Kennede Electronics Mfg Stock Fair Value – Guohai Construction and Xiaosong Technology Join Forces with Kennede Electronics MFG for 294.2 Million Yuan Contract

April 14, 2023

Trending News ☀️

Kennede ($SZSE:002723) Electronics MFG, a leading technology and manufacturing company, recently announced a major contract with Guohai Construction and Guangdong Xiaosong Technology. The total amount of the contract is worth 294.2 million yuan, and it will involve the construction of a new bridge. It designs, manufactures and distributes a variety of electronics and electrical products for the automotive, industrial, medical, and consumer markets.

In addition, it also provides a number of manufacturing services and has established itself as one of the leading players in the industry. The construction of this new bridge is an important milestone for Kennede Electronics MFG, as it marks the beginning of a major venture for the company. This new venture is expected to bring immense economic growth to the region as well as provide employment opportunities for local residents. Furthermore, it is anticipated that this project will lead to further investments in the area, furthering the company’s commitment to its community. Kennede Electronics MFG is confident that this project will prove to be a great success.

Share Price

On Monday, the stock of Kennede Electronics MFG opened at CNY10.3 and closed at CNY10.4, up by 1.3% from last closing price of 10.3. It marks a significant milestone for the company as it is the largest contract ever signed by Kennede Electronics MFG. The contract is set to bring tremendous growth to the company and its shareholders by providing new opportunities to expand their business in the local market. Guohai Construction will be in charge of constructing the production facility while Xiaosong Technology will provide the necessary equipment and technology.

This strategic partnership between the three companies will facilitate the development of advanced products and services for the benefit of their customers. It also serves as a testimony to their commitment to providing quality products and services to their customers. It is expected that with this new contract, Kennede Electronics MFG will be able to establish itself as a leader in the electronics manufacturing industry. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Kennede Electronics Mfg. More…

| Total Revenues | Net Income | Net Margin |

| 1.45k | 25.73 | 2.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Kennede Electronics Mfg. More…

| Operations | Investing | Financing |

| -104.55 | -315.48 | 657 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Kennede Electronics Mfg. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.45k | 1.2k | 3.89 |

Key Ratios Snapshot

Some of the financial key ratios for Kennede Electronics Mfg are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 21.3% | 801.6% | 4.1% |

| FCF Margin | ROE | ROA |

| -17.4% | 3.0% | 1.5% |

Analysis – Kennede Electronics Mfg Stock Fair Value

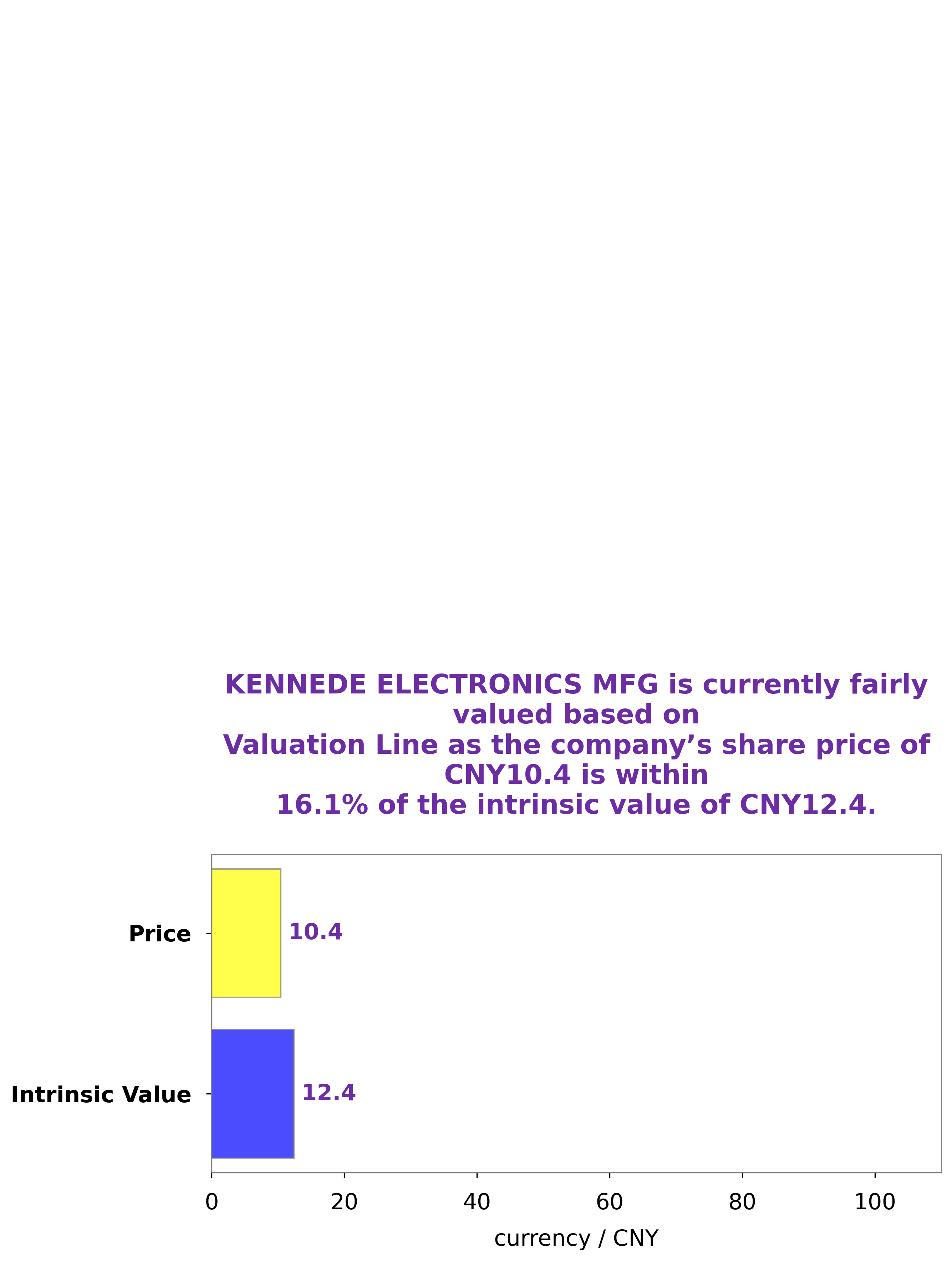

At GoodWhale, we recently conducted a financial analysis of KENNEDE ELECTRONICS MFG utilizing our proprietary tools. After studying the company’s financials and taking into account the current market conditions, our proprietary Valuation Line produced an intrinsic value of CNY12.4 per share. Meanwhile, KENNEDE ELECTRONICS MFG’s stock is currently trading at CNY10.4, which implies a 16.2% undervaluation of the stock. We believe that this presents a rare opportunity for investors to purchase KENNEDE ELECTRONICS MFG stock at a fair price. More…

Peers

Kennede Electronics MFG Co Ltd is in fierce competition with its rivals, Elec-tech International Co Ltd, Yotrio Group Co Ltd and Energy Focus Inc. All four companies are vying for dominance in the electronics manufacturing industry, pushing each other to innovate and create better products for consumers. With the latest advances in technology and materials, the competition between these four companies is only heating up as each one strives to come out on top.

– Elec-tech International Co Ltd ($SZSE:002005)

Elect-tech International Co Ltd is a leading global electronics manufacturing company. The company specializes in the production of consumer electronics, home appliances, and industrial products. As of 2023, the company has a market capitalization of 2.49 billion dollars, making it one of the largest publicly traded companies in its industry. Despite its impressive size, their Return on Equity (ROE) is -25.78%, indicating that the company is not generating strong returns on the investments of its shareholders.

– Yotrio Group Co Ltd ($SZSE:002489)

Yotrio Group Co Ltd is a Chinese-based company that specializes in the manufacture, installation, and maintenance of outdoor leisure and sports products. With a market cap of 7.64 billion as of 2023, Yotrio Group Co Ltd is a large publicly traded company. The company’s Return on Equity (ROE) is -1.47%, indicating that the company has not been able to use its equity efficiently to generate profits. This can be due to a number of factors, including high levels of debt or low levels of profitability. Despite this, Yotrio Group Co Ltd continues to be a major player in the outdoor leisure and sports industry.

– Energy Focus Inc ($NASDAQ:EFOI)

Energy Focus Inc is a publicly traded company that specializes in LED lighting products and lighting control technologies. As of 2023, the company has a market cap of 5.39M, which is a measure of the company’s overall value and its potential for future growth. Additionally, the company has a Return on Equity of -211.73%, indicating that it is currently losing money on equity investments. Despite this, the company has continued to expand its product offerings, making it an attractive investment for those looking to diversify their portfolio.

Summary

Kennede Electronics MFG is an attractive investment option for investors given its recent contract with Guohai Construction. It also shows how the company is well-positioned to profit from the construction industry in the near future. Lastly, the company has a strong management team and a solid track record, which indicates potential for future growth. Thus, investing in Kennede Electronics MFG could represent a good opportunity for long-term investors.

Recent Posts