Victory Capital Management Invests $253K in American Woodmark Co.

February 20, 2023

Trending News 🌥️

American Woodmark ($NASDAQ:AMWD) is a stock listed on the NASDAQ, and the investment by Victory Capital serves as a strong endorsement for the company’s financial stability. American Woodmark Co. is one of the largest manufacturers of kitchen cabinetry in the United States. The company caters to a variety of customers worldwide, including large retail stores, home centers and single-family builders. After the investment by Victory Capital Management Inc., American Woodmark is projected to expand its services even further, making its products more widely available to consumers across the globe. Along with increased purchasing opportunities, the company is now positioned to continue its success due to the alignment with Victory Capital’s financial backing.

This could prove to be a lucrative move for both sides as American Woodmark continues to expand its services and market share. It remains to be seen what impact the investment from Victory Capital Management Inc. will have on American Woodmark Co., but it is certainly an encouraging sign for shareholders and customers alike. With this investment, American Woodmark is well-positioned to continue its growth and success for years to come.

Price History

This investment may suggest that Victory Capital Management Inc. is bullish on the future prospects of American Woodmark Co. and has faith in the company’s ability to continue to provide strong returns. The investment could potentially incentivise other investors to consider American Woodmark Co. as a long-term investment opportunity. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for American Woodmark. More…

| Total Revenues | Net Income | Net Margin |

| 2.07k | 14.12 | 3.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for American Woodmark. More…

| Operations | Investing | Financing |

| 90.05 | -35.44 | -17.78 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for American Woodmark. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.65k | 821.85 | 49.88 |

Key Ratios Snapshot

Some of the financial key ratios for American Woodmark are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 7.8% | -12.9% | 1.4% |

| FCF Margin | ROE | ROA |

| 2.8% | 2.3% | 1.1% |

Analysis

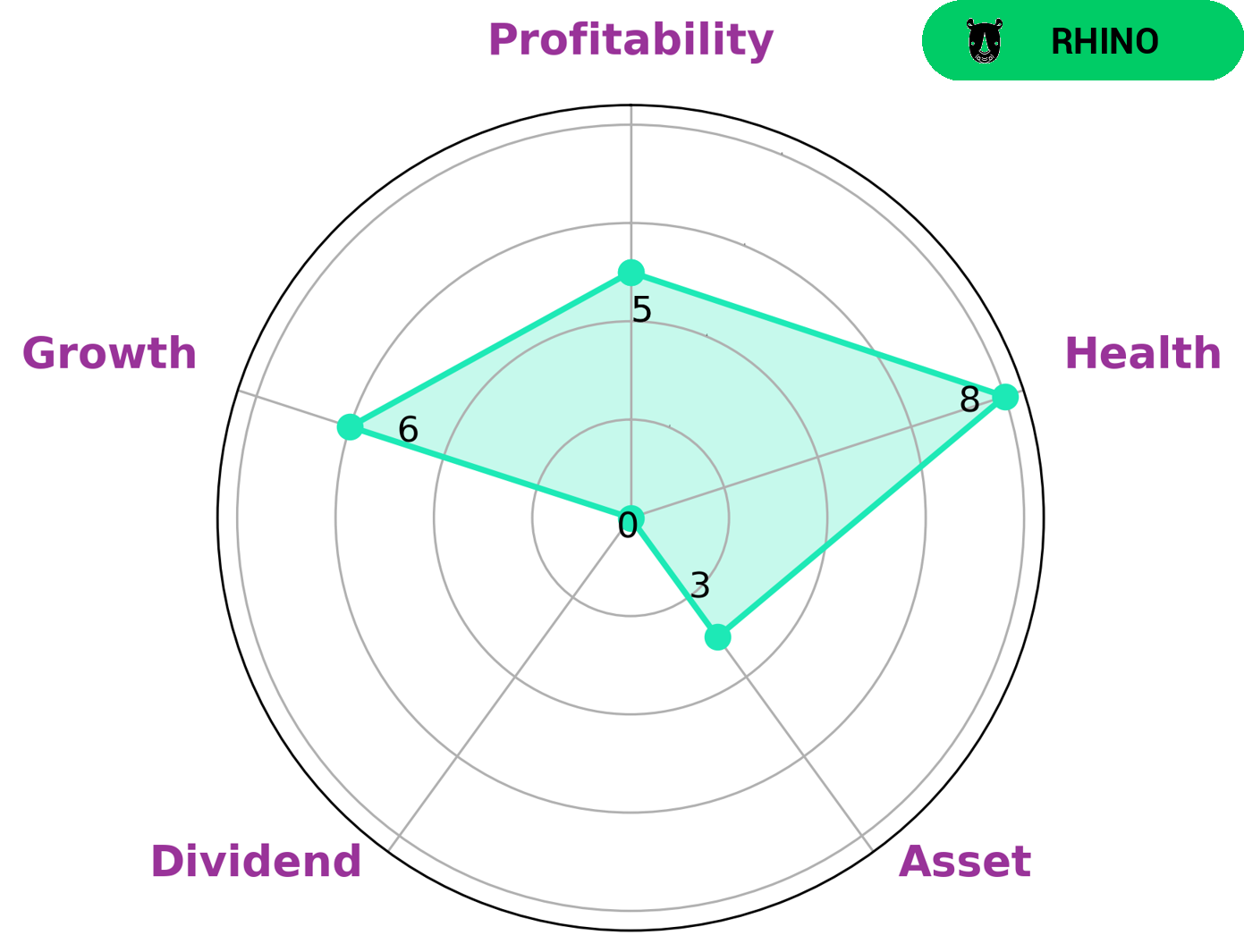

We at GoodWhale recently conducted an analysis of AMERICAN WOODMARK’s wellbeing, using our proprietary Star Chart metric. According to the analysis, AMERICAN WOODMARK is strong in leadership, medium in growth, profitability, and weak in asset and dividend. Overall, AMERICAN WOODMARK has a high health score of 8/10. This score is based on its cashflows and debt, as well as its capability to pay off debt and fund future operations. From our analysis, we have classified AMERICAN WOODMARK as a ‘rhino’ – a type of company that has achieved moderate revenue or earnings growth. Given these results, we believe that value and growth investors may be interested in AMERICAN WOODMARK as an investment opportunity. Value investors may appreciate the company’s high health score, while growth investors may be encouraged by AMERICAN WOODMARK’s moderate revenue and earnings growth. More…

Peers

There is fierce competition between American Woodmark Corp and its competitors LGI Homes Inc, Landbay Inc, and Yotrio Group Co Ltd. All three companies are vying for market share in the wood cabinetry market. American Woodmark Corp has a strong presence in the United States, while its competitors are based in China. Yotrio Group Co Ltd is the largest of the three companies, but all three are well-established and have a loyal customer base.

– LGI Homes Inc ($NASDAQ:LGIH)

LGI Homes Inc is a homebuilding company that focuses on the development and construction of entry-level homes for first-time homebuyers. It has a market cap of 2.15B as of 2022 and a ROE of 19.45%. The company operates in Texas, Arizona, Florida, Georgia, New Mexico, North Carolina, Oklahoma, South Carolina, Colorado, Washington, and Tennessee.

– Landbay Inc ($OTCPK:LNBY)

Landbay Inc is a real estate lending platform that enables investors to earn interest from loans secured by UK property. The company has a market capitalization of £9.75 million and a return on equity of 37.4%. Landbay offers a variety of investment products, including fixed-rate bonds and peer-to-peer loans, that offer attractive returns and are backed by physical property. The company is headquartered in London, England.

– Yotrio Group Co Ltd ($SZSE:002489)

Yotrio Group Co Ltd is a company that manufactures and sells outdoor products. It has a market cap of 7.48B as of 2022 and a Return on Equity of -1.47%. The company’s products include tents, awnings, and other outdoor gear. It also operates an online store.

Summary

Victory Capital Management, Inc. has recently invested in American Woodmark Corporation, a leading manufacturer and distributor of kitchen, bath, and home organization cabinetry for the remodeling, home building, and new home construction markets. The company’s recent financial report indicated a positive gross margin trend and a reduction in operating expense as a percentage of sales. Growth in the company’s customer-purchasing power and higher-than-expected sales are also seen as positive prospects for the company’s future success.

This news encouraged Victory Capital Management, Inc. to make its investment in American Woodmark. The company is also exploring ways to accelerate growth through its ongoing focus on product innovation, expanded distribution, and providing exceptional value to customers.

Recent Posts