Hooker Furniture Reports Loss Despite Revenues Above Expectations

April 18, 2023

Trending News 🌧️

Despite the better-than-expected earnings, the company’s revenue of $131.3M fell short of the anticipated $136.79M. The company is known for its high-quality products and dedication to providing customers with a variety of furniture styles to best fit their lifestyle needs. The furniture was designed to offer both comfort and style, while also being affordable.

Overall, Hooker ($NASDAQ:HOFT) Furniture reported a loss despite reporting revenues above expectations. The company has taken steps to strengthen their financial position and they remain optimistic that they can capitalize on their strong brand in the future.

Price History

The stock opened at $17.9 and closed at $18.0, down by 1.0% from its previous closing price of 18.2. Despite the loss, the company expressed optimism that its market strategies have been effective in driving sales. Hooker Furniture has been focusing on expanding their product offerings, expanding their geographic reach, and increasing their distribution channels. This strategy has been successful in driving revenues, even in the midst of economic downturns. The company is also investing in technology to improve customer service and enhance its online presence. The company has reported that the loss was primarily caused by higher expenses related to restructuring and investments in new product lines.

Additionally, the company is also facing pressure from competitors who are offering lower prices. Overall, Hooker Furniture is confident in its ongoing strategies and believes it will continue to drive sales and market share growth. The company is committed to providing quality products and services to its customers while balancing profitability with customer satisfaction. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Hooker Furnishings. More…

| Total Revenues | Net Income | Net Margin |

| 583.1 | -4.42 | -0.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Hooker Furnishings. More…

| Operations | Investing | Financing |

| -21.72 | -29.96 | 1.32 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Hooker Furnishings. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 381.72 | 145.69 | 22.73 |

Key Ratios Snapshot

Some of the financial key ratios for Hooker Furnishings are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -1.5% | -34.4% | -1.0% |

| FCF Margin | ROE | ROA |

| -4.4% | -1.4% | -0.9% |

Analysis

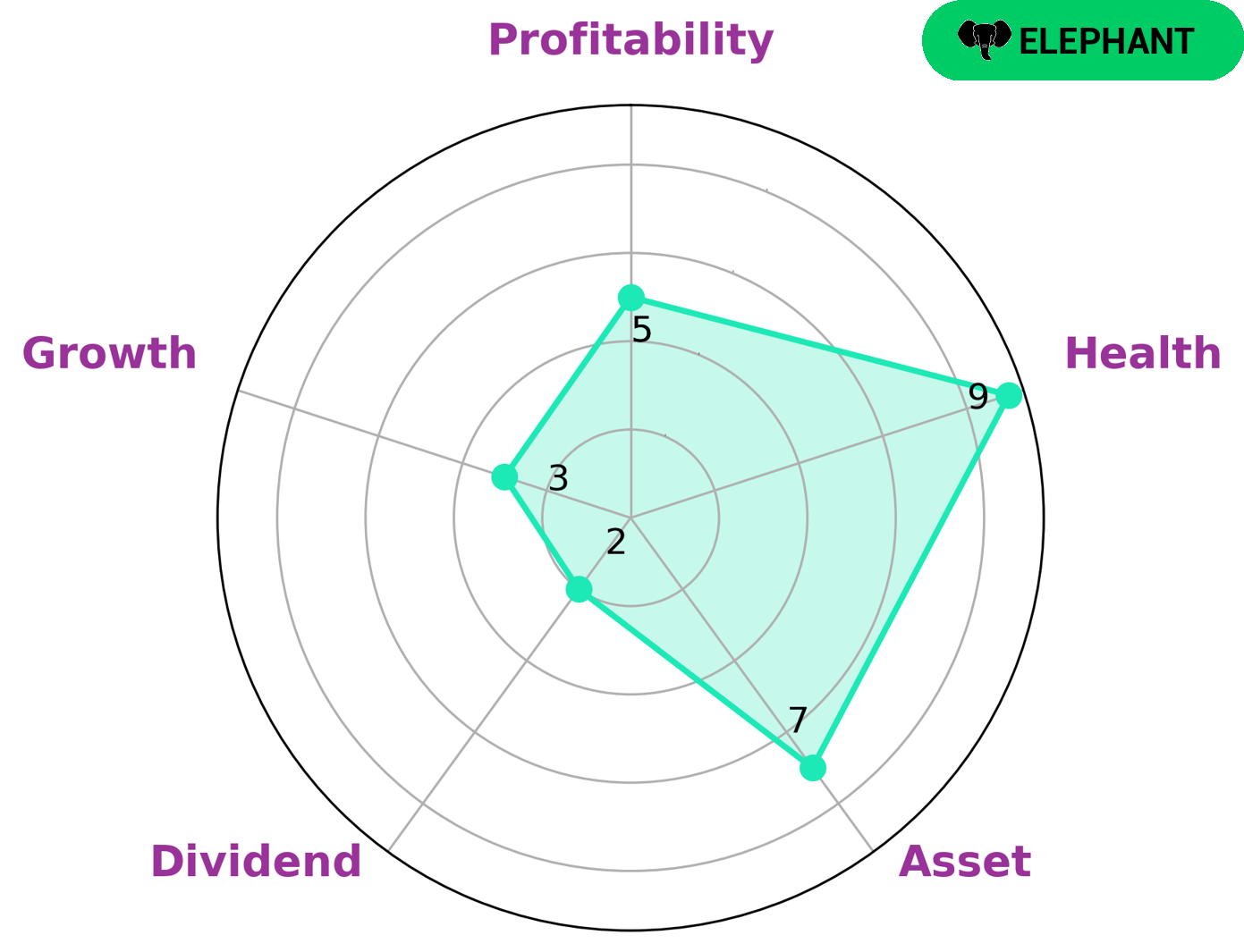

As a financial analyst at GoodWhale, I have conducted a thorough analysis of the fundamentals of HOOKER FURNISHINGS. After evaluating the company’s cashflow and debt situation using our Star Chart, I am pleased to report that HOOKER FURNISHINGS has a high health score of 9/10. This suggests that the company is capable of both paying off its debt and funding future operations. Our analysis also classifies the company as an ‘elephant’ which is a type of company with assets that outweigh its liabilities. The strength of HOOKER FURNISHINGS’ assets makes it an attractive investment opportunity for a variety of investors. Additionally, HOOKER FURNISHINGS is strong in asset, medium in profitability and weak in dividend and growth. This makes it an especially attractive option for investors who are looking for stability while still obtaining a return on their investments. More…

Peers

Hooker Furnishings Corp has been a leader in the home furnishings industry for over 75 years, offering a wide range of quality and stylish products to customers all over the world. Along with Hooker Furnishings Corp, other major players in the market include Savimex Corp, A-Zenith Home Furnishings Co Ltd and Shashwat Furnishing Solutions Ltd, all of whom offer competitive products and services in the home furnishings sector.

– Savimex Corp ($HOSE:SAV)

A-Zenith Home Furnishings Co Ltd is a furniture retailer and manufacturing company that specializes in custom-made furniture pieces for the home. As of 2022, the company has a market capitalization of 1.38 billion dollars, which is an indication of its relative size in the furniture industry. The company also has a Return on Equity (ROE) of -11.08%, which suggests that it is not making the most efficient use of its capital. This could be due to a number of factors such as operational inefficiencies, over-investment in certain areas, or poor management decisions. While the company may not currently be performing at its peak, its market cap indicates that it is still a large player in the industry.

– A-Zenith Home Furnishings Co Ltd ($SHSE:603389)

Shashwat Furnishing Solutions Ltd is a leading player in the home furnishing solutions industry. It has a market cap of 80.39M as of 2022, making it one of the largest companies in the sector. The company specializes in providing a wide range of home furnishing solutions, such as curtains, blinds, upholstery, and customized furniture. It also offers interior design services and installation of home furnishing products. It operates through a network of more than 1,000 distributors and dealers across India. The company has also diversified its services to include online sales, branding, and marketing services.

Summary

The company reported a GAAP earnings per share of -$1.60, beating analysts’ expectations by $1.33. Despite the revenue shortfall, investors may look to the strong earnings beat as a sign of overall improvement in the company’s financial performance. Analysts will likely continue to monitor Hooker Furniture’s financials closely as they assess the potential future performance of the company.

Recent Posts