Steven Madden Intrinsic Stock Value – Analysts at Defense World Recommend ‘Moderate Buy’ for Steven Madden, Ltd.

May 19, 2023

Trending News ☀️

Analysts at Defense World have recently given a “Moderate Buy” consensus recommendation for Steven Madden ($NASDAQ:SHOO), Ltd. Steven Madden, Ltd. is a leading designer, marketer and distributor of quality fashion footwear for men, women and children. It also produces accessories and apparel. The company operates through its retail stores, third party retailers, e-commerce, and wholesales. The company’s products are popular among the fashion-conscious consumers across the globe.

Analysts at Defense World have given Steven Madden, Ltd. a “Moderate Buy” recommendation based on their strong business fundamentals, which include their competitive advantage in the fashion industry, its ability to capitalize on trends and styles, and their efforts in expanding internationally. The company has also experienced growth in its e-commerce platform due to the increased availability of its products. All these factors make for a strong investment and analysts at Defense World have expressed optimism about the company’s future prospects.

Stock Price

On Monday, STEVEN MADDEN opened at $33.0 and closed at $32.7, representing a 0.3% decrease from its last closing price of 32.8. This was unsurprising given the overall trend of the stock over the last few weeks, which has been steadily declining. Despite this, analysts remain optimistic about the stock and believe it is still a solid buy for investors seeking long-term returns. With the company’s strong fundamentals and increasing revenues, analysts expect the stock to remain steady in the near future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Steven Madden. More…

| Total Revenues | Net Income | Net Margin |

| 2.03k | 178.28 | 8.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Steven Madden. More…

| Operations | Investing | Financing |

| 274.05 | -26.13 | -206.67 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Steven Madden. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.21k | 367.42 | 10.8 |

Key Ratios Snapshot

Some of the financial key ratios for Steven Madden are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 5.4% | 24.4% | 11.4% |

| FCF Margin | ROE | ROA |

| 12.7% | 17.4% | 11.9% |

Analysis – Steven Madden Intrinsic Stock Value

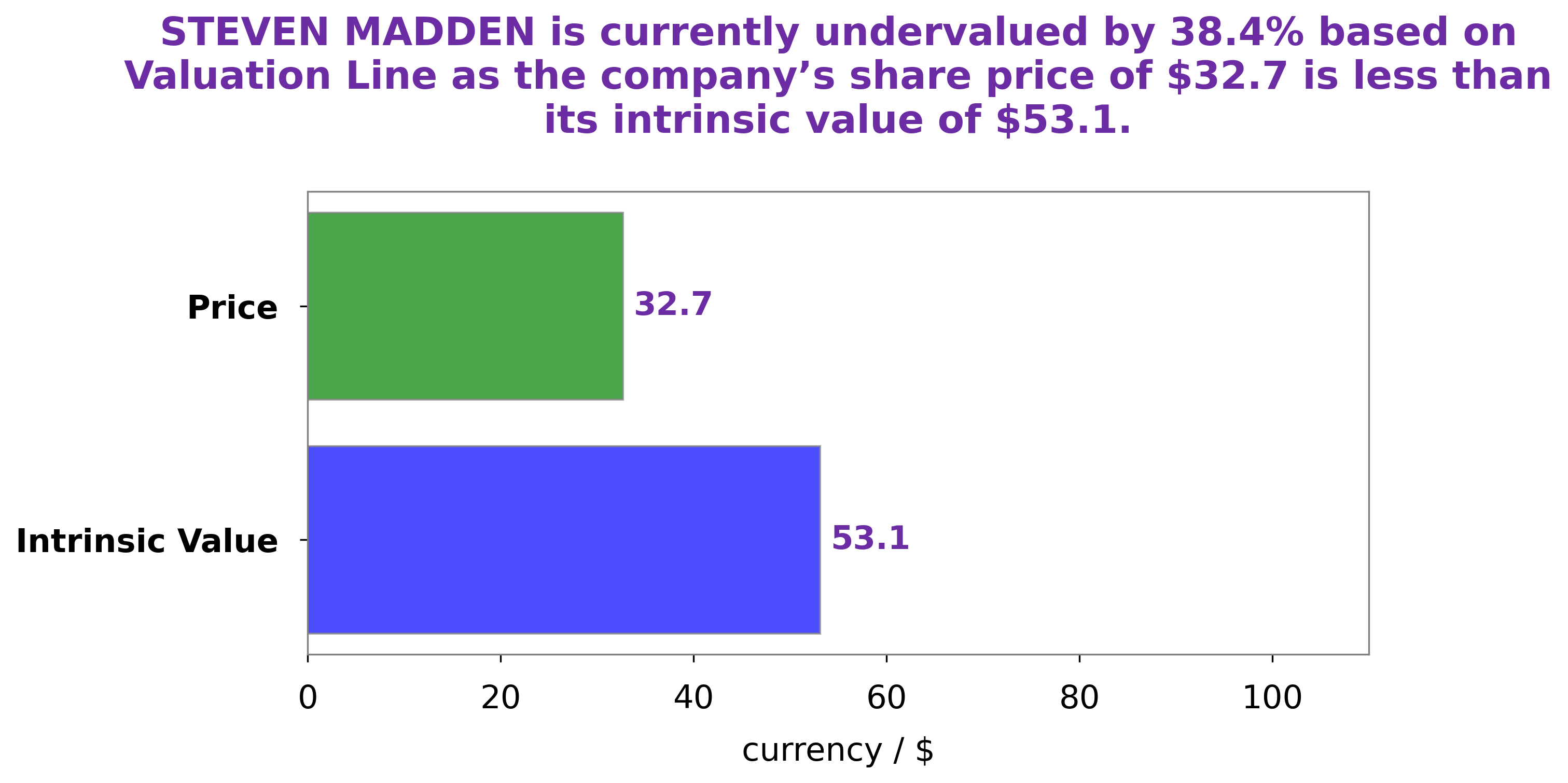

At GoodWhale, we have taken a close look at the financials of STEVEN MADDEN. Our proprietary Valuation Line shows that the intrinsic value of STEVEN MADDEN share is around $53.1. Interestingly, the current market price of STEVEN MADDEN is $32.7, which is about 38.4% lower than the intrinsic value. Thus, we come to the conclusion that the stock is undervalued at the moment and there could be potential for investors who are looking to enter the market. More…

Peers

The competition in the footwear industry is fierce with many companies vying for market share. Steven Madden Ltd, a leading designer and marketer of fashion footwear for women, faces stiff competition from the likes of Puma SE, Deckers Outdoor Corp, and Tod’s SpA. While each company has its own unique marketing strategy, they all share one common goal: to be the top dog in the footwear industry.

– Puma SE ($OTCPK:PUMSY)

Puma SE is a German multinational corporation that designs and manufactures athletic and casual footwear, apparel, and accessories. As of 2022, Puma SE has a market cap of 6.97B and a Return on Equity of 17.11%. Founded in 1948, Puma SE is the third largest sportswear manufacturer in the world. The company’s products are sold in over 120 countries worldwide.

– Deckers Outdoor Corp ($NYSE:DECK)

Deckers Outdoor Corporation is an American footwear company based in Goleta, California. The company was founded in 1973 by Douglas Tompkins and owns several brands including UGG, Teva, and Sanuk. As of 2022, the company had a market capitalization of $9.2 billion and a return on equity of 23.76%. The company’s products are sold in over 170 countries and its brands are some of the most recognizable in the world.

– Tod’s SpA ($OTCPK:TODGF)

Tod’s SpA is an Italian luxury goods company specializing in leather shoes, handbags, luggage, and other accessories. The company was founded in 1920 by Filippo della Valle and is headquartered in Rome, Italy. As of 2022, Tod’s SpA had a market capitalization of 1.03 billion euros and a return on equity of 2.64%.

Summary

Analysts at Defense World recently issued a consensus recommendation of “Moderate Buy” for Steven Madden, Ltd., a publicly traded footwear and accessories company. This investment advice suggests a medium-term positive outlook for the company’s stock. Analysts see potential for increased revenue and growth in the upcoming quarters, as well as the potential for increased dividend payouts and share buybacks. They believe that there is an opportunity to capitalize on the company’s strong presence in the footwear and accessories industry.

Additionally, analysts anticipate that the company will continue to benefit from cost savings initiatives and strong performance of international markets. With this in mind, analysts recommend that investors buy the stock with a medium-term outlook.

Recent Posts