Caleres Stock Slides as Piper Sandler Remains on the Sidelines

May 26, 2023

Trending News 🌥️

Caleres ($NYSE:CAL), a retailer and wholesaler of premier fashion footwear, recently experienced a decline in its stock prices as Piper Sandler stepped back from the situation. Caleres operates in the United States, Canada and China under brands including Famous Footwear, Allen Edmonds, Sam Edelman, Naturalizer, and Vionic. The company is focused on meeting the footwear needs of their customers through a wide selection of product fit, style, quality, and price. Piper Sandler had previously been giving Caleres a “buy” rating but has since taken a step back as the stock slid. The company has recently reported strong earnings and increased sales on their online platforms, which could lead to further stock increases in the future.

However, until Piper Sandler decides to weigh in with a more positive opinion, investors may be more hesitant to add Caleres to their portfolios.

Market Price

On Thursday, CALERES stock opened the market at $19.3 and closed at $18.5, representing a 8.7% decrease from the previous closing price of $20.3. This significant drop in stock prices was largely due to Piper Sandler’s decision to remain on the sidelines in regards to CALERES. It is yet to be seen however, whether the stock can recover its previous levels or continue to slide further. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Caleres. More…

| Total Revenues | Net Income | Net Margin |

| 2.97k | 181.74 | 6.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Caleres. More…

| Operations | Investing | Financing |

| 125.88 | -64.04 | -58.15 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Caleres. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.84k | 1.41k | 11.18 |

Key Ratios Snapshot

Some of the financial key ratios for Caleres are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 0.5% | 22.4% | 7.7% |

| FCF Margin | ROE | ROA |

| 2.1% | 34.7% | 7.7% |

Analysis

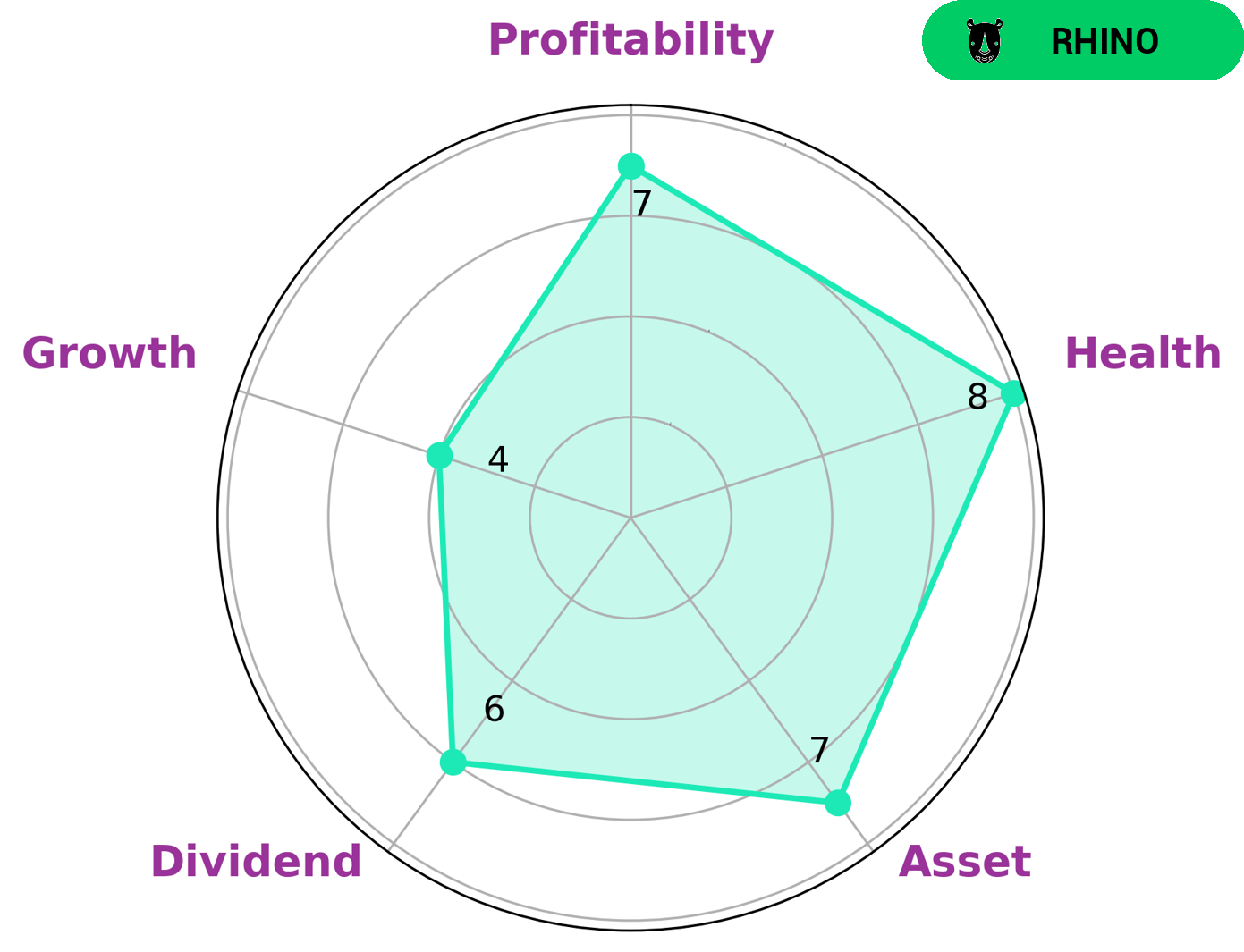

As GoodWhale, we conducted an analysis of CALERES‘s fundamentals. Our Star Chart showed that CALERES has a high health score of 8/10, indicating that they are capable of safely riding out any crisis without the risk of bankruptcy. Additionally, we classified CALERES as a ‘rhino’, which is a type of company that has achieved moderate revenue or earnings growth. We believe that investors who are interested in low-risk investments and value stability will be particularly interested in CALERES. The company is strong in terms of asset and profitability, and is medium in terms of dividend and growth. This makes it an attractive option for those who are looking for a safe investment that will still yield returns over the long term. More…

Peers

Its main competitors are Deckers Outdoor Corp, adidas AG, and Sreeleathers Ltd. Caleres Inc has a strong presence in the US market and is expanding rapidly in Europe and Asia. The company has a diversified product portfolio and a strong brand portfolio. Caleres Inc is a publicly traded company on the New York Stock Exchange.

– Deckers Outdoor Corp ($NYSE:DECK)

Deckers Outdoor Corporation is an American footwear company based in Goleta, California. The company operates in two segments: Direct-to-Consumer and Wholesale. It designs, markets, and distributes footwear, apparel, and accessories for men, women, and children under the UGG, Koolaburra, Hoka One One, Teva, and Sanuk brands. Direct-to-Consumer revenue represents sales made through the Company’s own e-commerce platforms and retail stores.

The company has a market capitalization of 9.23 billion as of 2022 and a return on equity of 23.34%. Deckers Outdoor Corporation designs, markets, and distributes footwear, apparel, and accessories for men, women, and children under the UGG, Koolaburra, Hoka One One, Teva, and Sanuk brands. The company operates in two segments: Direct-to-Consumer and Wholesale. Direct-to-Consumer revenue represents sales made through the Company’s own e-commerce platforms and retail stores.

– adidas AG ($OTCPK:ADDDF)

adidas AG is a German multinational corporation that designs and manufactures sports shoes, clothing and accessories. The company is headquartered in Herzogenaurach, Bavaria, and employs more than 60,000 people in over 160 countries.

adidas AG has a market capitalization of 20.83 billion as of 2022. The company’s return on equity is 16.07%. adidas AG designs, manufactures and markets sports footwear, apparel and accessories. The company sells its products through retail stores, online stores and independent distributors.

– Sreeleathers Ltd ($BSE:535601)

Sreeleathers Ltd is a publicly traded company with a market capitalization of 4.94 billion as of 2022. The company has a return on equity of 5.38%. Sreeleathers is engaged in the business of marketing and retailing of leather footwear and accessories. The company has a network of over 300 stores across India.

Summary

Caleres is a footwear retailer and brands company that has recently seen its stock slide as Piper Sandler steps to the sidelines. Investors may want to consider the potential risks and rewards of investing in this company. In the short term, the stock has decreased from its recent high, making it an attractive value proposition for those looking for an entry point. Longer term, the company is expected to benefit from strong brand recognition and an expanding portfolio of footwear products. Additionally, Caleres has recently announced new initiatives such as the launch of new designs and strategic partnerships with major retailers. For investors looking for steady returns in the footwear industry, Caleres could be a good option.

However, its need to remain competitive and its reliance on consumer spending could be potential risks that investors should assess.

Recent Posts