Comerica Bank Reduces Investment in United Natural Foods by 19.1%

April 28, 2023

Trending News ☀️

In its 4th quarter filing, Comerica Bank decreased its ownership in United Natural Foods ($NYSE:UNFI), Inc. by 19.1%. This is a sizable reduction, given that Comerica Bank had previously held a large stake in the company. This could be indicative of a potential shift in the banking firm’s investment strategy. The drop in Comerica Bank’s stake also decreases the liquidity of United Natural Foods stock, as the number of shares available for purchase is now lower.

The implications of this move remain to be seen, but it is clear that investors are keeping a close eye on United Natural Foods. As one of the largest companies in the organic and natural food sector, the company remains a major player in the industry and its performance will continue to be closely monitored by investors.

Market Price

UNFI’s stock opened at $26.2 and closed at $26.6, up by 2.1% from the previous closing price of 26.0. It is currently unknown as to why Comerica Bank chose to reduce its investment in UNFI, but the company is likely to issue a statement addressing the matter soon. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for UNFI. More…

| Total Revenues | Net Income | Net Margin |

| 29.86k | 191 | 0.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for UNFI. More…

| Operations | Investing | Financing |

| 558 | -63 | -501 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for UNFI. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 7.63k | 5.79k | 30.91 |

Key Ratios Snapshot

Some of the financial key ratios for UNFI are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 6.8% | 33.8% | 1.3% |

| FCF Margin | ROE | ROA |

| 0.9% | 13.1% | 3.2% |

Analysis

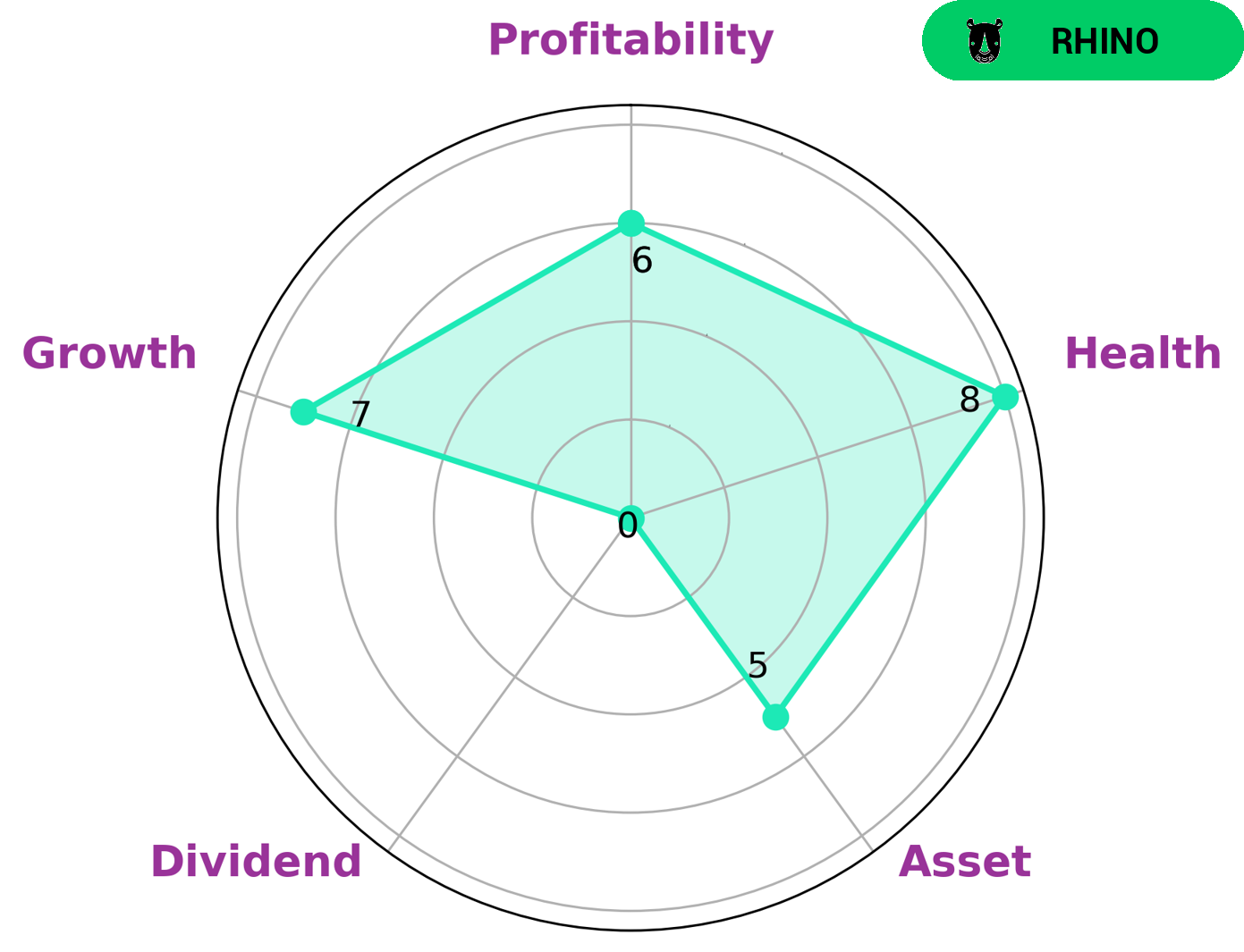

At GoodWhale, we analyze UNITED NATURAL FOODS’s financials to understand their health score. Upon analyzing the financial data, we see that UNITED NATURAL FOODS has a high health score of 8/10, indicating its strong potential to sustain operations in a time of crisis. Our star chart further classifies UNITED NATURAL FOODS as a ‘rhino’ type of company which falls under the moderate revenue or earnings growth companies. UNITED NATURAL FOODS is considered to be strong in growth, medium in asset, profitability and weak in dividend. As such, we can conclude that this company may be attractive to investors who are interested in companies that are capable of delivering long-term growth, but don’t necessarily need the extra income provided by dividends. More…

Peers

This company faces stiff competition from other industry players such as SpartanNash Co, Globrands Group Ltd, and Healthier Choices Management Corp. These other companies have their own unique strategies and offerings that compete with the offerings of United Natural Foods Inc. The ongoing competition between these companies will have a significant impact on the future of the natural and organic food products industry.

– SpartanNash Co ($NASDAQ:SPTN)

SpartanNash Co is a food distributor and retailer located in the United States. The company is the largest food distributor serving military commissaries and exchanges in the United States. As of 2022, SpartanNash Co has a market cap of 1.09B, reflecting an increase of 53% over the previous year. Additionally, the company has a Return on Equity (ROE) of 7.43%, indicating that the company is performing well. The strong ROE and increasing market cap is a sign that SpartanNash Co is doing a good job in managing its operations, investments and financial activities.

– Globrands Group Ltd ($OTCPK:GLBGF)

Healthier Choices Management Corp is a health and wellness company that brings healthy, affordable products to consumers. The company has a market cap of 50.96M as of 2022, which is indicative of a mid-size company. Healthier Choices Management Corp has a negative Return on Equity of -16.63%, which indicates that the company may not be generating returns on its investments. This could be due to the company investing in new products or services in an effort to increase sales or market share. Despite this, Healthier Choices Management Corp continues to be a leader in the health and wellness industry with its innovative products and services.

Summary

This may be indicative of a reshuffling of investments or a shift in sentiment towards the company. It is important to note that this is only one of many indicators investors should consider when making decisions and conducting analysis on UNFI. Additionally, investors should consider other factors such as the company’s financials and market conditions. Ultimately, independent research and analysis should be conducted before making any investment decisions.

Recent Posts