Designer Brands Stock Intrinsic Value – Designer Brands Feel the Effects of Promotional Retail Environment in Q1

June 14, 2023

🌥️Trending News

The highly promotional retail climate, driven by an increase in online spending and other factors, had a significant impact on the performance of Designer Brands ($NYSE:DBI) in the first quarter. The company’s chief executive officer, Roger Johnson, spoke about the challenges that the company faced in Q1 during a recent conference call with analysts. Johnson noted that many of Designer Brands’ competitors were offering deep discounts on products, which negatively impacted their margins and overall profitability.

Additionally, Johnson also pointed out that the company faced a number of supply chain disruptions as a result of the global pandemic. The company’s strong e-commerce capabilities allowed them to continue to serve customers even when many of their brick and mortar stores were closed. Additionally, Designer Brands has also been able to reduce their overhead costs by negotiating better contracts with suppliers and focusing on automation and digital solutions. The company plans to continue their focus on digital solutions to reduce costs and optimize sales. Additionally, they will be continuing to offer discounts and promotions to customers and explore new opportunities for growth.

Share Price

On Monday, shares of Designer Brands opened at $8.6 and closed at $9.2, a rise of 6.9% from its previous closing price of $8.6. This represented an increase in share values despite the difficult retail environment, demonstrating the company’s strength in weathering the storm. With the continued presence of promotions in the market, Designer Brands was able to remain competitive and capture value. The company also appears to be well-positioned to benefit from any future market improvements, suggesting further potential for growth in the months ahead. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Designer Brands. More…

| Total Revenues | Net Income | Net Margin |

| 3.23k | 147.91 | 4.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Designer Brands. More…

| Operations | Investing | Financing |

| 264.64 | -194.95 | -74.74 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Designer Brands. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.13k | 1.69k | 6.7 |

Key Ratios Snapshot

Some of the financial key ratios for Designer Brands are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 1.3% | 13.5% | 4.8% |

| FCF Margin | ROE | ROA |

| 6.4% | 22.0% | 4.5% |

Analysis – Designer Brands Stock Intrinsic Value

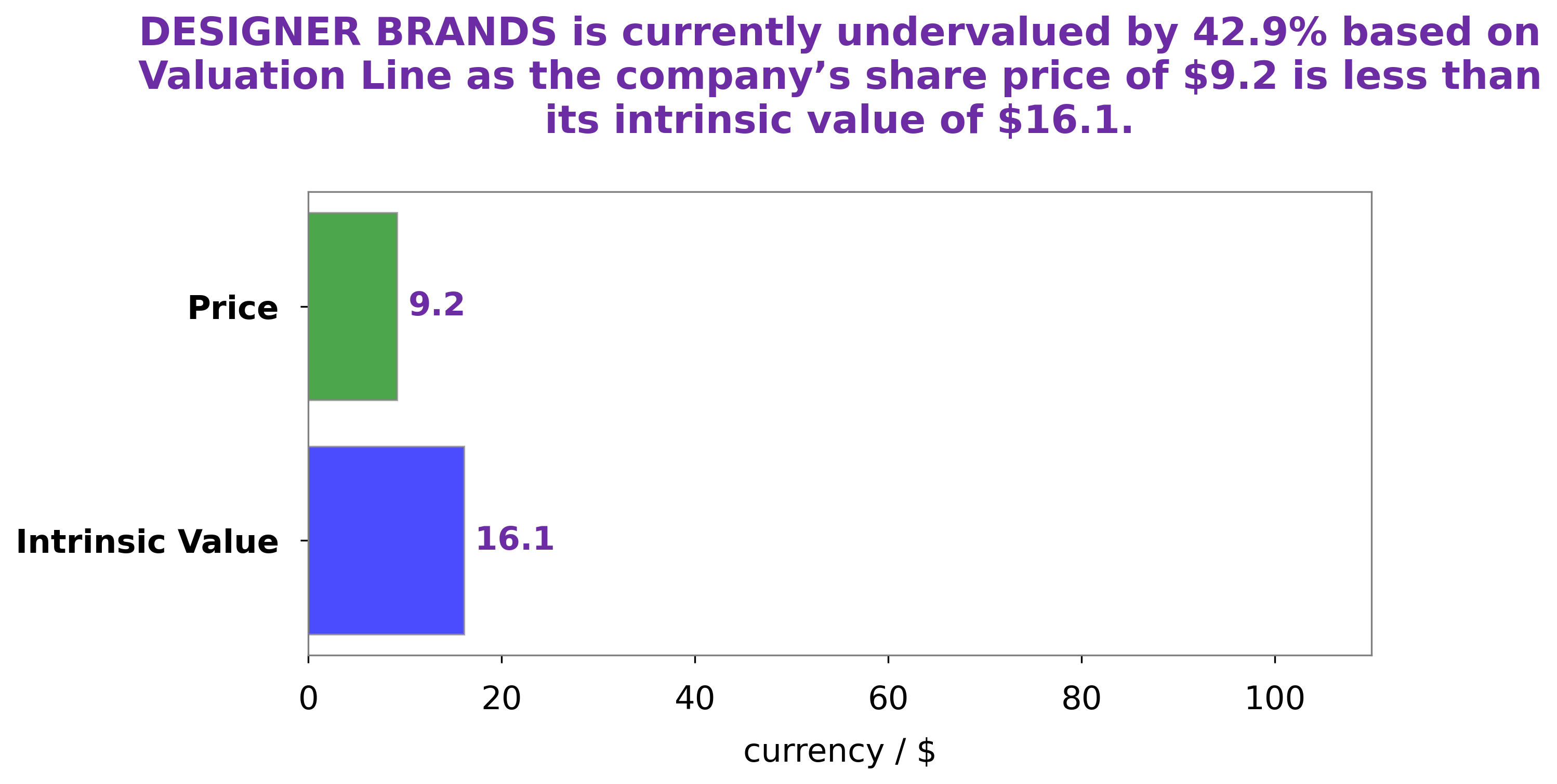

GoodWhale analysts have conducted an analysis on the financials of DESIGNER BRANDS. According to our proprietary Valuation Line, the fair value of DESIGNER BRANDS share is currently around $16.1. This implies that the stock is currently trading at $9.2, which is undervalued by 42.9%. This presents an attractive investment opportunity for potential investors. The financials of DESIGNER BRANDS have been thoroughly studied by our analysts, and we believe the company is in a strong position to deliver an excellent return on investment. With this in mind, now might be an ideal time for investors to enter the market and take advantage of the current undervaluation. More…

Peers

Designer Brands Inc. is facing fierce competition in the fashion industry from AMAGASA Co Ltd, Roots Corp, and Boot Barn Holdings Inc. Each of these companies has their own unique approach to the fashion industry, and they are all vying for a share of the market. As a result, Designer Brands Inc. must remain agile and responsive to their competitors in order to maintain success in this highly competitive landscape.

– AMAGASA Co Ltd ($TSE:3070)

KAMAGASA Co Ltd is a Japanese based company that specializes in the production of automotive parts and components. The company has a market cap of 2.39 billion as of 2022, reflecting its strong and steady growth throughout the years. Its Return on Equity (ROE) also stands at -145.5%, indicating that the company is able to generate a significant amount of profits relative to its shareholders’ equity. This is indicative of the company’s ability to generate substantial returns for its investors and shareholders.

– Roots Corp ($TSX:ROOT)

Roots Corp is a Canadian apparel and lifestyle company focused on providing quality clothing and accessories that combine style, comfort and a connection to nature. Its market cap of 110.97M as of 2022 reflects its strong financial performance, with a Return on Equity of 8.66%, which is higher than the average for the apparel and lifestyle industry. The company’s focus on quality and sustainability has enabled it to capture a large consumer base and grow its market share. Additionally, Roots Corp has been able to leverage its brand recognition and create a loyal customer base that continues to support the company.

– Boot Barn Holdings Inc ($NYSE:BOOT)

Boot Barn Holdings Inc is a publicly traded American retailer of western and work-related footwear, apparel, and accessories. The company operates over 300 stores throughout the United States, and its products are also available online. As of 2022, the market cap of Boot Barn Holdings Inc is 1.84 billion dollars. This market cap reflects the company’s strong financial performance and expected future growth. Additionally, Boot Barn Holdings Inc has a Return on Equity (ROE) of 23.87%. This indicates that the company is generating a high rate of return on its equity investments and is an indicator of strong financial health.

Summary

Designer Brands (DESN) saw their stock price move up on the first day of trading following the announcement of their Q1 performance. Despite this, the company has seen increased demand for its products, resulting in higher sales and improved operating margin. Investors will be keeping an eye on Designer Brands in the coming months to see if they can continue their growth despite the challenging retail environment.

Recent Posts