S&P Global Reiterates Buy Rating on Outstanding Performance

May 27, 2023

Trending News ☀️

S&P ($NYSE:SPGI) Global has recently reiterated their Buy Rating on their Outperformance. This positive assessment of the company comes as a result of its strong financial performance and recognition of its potential for long-term growth. S&P Global is an American financial services company providing independent investment research and analysis, index and market intelligence, and credit ratings. S&P Global’s ratings are used by investors and lenders to make informed decisions, and are trusted by individuals and institutions worldwide. The company’s strong performance has been driven by its expansion into new markets, development of innovative products, and its disciplined approach to managing finances.

S&P Global is well-positioned to capitalize on the growth opportunities in the global markets and continue to expand its reach. Investors should consider adding S&P Global to their portfolios for exposure to a diversified portfolio with potential growth opportunities.

Share Price

On Friday, S&P Global stock opened at $358.8 and closed at $360.8, up by 0.7% from prior closing price of 358.3. This assessment from S&P Global, combined with the positive performance on Friday, indicates that S&P Global is confident in its Buy rating on the stock. Investors should take note of this positive assessment and consider adding S&P Global to their portfolio in light of its performance and reaffirmed Buy rating. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for S&p Global. More…

| Total Revenues | Net Income | Net Margin |

| 11.95k | 2.81k | 19.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for S&p Global. More…

| Operations | Investing | Financing |

| 2.98k | 474 | -6.35k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for S&p Global. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 62.02k | 22.25k | 113.08 |

Key Ratios Snapshot

Some of the financial key ratios for S&p Global are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 20.0% | 1.7% | 35.3% |

| FCF Margin | ROE | ROA |

| 24.0% | 7.3% | 4.2% |

Analysis

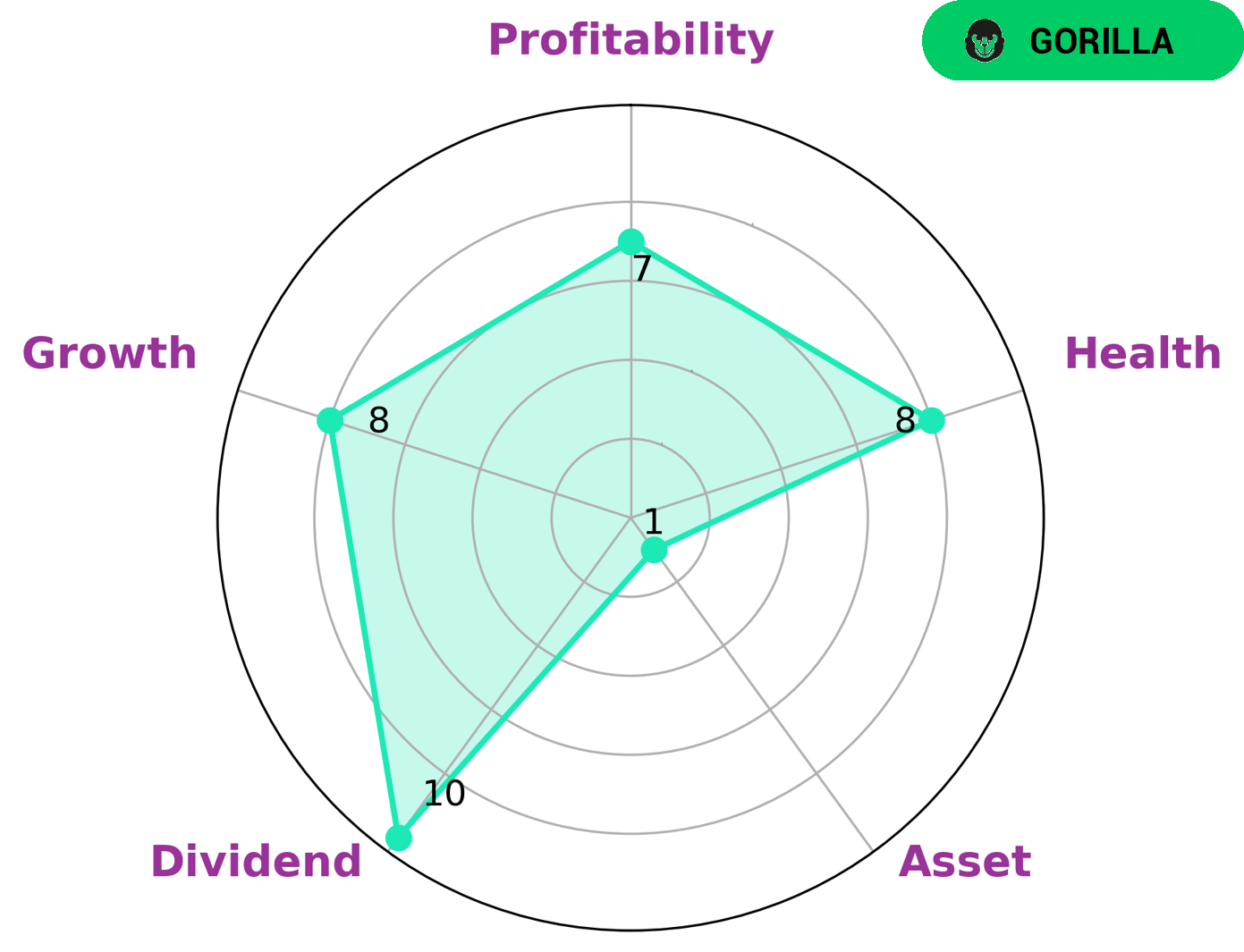

GoodWhale conducted an analysis of S&P GLOBAL‘s wellbeing and based on Star Chart, S&P GLOBAL is classified as a ‘gorilla’, which is a type of company that has achieved stable and high revenue or earning growth due to its strong competitive advantage. It is important to consider what type of investors may be interested in such a company. S&P GLOBAL is strong in dividend, growth, and profitability, but weak in asset. However, its health score of 8/10 with regard to its cashflows and debt indicates that it is capable to pay off debt and fund future operations. Overall, S&P GLOBAL appears to be a very successful and stable company that could be of interest to a variety of investors. It has a competitive advantage that has allowed for high and consistent growth in revenue and earnings. Additionally, its strong health score indicates that it is able to pay off debt and continue to fund future operations. More…

Peers

In the world of financial analysis and investment, there are a few major players that everyone knows. S&P Global Inc is one of these companies, and they frequently compete with others such as OTC Markets Group Inc, Euromoney Institutional Investor PLC, and Nasdaq Inc. All of these companies provide essential services to their clients, and all are leaders in their field. Though they may compete with each other, they also frequently collaborate in order to provide the best possible service to their clients.

– OTC Markets Group Inc ($OTCPK:OTCM)

OTC Markets Group Inc is a United States financial market providing price and liquidity information for almost 10,000 over-the-counter securities. The company has a market capitalization of 664.01 million as of 2022 and a return on equity of 76.45%. The company operates three markets: the OTCQX Best Market, the OTCQB Venture Market, and the Pink Open Market. The company also provides a range of services for broker-dealers, including trade reporting, regulatory compliance, and market data.

– Euromoney Institutional Investor PLC ($LSE:ERM)

Euromoney Institutional Investor PLC is a provider of business information and capital markets intelligence. The company has a market cap of 1.58B as of 2022 and a return on equity of 2.93%. The company provides analysis and data on the global financial markets, including capital markets, banking, and asset management. The company also offers conferences, training, and publications.

– Nasdaq Inc ($NASDAQ:NDAQ)

Nasdaq is a leading global provider of trading, clearing, exchange technology, listing, information and public company services. It offers a wide range of products and services for businesses of all sizes, from startups to large enterprises. Nasdaq is home to some of the world’s most innovative companies, including Tesla, Microsoft, and Apple. It is also one of the largest exchanges in the world, with a market capitalization of over $30 billion. Nasdaq’s return on equity is an impressive 16.97%. This means that for every $1 invested in the company, shareholders can expect to receive $0.17 in return. Nasdaq’s strong market position and profitability make it an attractive investment for many investors.

Summary

S&P Global has been consistently performing well and has earned a Buy rating from analysts. It is expected to continue to outpace the overall market in terms of performance. Investors are advised to take advantage of the company’s strong financial position and attractive valuations. S&P Global’s growth strategy focuses on organic growth, as well as strategic acquisitions, partnerships, and alliances. The company’s management continues to execute initiatives to drive growth and increase profitability.

Significant investments have been made in technology and research & development to enhance its product and services offerings. S&P Global has a strong balance sheet, with low debt levels, ample liquidity, and strong cash flows from operations. It is well-positioned to navigate the current macroeconomic environment and deliver long-term value for shareholders.

Recent Posts