Local Bounti Corporation [LOCL] Stock Surges 110.65% in 2023: Is it the Best Trade Option?

March 23, 2023

Trending News ☀️

The stock of Local Bounti ($NYSE:LOCL) Corporation LOCL has surged an impressive 110.65% in 2023 and is currently trading at $0.74. This is an astonishingly high rate of return and has many investors wondering if LOCL is the best trade option in the current market. When considering LOCL as a trade option, it is important to consider the stock’s volatility. This high level of volatility means that investors can expect a degree of risk when investing in LOCL.

However, the potential returns on LOCL are attractive and may be worth the risk. Another key factor to consider when deciding to invest in LOCL is the company’s current financial standing. The company has been able to record consistent profits since its inception, which has allowed it to maintain a strong balance sheet and pay regular dividends to its shareholders. This, along with its high performance in the current market, could suggest that the company is in a position to continue to deliver good returns for investors in both the short and long term. Therefore, considering the current stock price of Local Bounti Corporation LOCL at $0.74, up 110.65%, it may be worth investing in the stock for those willing to take on a degree of risk. The stock’s volatility and the company’s current financial standing makes LOCL an attractive trade option, with potential for both short-term and long-term returns.

Stock Price

On Tuesday, LOCL opened at $0.6 and closed at $0.5, representing a 17.1% plunge from the last closing price of $0.6. This follows a 110.65% increase in share price over the course of 2023. Given the recent surge, many investors are wondering if LOCL is the best trade option.

While the stock has seen significant growth this past year, it’s important to consider other factors such as the company’s financials, industry trends and the overall market conditions. Investors should conduct their own research before investing and consider any potential risks. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Local Bounti. More…

| Total Revenues | Net Income | Net Margin |

| 13.15 | -112.81 | -808.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Local Bounti. More…

| Operations | Investing | Financing |

| -42.04 | -172.7 | 223.93 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Local Bounti. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 262.13 | 142.78 | 1.27 |

Key Ratios Snapshot

Some of the financial key ratios for Local Bounti are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | -761.7% |

| FCF Margin | ROE | ROA |

| -944.4% | -49.1% | -23.9% |

Analysis

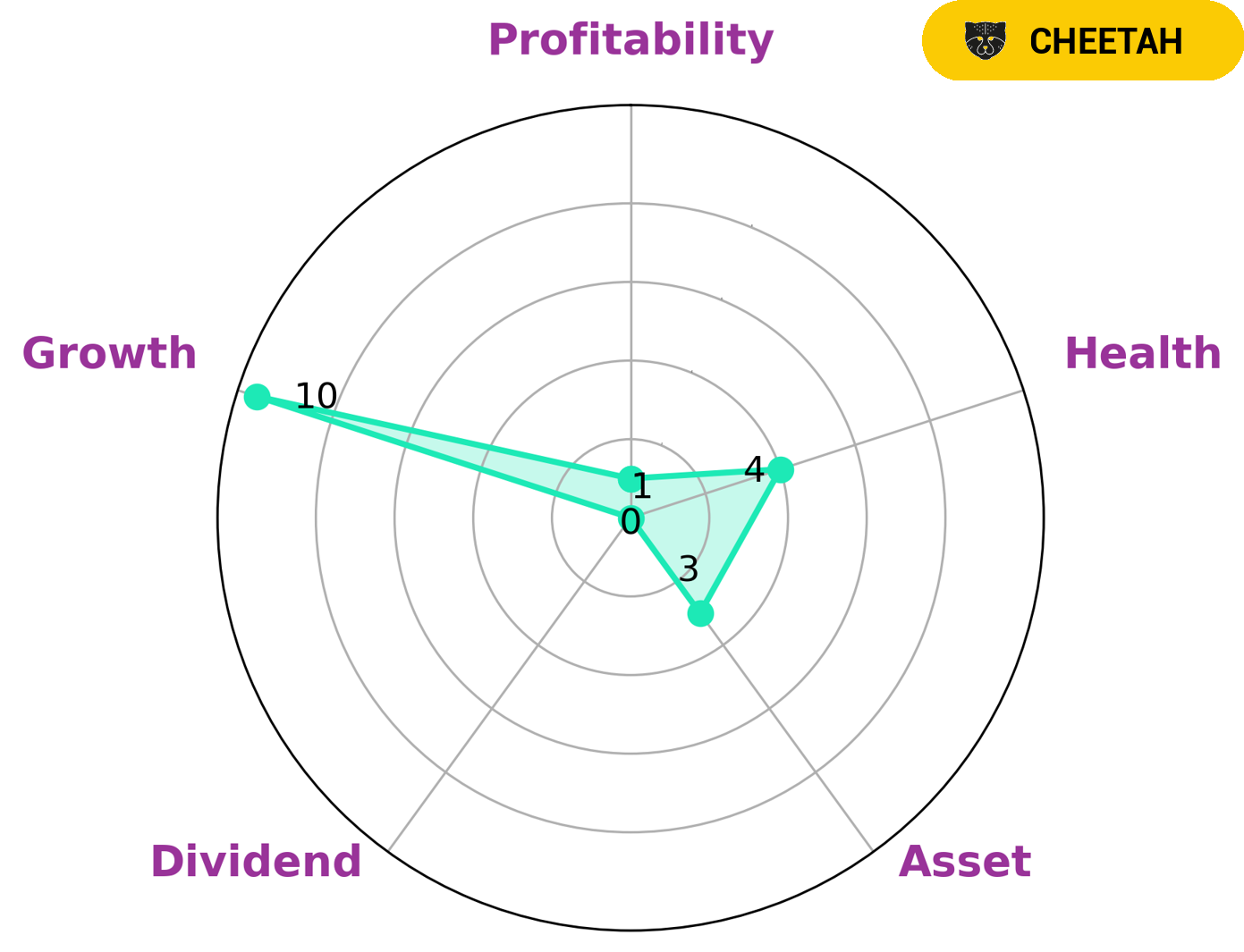

As GoodWhale, we have conducted an analysis of LOCAL BOUNTI‘s fundamentals and based on our Star Chart we have classified it as a ‘cheetah’, a type of company that is characterized by high revenue or earnings growth but is considered less stable due to lower profitability. We believe that investors with a high appetite for risk may be interested in such companies. Our analysis also shows that LOCAL BOUNTI has an intermediate health score of 4/10 with regard to its cashflows and debt, indicating that the company is likely to pay off its debt and fund its future operations. Furthermore, when looking at the various aspects of LOCAL BOUNTI’s performance, we can see that it is strong in terms of growth and weak in terms of asset, dividend, and profitability. More…

Peers

– Kalera AS ($NASDAQ:APPH)

AppHarvest Inc is a publicly traded company with a market capitalization of 185.3 million as of 2022. The company has a return on equity of -28.49%. AppHarvest is a vertically integrated agriculture technology and services company. The company’s mission is to build a more sustainable food system by revolutionizing the way food is grown and distributed. AppHarvest is headquartered in Lexington, Kentucky.

– AppHarvest Inc ($OTCPK:ALFDF)

Astral Foods Ltd is a South African poultry producer. The company has a market cap of 416.45M as of 2022 and a Return on Equity of 17.23%. Astral Foods Ltd is the second-largest poultry producer in South Africa and the largest in Africa. The company supplies chicken to major retailers, fast-food outlets, and the export market.

Summary

Investing in Local Bounti Corporation (LOCL) has seen a huge surge in price of 110.65% in 2023, making it an attractive option for investors. Right now, news sentiment is mostly positive and the stock has moved down on the same day. It is important to analyze the potential of any investment before making a decision. Evaluating the company’s financials, competitive landscape and future prospects are all key factors when researching a stock.

Additionally, it is important to understand the risks associated with any investment and to diversify your portfolio. By researching the company and its industry, investors can make more informed decisions about investing in LOCL.

Recent Posts