Natuzzi S.p.a Stock Fair Value Calculator – Natuzzi S.p.A. Reports Revenue of €86.1M Despite Net Loss of €3.3M

June 3, 2023

☀️Trending News

Despite recording a net loss of €3.3M, the company was able to generate a revenue of €86.1M. They specialize in creating sofas and armchairs with unique and patented designs that are made-to-order and customized for each individual customer. The company has also recently expanded into the hospitality industry, offering customized solutions for both residential and commercial customers.

Natuzzi ($NYSE:NTZ) S.p.A. is a publicly traded company on both the Milan stock exchange and the New York Stock Exchange. Despite its recent net loss, Natuzzi S.p.A. continues to focus on innovation and design in order to remain competitive in the global furniture market.

Earnings

NATUZZI S.P.A, in its earning report of FY2022 Q4 ending December 31 2022, reported total revenue of 116.5M EUR, a 0.8% increase compared to the previous year. However, the company also reported a net loss of 6.0M EUR, representing a 505.4% decrease from the same period in the previous year. Despite this, NATUZZI S.P.A has seen an overall increase in total revenue from 99.9M EUR to 116.5M EUR over the past three years, indicating strong growth potential in the future.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Natuzzi S.p.a. More…

| Total Revenues | Net Income | Net Margin |

| 468.5 | -0.5 | -0.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Natuzzi S.p.a. More…

| Operations | Investing | Financing |

| 18.7 | -4.7 | -13.5 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Natuzzi S.p.a. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 368.6 | 276 | 8.24 |

Key Ratios Snapshot

Some of the financial key ratios for Natuzzi S.p.a are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 6.6% | – | 2.6% |

| FCF Margin | ROE | ROA |

| 4.0% | 8.1% | 2.1% |

Stock Price

Despite this, NATUZZI still ended the quarter with a net loss of €3.3M due to a series of factors, including the global health crisis and the corresponding economic recession. Despite the net loss, NATUZZI S.P.A stock opened at $6.0 on Friday and closed at $6.7 per share, marking a 12.5% increase from its previous closing price of $6.0 per share. This increase was likely due to investor optimism about the company’s potential growth, despite its current state of affairs.

Overall, the news of NATUZZI S.P.A’s first quarter results was mixed, with revenue growing but still suffering a net loss for the quarter. Investors remain cautiously optimistic about the company’s future prospects as they anticipate further developments in upcoming quarters. Live Quote…

Analysis – Natuzzi S.p.a Stock Fair Value Calculator

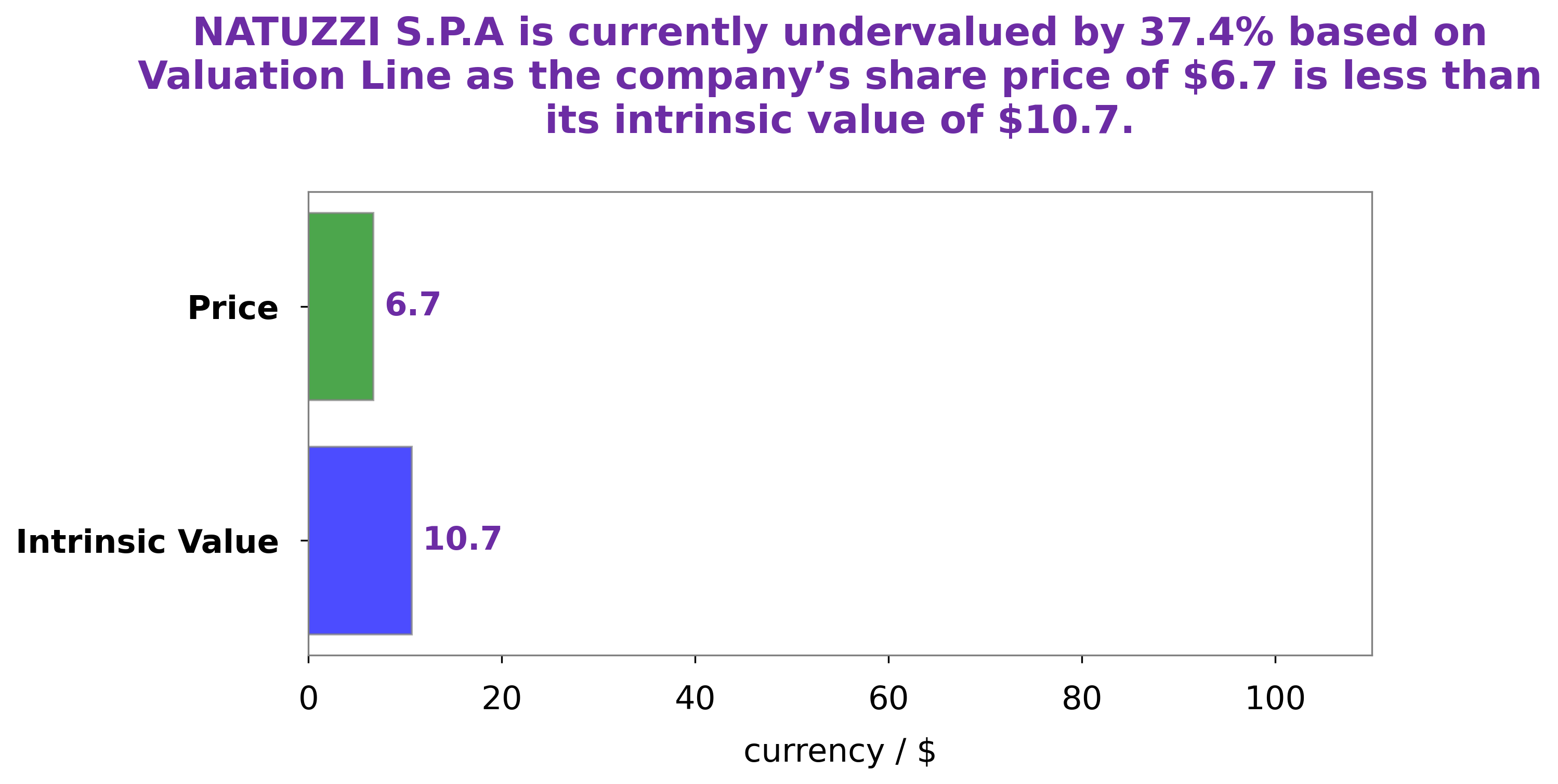

At GoodWhale, we have conducted an analysis of NATUZZI S.P.A‘s financials and calculated the fair value of its share to be around $10.7. This was determined using our proprietary Valuation Line and indicates that currently, NATUZZI S.P.A stock is undervalued by 37.2%, as it is currently traded at $6.7. We believe this presents an opportunity for investors to acquire a quality stock at a discounted price. More…

Peers

All of these companies offer high-quality products, designed to meet the demands of modern life. Natuzzi SPA prides itself on its commitment to innovation, its use of quality materials, and its dedication to creating timeless pieces that will be cherished for years to come.

– Tree Holdings Ltd ($SEHK:08395)

Tree Holdings Ltd is a diversified Hong Kong-based company that specializes in providing integrated corporate services, including financial advisory and wealth management services. As of 2023, the company has a market cap of 1.2B, which indicates robust investor confidence in the company’s products and services. Moreover, the company has a Return on Equity of 3.09%, which is impressive given the current macroeconomic conditions. This suggests that the company is efficiently leveraging its resources to generate returns for its shareholders.

– Inscape Corp ($OTCPK:ICPBQ)

Inscape Corp is a leading multimedia technology company that develops and distributes over-the-air digital broadcast products. The company has a market cap of 352.33k as of 2023, which represents the total value of its outstanding shares. Its Return on Equity (ROE) is -314.57%, which indicates that the company has not been able to generate profits from its shareholders’ investments. This means that the company has not been able to efficiently utilize the money it has raised from the equity markets. However, Inscape Corp is still able to generate revenue from its operations and continues to develop and launch innovative products.

– Vilniaus Baldai AB ($LTS:0IY5)

Vilniaus Baldai AB is a furniture manufacturing and retail company based out of Lithuania. With a market cap of 24.09M as of 2023, it is one of the largest furniture companies in the country. Its Return on Equity (ROE) of -12.46% is indicative of the challenges the company has faced due to the pandemic and related economic circumstances. Despite this, Vilniaus Baldai AB has managed to continue producing and delivering its unique furniture products to its loyal customer base.

Summary

Analysis into Natuzzi S.P.A. indicates a net loss of €3.3 million in the past quarter, with revenue of €86.1 million. Despite this decrease in profits, the stock price still moved up the same day, suggesting that investors are confident that the Italian furniture manufacturer is still a sound investment. The company’s strong revenue suggests that there is still great potential for growth in future quarters, and investors appear optimistic about the company’s long-term prospects. With a solid balance sheet and strong presence in the furniture market, Natuzzi S.P.A. is a great investment opportunity for investors looking to diversify their portfolios.

Recent Posts