Lebenthal Global Advisors LLC Takes Strategic Position in Archer-Daniels-Midland Company

May 2, 2023

Trending News 🌥️

ARCHER-DANIELS-MIDLAND ($NYSE:ADM): On April 29th, 2023, Lebenthal Global Advisors LLC announced that it had taken a strategic position in Archer-Daniels-Midland Company (ADM). ADM is an American agribusiness and food processing company that works in areas such as grain trading, crop processing, and animal feed manufacture. ADM is one of the world’s leading agricultural providers and produces a variety of products, ranging from corn sweeteners and starches to vegetable oil products and biodiesel. It is well known for its trading of commodity crops such as corn, wheat, soybeans, and sunflowers, as well as its processing of these crops into food ingredients, animal feeds, and industrial products.

ADM also manufactures a variety of products such as biodiesel fuel, animal feed supplements, and health ingredients. With the strategic position taken by Lebenthal Global Advisors LLC, investors now have a greater chance to benefit from ADM’s extensive network of operations and its wide array of products. This new partnership will provide them with a great opportunity to capitalize on the company’s growth potential and position themselves for long-term success.

Price History

The stock opened at $78.2 and closed at $77.8, a decrease of 0.4% from its previous closing price of 78.1. This position taken by Lebenthal Global Advisors will likely have an impact on the company’s performance in the future. With a strategic position in the company, Lebenthal Global Advisors will be able to leverage its resources and expertise to help ADM reach new heights. This could translate into increased shareholder value in the near future.

In addition, Lebenthal Global Advisors’ strategic position could help ADM gain access to new market opportunities and enable it to expand its customer base. With the help of this strategic partner, ADM will be able to unlock significant growth potential for its shareholders. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Archer-daniels-midland Company. More…

| Total Revenues | Net Income | Net Margin |

| 101.98k | 4.46k | 4.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Archer-daniels-midland Company. More…

| Operations | Investing | Financing |

| 3.07k | -1.39k | -5.22k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Archer-daniels-midland Company. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 38.83k | 13.64k | 46.11 |

Key Ratios Snapshot

Some of the financial key ratios for Archer-daniels-midland Company are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 16.6% | 37.5% | 5.7% |

| FCF Margin | ROE | ROA |

| 1.6% | 14.7% | 9.4% |

Analysis

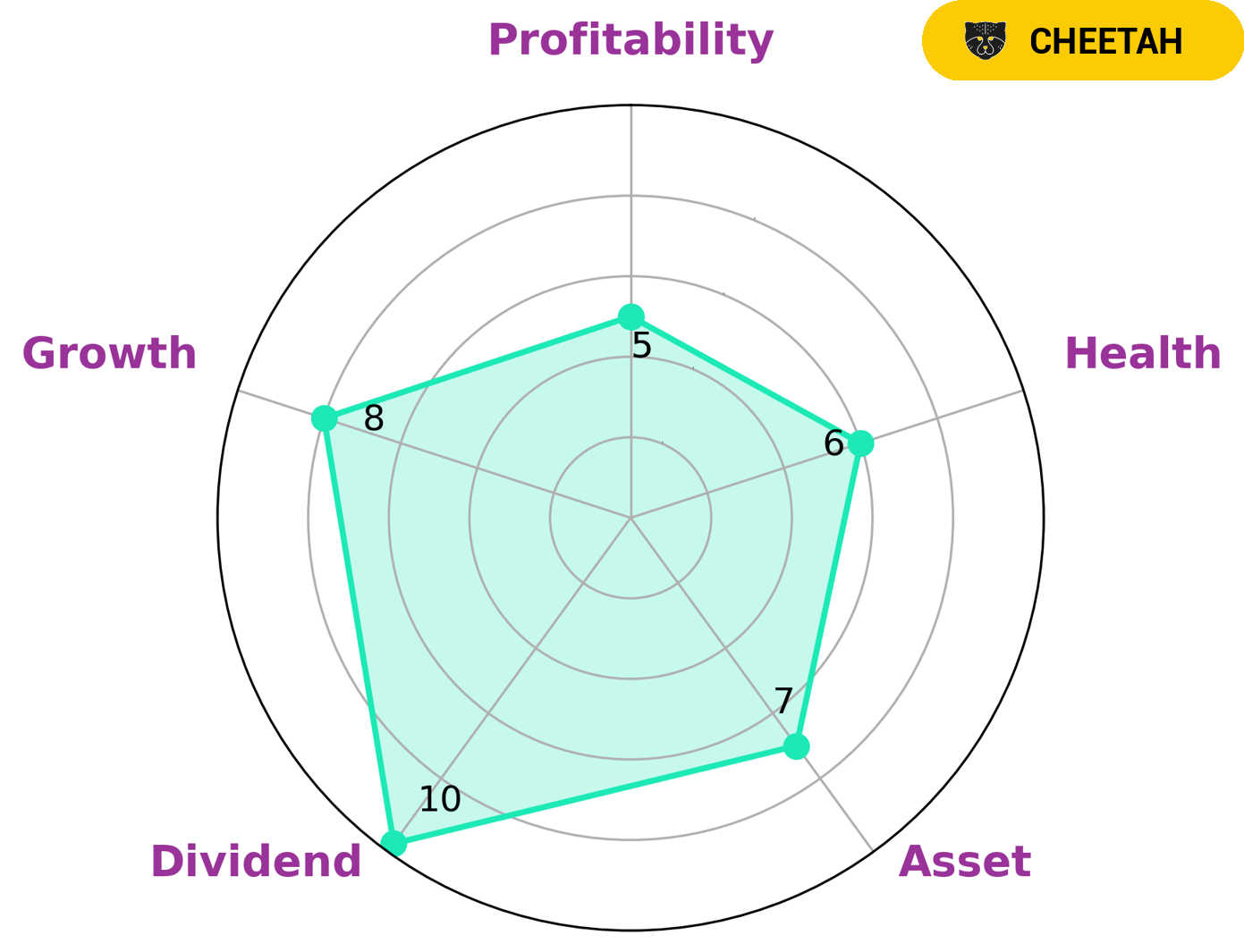

GoodWhale conducted an analysis of the fundamentals of ARCHER-DANIELS-MIDLAND COMPANY. Our star chart showed that ARCHER-DANIELS-MIDLAND COMPANY is strong in asset, dividend, growth, and medium in profitability. The health score for ARCHER-DANIELS-MIDLAND COMPANY was 6/10, indicating that it is likely to be able to pay off debt and fund future operations. Further analysis classified ARCHER-DANIELS-MIDLAND COMPANY as a ‘cheetah’, which we conclude achieved high revenue or earnings growth but is considered less stable due to lower profitability. Investors looking for higher returns may be interested in this type of company as it is likely to possess higher risk and higher reward. However, investors should be aware that this type of stock is much more volatile than average, so careful consideration should be taken before investing in such a company. More…

Peers

The Archer-Daniels Midland Co is in competition with Darling Ingredients Inc, Vilmorin & Cie, and Golden Growers Coop. All four companies produce food ingredients and additives. Archer-Daniels Midland Co has an edge over its competitors because it is the largest producer of corn sweeteners and corn oil in the United States.

– Darling Ingredients Inc ($NYSE:DAR)

Darling Ingredients Inc has a market cap of 12.59B as of 2022, a Return on Equity of 16.72%. Darling is in the business of turning animal by-products into renewable ingredients for the food, feed, fuel, and other industries. The company operates in three segments: Feed Ingredients, Food Ingredients, and Fuel Ingredients.

– Vilmorin & Cie ($LTS:0HJC)

Vilmorin & Cie is a French multinational agricultural and horticultural company. It is the world’s fourth-largest seed company. The company has a market cap of 1.03B as of 2022 and a Return on Equity of 7.29%. The company specializes in the production of seeds for a range of crops, including vegetables, fruits, cereals, and forage plants. The company also provides agricultural services, such as crop consulting, soil analysis, and irrigation design.

Summary

Lebenthal Global Advisors LLC has announced the acquisition of a new position in Archer-Daniels-Midland Company (ADM). Investment analysts suggest that this is a bullish sign for the company, with positive trends in revenue, earnings, cash flow and margin expansion set to continue. Furthermore, the company is well-positioned to benefit from increasing global demand for food and agricultural goods. Its product offering is diversified across a variety of markets and sectors, providing a defensive investing strategy.

Financial analysts have also highlighted strong returns on equity and low debt levels as other attractive features. Therefore, investors should consider adding ADM to their portfolios.

Recent Posts