Designer Brands Intrinsic Value Calculation – Invest in HIBB, R. Instead of DBI Stock To Get Designer Brands at a Lower Price

June 23, 2023

🌧️Trending News

DESIGNER ($NYSE:DBI): Investing in designer brands has long been a popular choice for fashion-forward individuals who want to stay ahead of the latest trends.

However, investing in these designer brands can be expensive. DBI is a publicly traded company in the apparel and footwear industry, while HIBB and R. are peers in the same industry. By investing in HIBB or R. stock, you can get more for less than designer brands from industry peers. This can help you save money and still get the designer brands you want. A major benefit of investing in HIBB or R. stock is that you can easily access the latest designer trends without breaking the bank. With HIBB or R. stock, you can get the same quality designer items as you would from DBI for a lower price. Furthermore, since these stocks are publicly traded, you have more control over your investment than you would with a private designer brand. These stocks offer the same quality designer items as DBI at a lower cost, and you have more control over your investment than you would with a private designer brand. By investing in HIBB or R. stock, you can save money and still get the designer brands you want.

Stock Price

On Tuesday, DESIGNER BRANDS (DBI) stock opened at $9.0 and closed at $9.0, down by 1.1% from prior closing price of 9.1. It offers a wide selection of clothing and accessories from leading designers such as Gucci, Prada, Balenciaga, Versace, and Louis Vuitton, as well as other luxury brands. The company also offers exclusive deals and discounts for its customers, which makes it an attractive alternative to DBI stock. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Designer Brands. More…

| Total Revenues | Net Income | Net Margin |

| 3.23k | 147.91 | 4.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Designer Brands. More…

| Operations | Investing | Financing |

| 264.64 | -194.95 | -74.74 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Designer Brands. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.13k | 1.69k | 6.7 |

Key Ratios Snapshot

Some of the financial key ratios for Designer Brands are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 1.3% | 13.5% | 4.8% |

| FCF Margin | ROE | ROA |

| 6.4% | 22.0% | 4.5% |

Analysis – Designer Brands Intrinsic Value Calculation

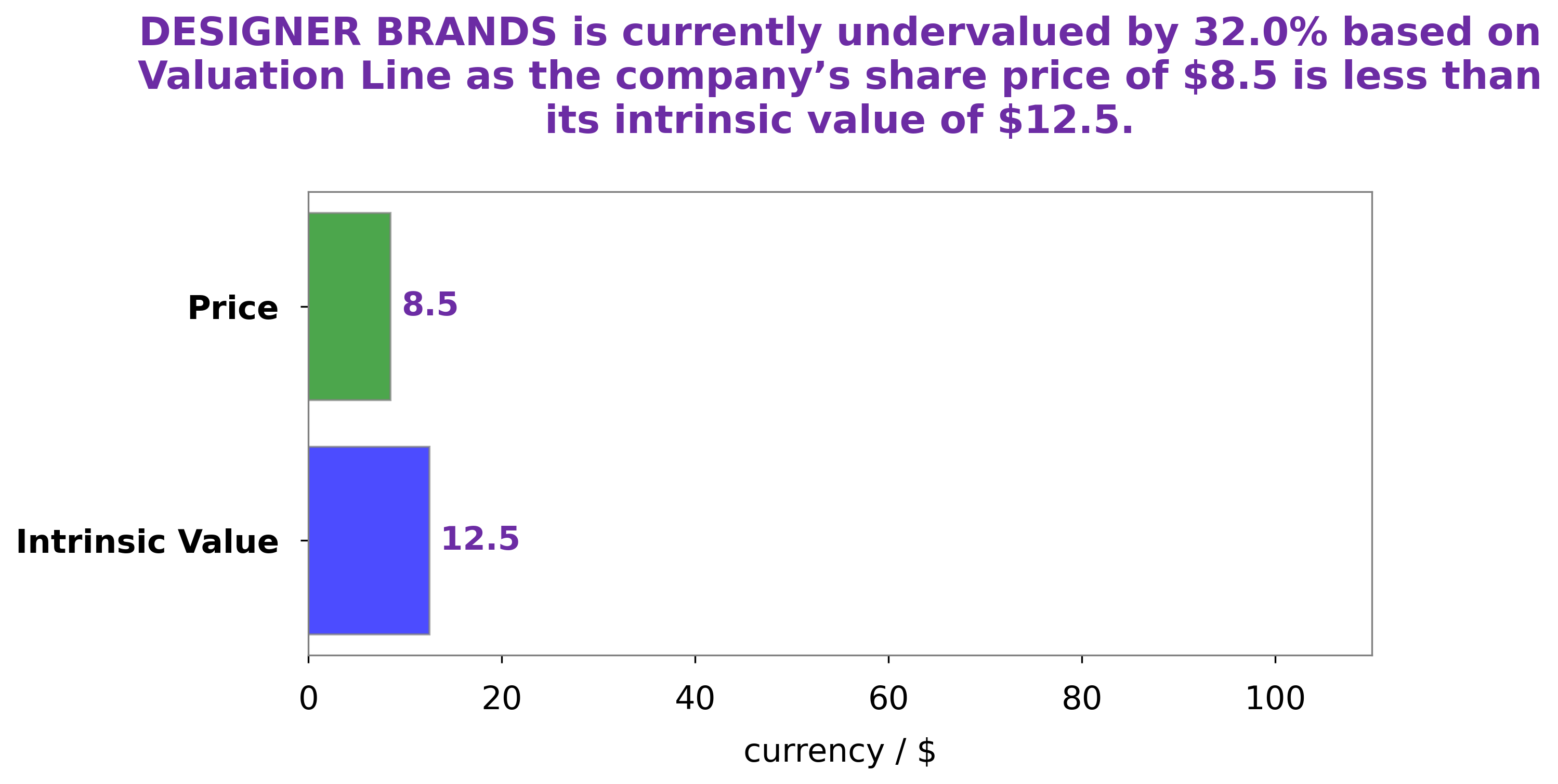

At GoodWhale, we have conducted an analysis of DESIGNER BRANDS‘s financials. Through our proprietary Valuation Line, we have determined that the fair value of DESIGNER BRANDS share is around $16.1. However, currently the stock is trading at $9.0, revealing an undervaluation of 44.2%. This presents investors with a fantastic opportunity to buy the stock at a discounted rate and potentially capitalize on future gains. More…

Peers

Designer Brands Inc. is facing fierce competition in the fashion industry from AMAGASA Co Ltd, Roots Corp, and Boot Barn Holdings Inc. Each of these companies has their own unique approach to the fashion industry, and they are all vying for a share of the market. As a result, Designer Brands Inc. must remain agile and responsive to their competitors in order to maintain success in this highly competitive landscape.

– AMAGASA Co Ltd ($TSE:3070)

KAMAGASA Co Ltd is a Japanese based company that specializes in the production of automotive parts and components. The company has a market cap of 2.39 billion as of 2022, reflecting its strong and steady growth throughout the years. Its Return on Equity (ROE) also stands at -145.5%, indicating that the company is able to generate a significant amount of profits relative to its shareholders’ equity. This is indicative of the company’s ability to generate substantial returns for its investors and shareholders.

– Roots Corp ($TSX:ROOT)

Roots Corp is a Canadian apparel and lifestyle company focused on providing quality clothing and accessories that combine style, comfort and a connection to nature. Its market cap of 110.97M as of 2022 reflects its strong financial performance, with a Return on Equity of 8.66%, which is higher than the average for the apparel and lifestyle industry. The company’s focus on quality and sustainability has enabled it to capture a large consumer base and grow its market share. Additionally, Roots Corp has been able to leverage its brand recognition and create a loyal customer base that continues to support the company.

– Boot Barn Holdings Inc ($NYSE:BOOT)

Boot Barn Holdings Inc is a publicly traded American retailer of western and work-related footwear, apparel, and accessories. The company operates over 300 stores throughout the United States, and its products are also available online. As of 2022, the market cap of Boot Barn Holdings Inc is 1.84 billion dollars. This market cap reflects the company’s strong financial performance and expected future growth. Additionally, Boot Barn Holdings Inc has a Return on Equity (ROE) of 23.87%. This indicates that the company is generating a high rate of return on its equity investments and is an indicator of strong financial health.

Summary

Designer brands refer to luxury or high-end fashion labels that have become popular among consumers. By investing in designer brands, investors can benefit from the impact of brand recognition and the potential for growth in the fashion industry.

However, it is important for investors to do research and compare different brands to ensure they are investing in the one that best suits their investment goals and risk tolerance.

Additionally, due to the high cost of designer brands, investors may want to consider alternative investments such as independents or industry peers such as HIBB and R which offer less expensive alternatives that still provide potential for growth and returns. Ultimately, by researching and analyzing the various options available, investors can identify the best investment opportunities for their portfolio.

Recent Posts