Whirlpool Corporation Intrinsic Value Calculation – Whirlpool Corporation Reports Record Breaking Earnings and Revenue

April 26, 2023

Trending News 🌥️

Non-GAAP Earnings Per Share (EPS) of $2.66 topped estimates by $0.49, while revenue of $4.65B exceeded projections by $150M. This marks the first quarter in which Whirlpool Corporation ($NYSE:WHR) has exceeded expectations in both respects. The stellar performance was attributed to a combination of the company’s product innovations, a growing consumer base and well managed strategies for dealing with the ongoing global pandemic. In particular, the company’s e-commerce platform and its focus on digital marketing have contributed to its strong sales growth. Whirlpool’s success is expected to continue in the coming months, as consumer demand for its products is expected to remain strong.

The company is well positioned to capitalize on current market conditions and its strong financial performance is likely to continue as long as consumer demand stays high. Overall, Whirlpool Corporation’s impressive earnings report signals a positive outlook for the company and its shareholders. With its innovative product offerings, robust digital presence and exceptional financial performance, Whirlpool is well positioned to succeed in the future.

Market Price

Despite the news, their stock opened at $141.0 and closed at $140.7, down by 0.2% from the prior closing price of $141.0. Analysts are attributing the slight decline in stock to investors’ caution in light of the upcoming earnings season. Despite this small dip, analysts remain hopeful for a strong performance in the near future as Whirlpool Corporation continues to make strides in innovation and efficiency.

Whirlpool Corporation is the world’s leading manufacturer of major home appliances, and its range of products includes refrigerators, washing machines, dishwashers, cooktops, ovens and more. With a strong focus on innovation and customer satisfaction, Whirlpool Corporation is well positioned to continue delivering record-breaking results in the coming quarters. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Whirlpool Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 19.45k | -2.01k | -2.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Whirlpool Corporation. More…

| Operations | Investing | Financing |

| 1.24k | -3.67k | 1.8k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Whirlpool Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 16.86k | 14.63k | 43.26 |

Key Ratios Snapshot

Some of the financial key ratios for Whirlpool Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -0.9% | -7.8% | -7.5% |

| FCF Margin | ROE | ROA |

| 3.4% | -41.6% | -5.4% |

Analysis – Whirlpool Corporation Intrinsic Value Calculation

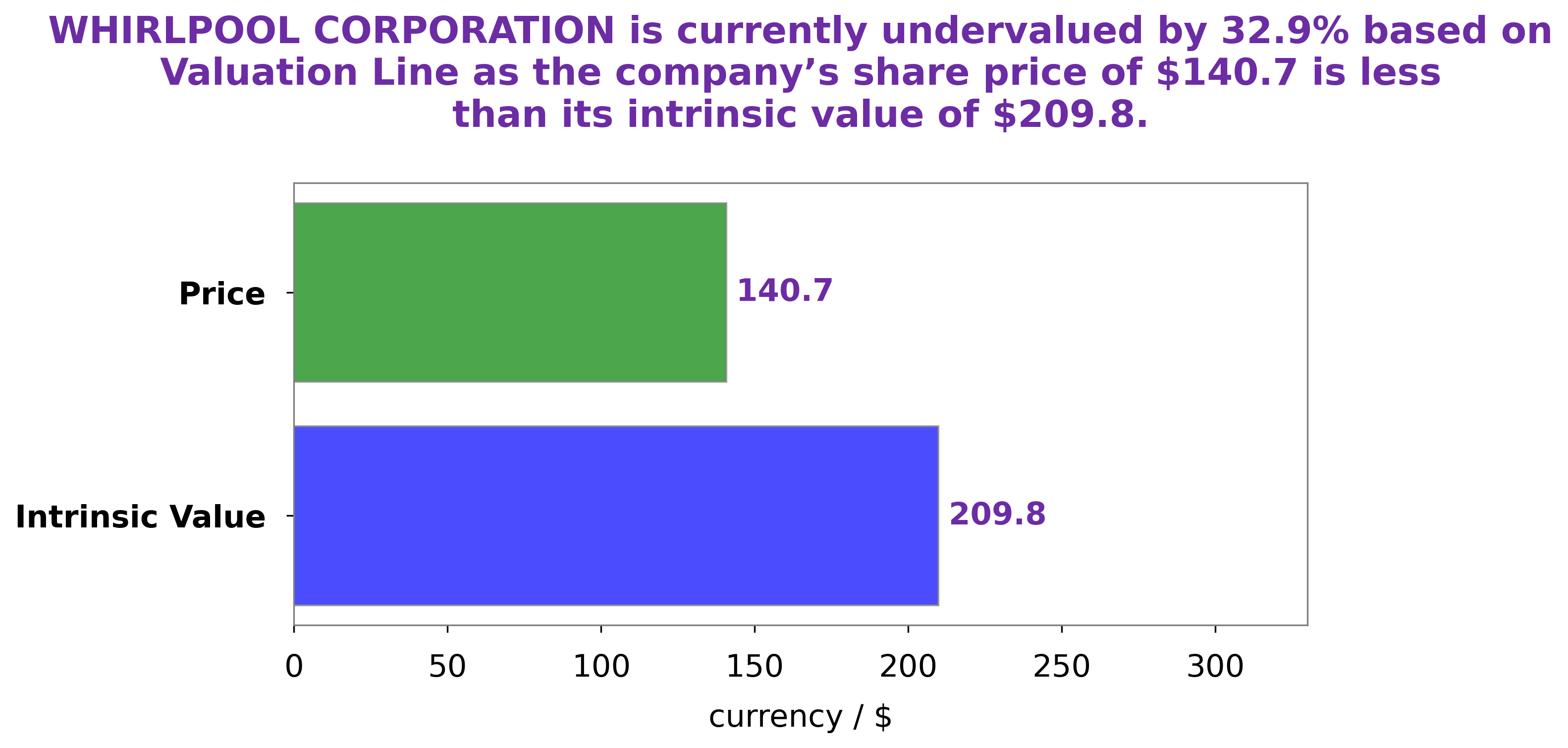

At GoodWhale, we are dedicated to helping investors gain valuable insights into WHIRLPOOL CORPORATION’s financial performance. We’ve recently calculated the fair value of WHIRLPOOL CORPORATION’s stock to be around $209.8 using our proprietary Valuation Line. This suggests that the current price of $140.7 is undervalued by 32.9%. With this information, investors can make more informed decisions on their investments in WHIRLPOOL CORPORATION. More…

Peers

The competition in the home appliance industry is fierce. Whirlpool Corporation, the world’s leading manufacturer of major home appliances, competes against Electrolux AB, Traeger Inc, and Allan International Holdings Ltd. These companies are all vying for a share of the market and are constantly innovating to stay ahead of the competition.

– Electrolux AB ($OTCPK:ELRXF)

Electrolux AB is a Swedish multinational home appliance manufacturer, headquartered in Stockholm. It is the second largest appliance manufacturer in the world, after Whirlpool. The company also makes appliances for professional use. The company has a market cap of 3.07B as of 2022 and a Return on Equity of 14.67%. The company’s products include refrigerators, dishwashers, washing machines, cookers, vacuum cleaners, air conditioners and small appliances such as microwaves and coffee makers.

– Traeger Inc ($NYSE:COOK)

Traeger Inc, a leading manufacturer of grilling products, has a market cap of 351.16M as of 2022. The company’s Return on Equity is -26.37%. Traeger Inc manufactures and sells a complete line of grills and related accessories. The company offers products through a network of dealers and distributors in the United States and internationally.

– Allan International Holdings Ltd ($SEHK:00684)

Allan International Holdings Ltd is a company that operates in the business of providing steel products and services. The company has a market capitalization of 379.68 million as of 2022 and a return on equity of -1.13%. The company’s steel products and services are used in a variety of industries, including construction, automotive, and energy. Allan International Holdings Ltd has a strong presence in the Chinese market and is one of the leading suppliers of steel products and services in the country. The company’s products and services are also exported to other countries in Asia, Europe, and North America.

Summary

Whirlpool Corporation recently reported their second quarter earnings. Non-GAAP EPS of $2.66 beat estimates by $0.49, while total revenue of $4.65B beat estimates by $150M. Overall, the company’s financial performance was strong, as evidenced by the earnings beat and higher-than-expected revenue. Looking ahead, investors will be keeping a close eye on Whirlpool’s ability to sustain this momentum and grow their business.

Investors are also encouraged by the company’s increasing focus on innovation, which could lead to new products and services. With a strong financial record and rising prospects for future growth, many investors believe that Whirlpool is well-positioned to outperform the market in the coming months.

Recent Posts