Flexsteel Industries: Long-Term Investment Opportunity Despite Short-Term Headwinds

March 31, 2023

Trending News ☀️

Flexsteel Industries ($NASDAQ:FLXS) is a long-term investment opportunity despite the current short-term headwinds that it is encountering. The company has a strong and long-standing history of providing quality products and services for its customers. The current difficult environment for Flexsteel Industries is due in part to the economic impact of the COVID-19 pandemic, which has caused weak consumer demand in many markets. This has led to uncertainty in the company’s short-term results and stock performance.

However, the company has continued to focus on cost control initiatives, maintaining their financial strength while developing new strategies to drive profitable growth in the future. With the current headwinds being experienced by Flexsteel Industries, there are opportunities for long-term investors. The company has a proven track record of being a reliable and established manufacturer of quality furniture products. They have also taken steps to ensure their financial stability, making them an attractive option for long-term investors looking for a solid investment with potential for future growth.

Price History

On Thursday, FLEXSTEEL INDUSTRIES stock opened at $19.5 and closed at $19.6, up by 1.6% from the previous closing price of 19.2. This growth trend indicates the potential for this strong company to continue to deliver good returns to investors in the long run. The company is well-positioned to benefit from a growing market for its products and services, with continued demand for flexsteel products likely to translate into sustained gains for the company in the near future.

Additionally, the company is expected to benefit from strategic investments and initiatives to increase efficiency and production, as well as its strong balance sheet which provides the financial stability necessary to weather any short-term storms. Overall, Flexsteel Industries has established itself as a strong long-term investment opportunity, despite the short-term headwinds that it is currently facing. Investors looking for an attractive return on their capital should consider investing in the company as it promises to deliver good returns over time. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Flexsteel Industries. More…

| Total Revenues | Net Income | Net Margin |

| 453.75 | 8.19 | 1.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Flexsteel Industries. More…

| Operations | Investing | Financing |

| 73.63 | -4.49 | -71.45 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Flexsteel Industries. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 262 | 129.91 | 25.4 |

Key Ratios Snapshot

Some of the financial key ratios for Flexsteel Industries are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 3.0% | 3.1% | 3.0% |

| FCF Margin | ROE | ROA |

| 15.2% | 6.5% | 3.2% |

Analysis

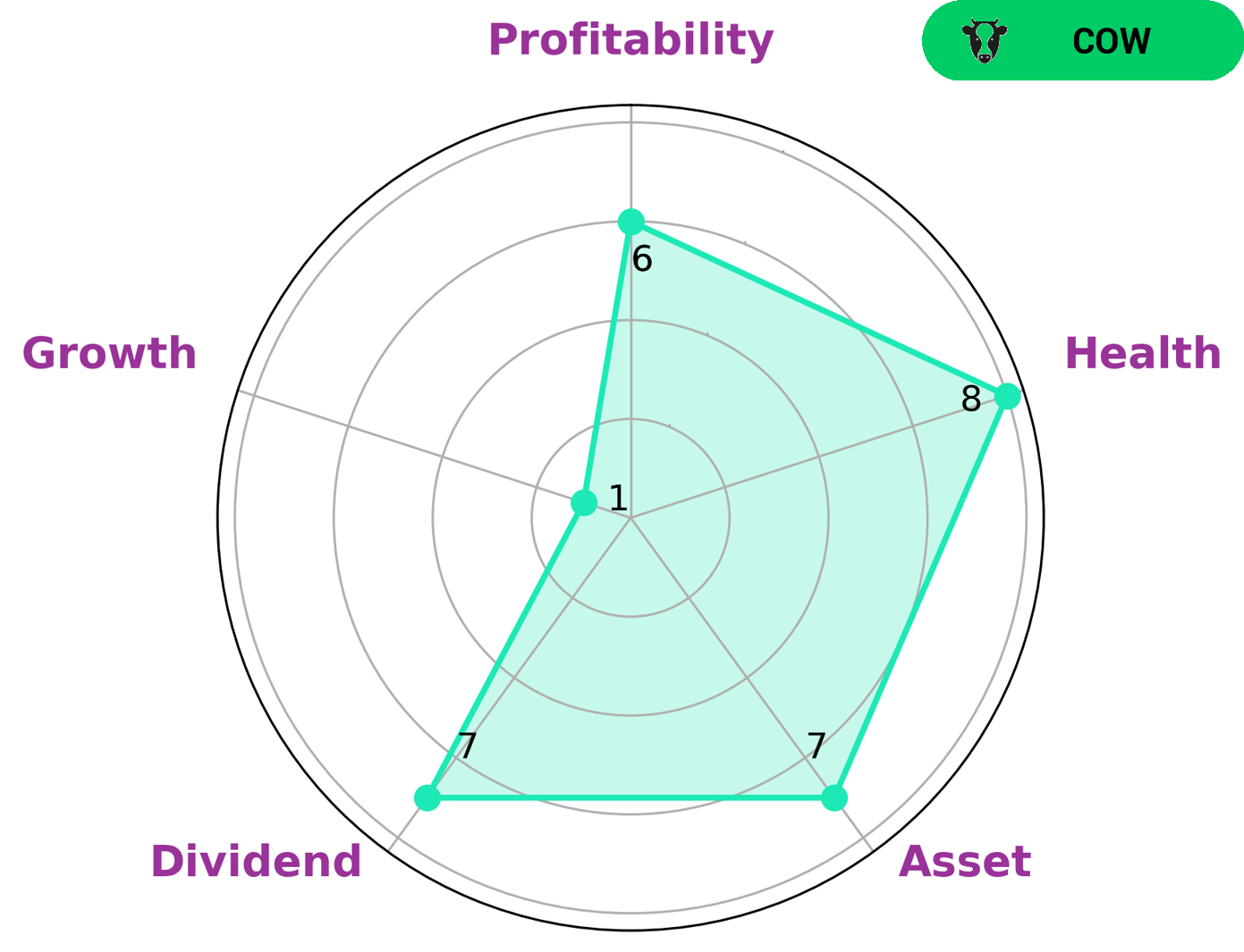

GoodWhale analysts have conducted a thorough analysis of FLEXSTEEL INDUSTRIES‘s fundamentals. Based on the results of our Star Chart analysis, FLEXSTEEL INDUSTRIES is classified as a “cow”, a sector of companies characterized by consistent, sustainable dividend payments. This makes FLEXSTEEL INDUSTRIES an attractive choice for investors who seek reliable income. In addition, FLEXSTEEL INDUSTRIES has a high health score of 8/10 with regard to its cashflows and debt. This indicates that the company is in a strong financial position and is able to pay off its debt and fund future operations. Moreover, GoodWhale analysts evaluated FLEXSTEEL INDUSTRIES in terms of asset, dividend, profitability, and growth and found it to be strong in the first two areas and medium in the latter two. More…

Peers

Flexsteel Industries Inc is one of the leading furniture manufacturers in the world, and has been competing with other top industry players such as Hooker Furnishings Corp, Savimex Corp, and Shashwat Furnishing Solutions Ltd for market share and customer loyalty. These competitors are all vying for their share of the furniture market, providing customers with high-quality products, competitive prices, and innovative designs. Flexsteel Industries Inc has been able to stay ahead of the competition by consistently delivering quality products, offering value-added services, and capitalizing on new opportunities.

– Hooker Furnishings Corp ($NASDAQ:HOFT)

Hooker Furnishings Corp is a furniture manufacturer and retailer based in North Carolina. The company has a market capitalization of 202.73M as of 2022, reflecting the value of its outstanding common stock. The company’s Return on Equity (ROE) is 3.08%, which shows that it is making effective use of its shareholders’ equity in generating profits. Hooker Furnishings Corp produces a wide range of home furniture items, including bedroom furniture, dining room furniture, office furniture, and outdoor furniture. The company operates across the United States and Canada, with a network of retail stores, distributors, and e-commerce websites.

– Savimex Corp ($HOSE:SAV)

Shashwat Furnishing Solutions Ltd is a public limited company with a market capitalization of 80.39M as of 2022. The company specializes in providing innovative and high quality furnishing solutions for residential and commercial spaces. It offers a wide array of products such as curtains, upholstery, mattresses, cushions, rugs, and blinds, with an emphasis on quality, design, and affordability. The company’s market capitalization indicates that it has a considerable amount of financial strength and capital resources to fund its operations and expansion plans. With its strong presence in the Indian market and growing international presence, Shashwat Furnishing Solutions Ltd is well-positioned to capitalize on the growing demand for quality furnishing solutions.

Summary

Flexsteel Industries is a potential investment opportunity for long-term investors, despite the temporary headwinds it currently faces. Flexsteel is committed to growing its market share, investing in research and development, and utilizing its existing core competencies. The company also maintains a conservative balance sheet with no long-term debt and a strong liquidity position.

Flexsteel is positioned to benefit from industry tailwinds as economic conditions improve worldwide. As such, it may be an attractive choice for investors looking for a long-term play with potential upside.

Recent Posts