Performance Food Intrinsic Value Calculation – Performance Food Group sees slight dip in holdings as Rhumbline Advisers reduces stake in 2nd quarter

September 10, 2024

🌥️Trending News

Performance Food ($NYSE:PFGC) Group is a leading foodservice distribution company that provides food and related products to a wide range of customers, including restaurants, healthcare facilities, and educational institutions. The company operates in three main segments: Performance Foodservice, Vistar, and PFG Customized. As a publicly traded company, Performance Food Group is required to report its stock holdings and changes in its investment portfolio through a 13F filing with the Securities and Exchange Commission (SEC). This filing provides a glimpse into the company’s investment strategy and any recent changes in its holdings. In its most recent 13F filing, Performance Food Group disclosed that Rhumbline Advisers, an investment management firm, had reduced its stake in the company by 3.1% in the second quarter. This slight dip in holdings may raise questions for investors about the reasons behind Rhumbline Advisers’ decision and the potential impact on the company’s stock performance. This reduction in holdings could reflect a shift in Rhumbline Advisers’ overall investment strategy or their perception of Performance Food Group’s future prospects.

However, it is worth noting that Rhumbline Advisers still holds a significant number of shares in the company, indicating that they still have confidence in Performance Food Group’s performance. Despite the slight dip in holdings by Rhumbline Advisers, Performance Food Group’s stock has been performing well in the market. In conclusion, while the recent 13F filing by Performance Food Group may raise some concerns among investors, it is important to note that the company remains well-positioned in the foodservice industry and continues to deliver strong financial results. As the economy continues to rebound, Performance Food Group is well-positioned to capitalize on the increasing demand for its products and services.

Stock Price

On Friday, the company’s stock opened at $73.4 and closed at $71.5, marking a decrease of 2.23% from its previous closing price of $73.13. This decrease in holdings by Rhumbline Advisers may have raised concerns among investors, as it is a significant move by a major shareholder. Rhumbline Advisers is an investment management firm that provides services to various institutional clients, including pension and profit-sharing plans, trusts, and endowments. It is possible that the firm may have decided to reallocate its investments to other companies or industries that it believes will provide better returns.

Additionally, Rhumbline Advisers may have decided to take profits on its holdings in Performance Food Group, as the company’s stock has been performing well in recent months. The company has also been expanding its business through strategic acquisitions, such as its recent purchase of Reinhart Foodservice. This acquisition is expected to further strengthen Performance Food Group’s position in the market and drive future growth. Overall, while the decrease in holdings by Rhumbline Advisers may have caused a brief dip in Performance Food Group’s stock, it does not necessarily reflect any underlying issues with the company. The company’s strong financial performance and strategic growth initiatives continue to make it a promising investment opportunity in the food service industry. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Performance Food. More…

| Total Revenues | Net Income | Net Margin |

| 57.87k | 429.4 | 0.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Performance Food. More…

| Operations | Investing | Financing |

| 961.6 | -570.7 | -380.3 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Performance Food. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 12.91k | 9.05k | 24.82 |

Key Ratios Snapshot

Some of the financial key ratios for Performance Food are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 29.5% | 4.9% | 1.4% |

| FCF Margin | ROE | ROA |

| 1.1% | 13.4% | 4.0% |

Analysis – Performance Food Intrinsic Value Calculation

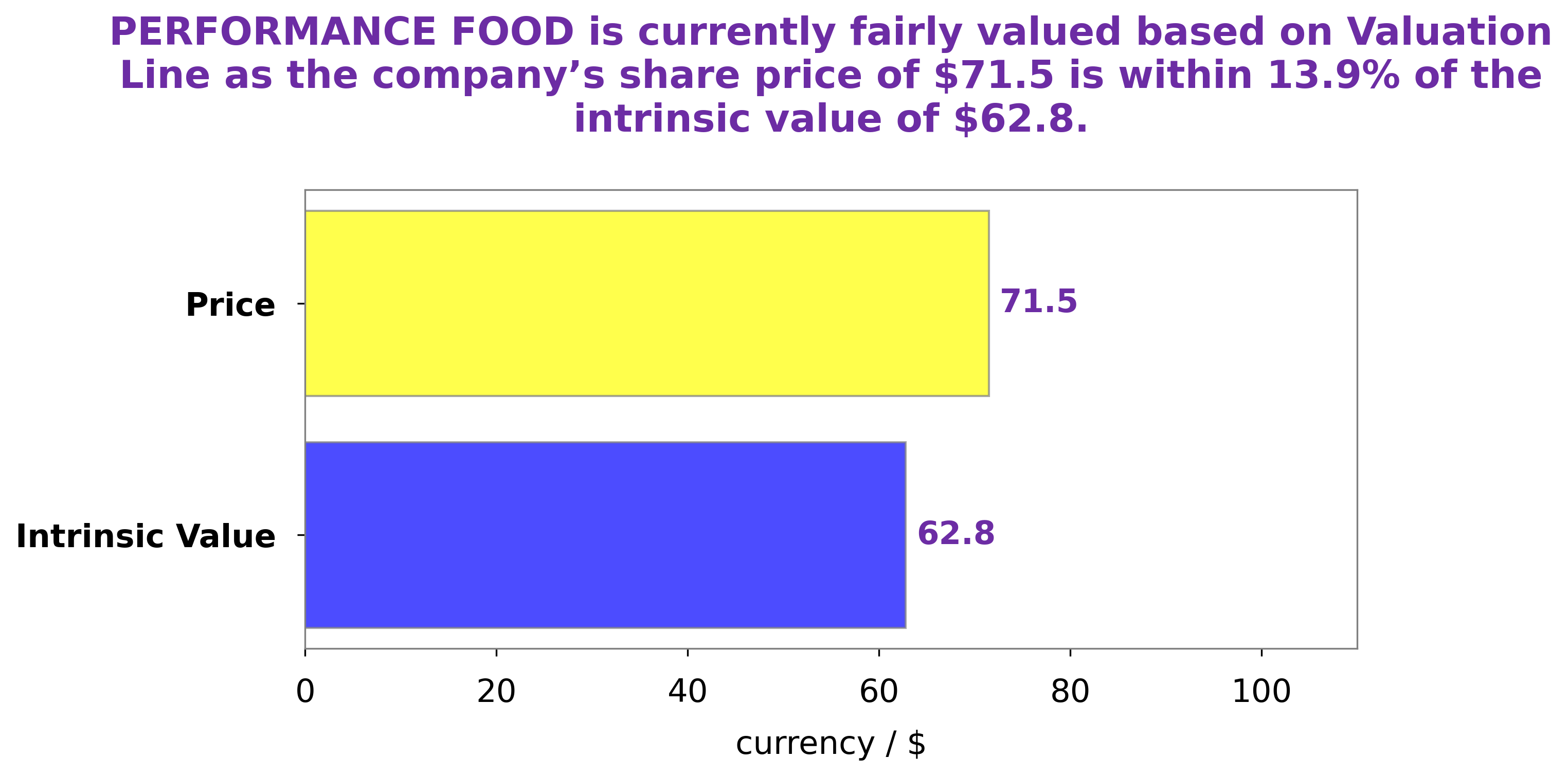

As a team at GoodWhale, we have conducted a thorough analysis on the wellbeing of PERFORMANCE FOOD, a leading foodservice distributor in the United States. We have taken into consideration various factors such as the company’s financial performance, market trends, and industry outlook to determine the current state of the company. After conducting our analysis, we have calculated the fair value of PERFORMANCE FOOD’s share to be around $62.8. This was calculated using our proprietary Valuation Line, which takes into account various financial metrics and market conditions. This indicates that the current stock price of PERFORMANCE FOOD, which is trading at $71.5, is overvalued by 13.8%. Our analysis also revealed that PERFORMANCE FOOD has been performing well in terms of financials, with strong revenue growth and profitability. However, we have also noticed that the stock price has been on an upward trend in recent months, which could be driven by market hype and speculation rather than the company’s actual performance. In light of this, we believe that there is a potential risk for investors who are currently holding PERFORMANCE FOOD shares at its current price. While we acknowledge that the company has a strong foundation and potential for growth, it is important to carefully consider the fair value of the stock before making any investment decisions. In conclusion, at GoodWhale, we recommend investors to closely monitor the stock price of PERFORMANCE FOOD and wait for a potential correction before considering investing in the company. As always, it is crucial to conduct thorough research and analysis before making any investment decisions. More…

Peers

The company operates through three segments: Performance Foodservice, PFG Customized, and Vistar. Performance Foodservice segment offers food and non-food products to independent restaurants, quick-service restaurants, caterers, and national restaurant chains. PFG Customized segment provides food and non-food products to customers who desire a customized distribution solution. Vistar segment supplies non-food products, equipment, and solutions to customers in the vending, office coffee service, theatre, and foodservice management industries.

– US Foods Holding Corp ($NYSE:USFD)

With a market capitalization of $6.66 billion as of 2022, US Foods Holding Corp is a publicly traded foodservice distributor. The company operates a network of nearly 300 distribution centers across the United States, serving more than 250,000 customers. US Foods Holding Corp also offers a variety of foodservice solutions, including custom-cut meat, seafood, and poultry; branded and private label products; and kitchen supplies and equipment. The company’s return on equity was 6.98% as of 2022.

– Sysco Corp ($NYSE:SYY)

Sysco is the global leader in selling, marketing and distributing food products to restaurants, healthcare and educational facilities, lodging establishments and other customers who prepare meals away from home. Its family of brands includesSysco, Brakes, FreshPoint and EFS. The company operates approximately 330 distribution facilities worldwide and serves more than 625,000 customer locations.

– Sligro Food Group NV ($LTS:0MKM)

Sligro Food Group is a Dutch food retailer and wholesaler. The company has a market cap of 662.56M as of 2022 and a return on equity of 8.07%. The company operates a chain of supermarkets and hypermarkets under the brand name “Sligro”.

Summary

Rhumbline Advisers reduced their stake in Performance Food Group by 3.1% during the second quarter, as reported by the company. This change in holdings reflects a potential decrease in confidence in the company’s performance. Other factors, such as market trends and financial data, may have influenced this decision. As with all investments, it is important to regularly analyze and reassess one’s holdings to make informed decisions.

This analysis can include evaluating the company’s financial health, industry movements, and potential risks. Overall, investing in Performance Food Group, or any company, requires thorough research and diligent monitoring to make the most successful investment decisions.

Recent Posts