company that operates in the business of providing steel products and services. The company has a market capitalization of 379.68 million as of 2022 and a return on equity of -1.13%. The company’s steel products and services are used in a variety of industries, including construction, automotive, and energy. Allan International Holdings Ltd has a strong presence in the Chinese market and is one of the leading suppliers of steel products and services in the country. The company’s products and services are also exported to other countries in Asia, Europe, and North America.

Summary

Investing in Whirlpool Corporation could be a lucrative option for investors looking for a higher return on investment. Recent news that Goldman Sachs has upgraded their rating of Whirlpool to a Buy has caused the stock to rise in value. Analysts are citing strong sales performance, continued innovation in product development, and a resilient balance sheet as reasons for the positive outlook.

With strong financials and a steady increase in the stock price, now could be a good time to invest in Whirlpool Corporation. Investors should take caution, however, and conduct their own research to ensure that the company is still a good fit for their investing plans.

Recent Posts