James Wilson, Securities Litigation Partner, Offers Free Consultation to ALICO Investors Who Lost Over $100,000

April 7, 2023

Trending News ☀️

James Wilson, a Partner in Securities Litigation, is offering free consultation to ALICO ($NASDAQ:ALCO) investors who have lost more than $100,000 on April 2nd, 2023. ALICO, or American Life Insurance Company, is an insurance and financial services provider based in Florida. Despite being considered one of the most successful insurance companies in the United States, ALICO has recently experienced serious losses. As a result, ALICO investors have been significantly impacted with many of them losing over $100,000.

Mr. Wilson has an extensive track record of success in securities litigation, which makes him well-suited to assist investors in recovering their losses from ALICO. He encourages all affected investors to take advantage of this opportunity and contact him directly to discuss the matter.

Stock Price

This announcement comes after ALICO‘s stock opened at $24.2 and closed at $24.1, down by 0.3% from its previous closing price of 24.2. These losses could be due to a variety of issues, such as potential market manipulation or insider trading. Investors are encouraged to contact Wilson’s office to arrange a free consultation to ensure their rights are protected and to explore the potential of seeking compensation. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Alico. More…

| Total Revenues | Net Income | Net Margin |

| 87.2 | -0.82 | -25.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Alico. More…

| Operations | Investing | Financing |

| 6.47 | 17.89 | -24.16 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Alico. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 412.99 | 167.39 | 31.68 |

Key Ratios Snapshot

Some of the financial key ratios for Alico are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -9.7% | 11.1% | 6.3% |

| FCF Margin | ROE | ROA |

| -15.7% | 1.4% | 0.8% |

Analysis

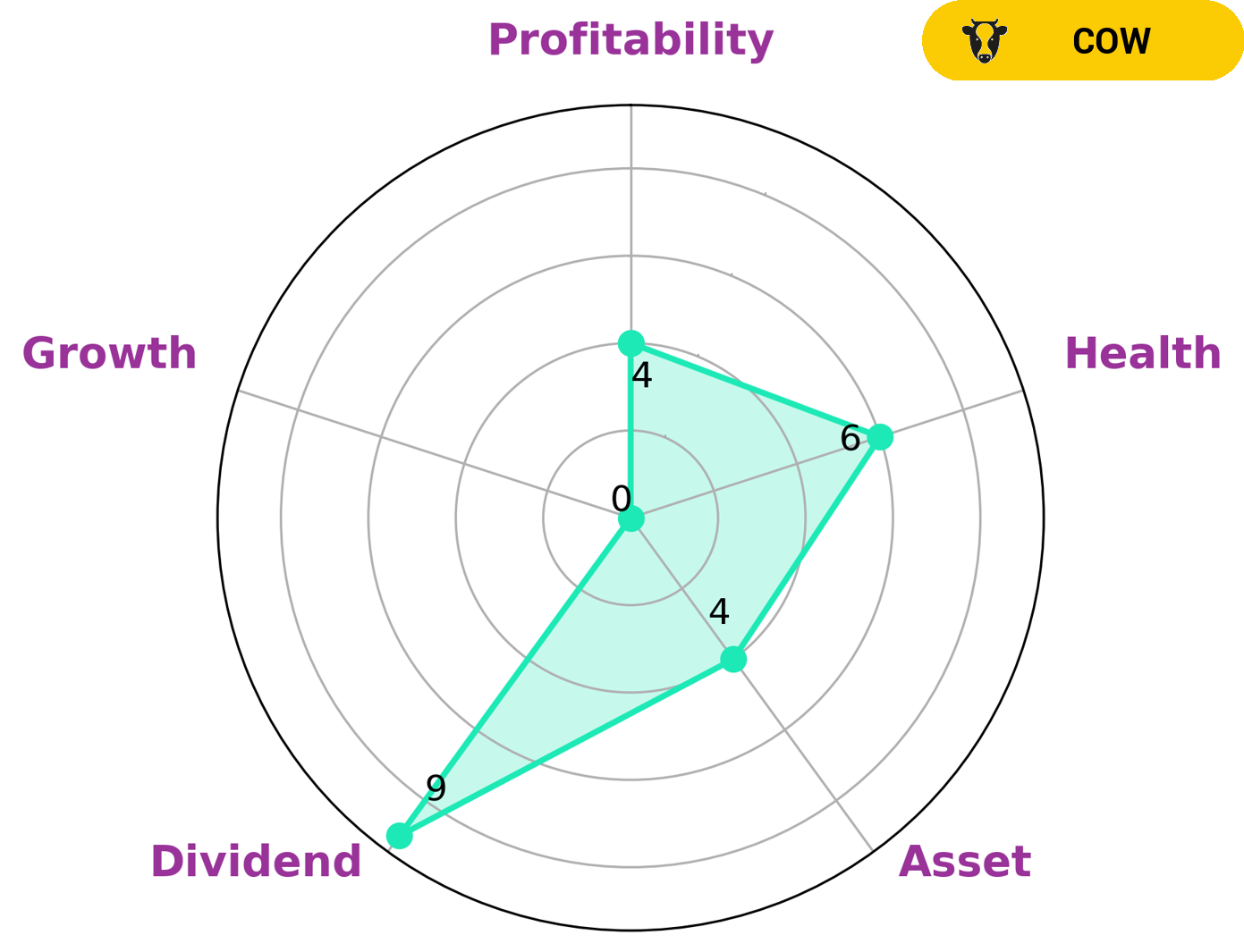

At GoodWhale, we recently conducted an analysis of ALICO’s fundamentals. Our Star Chart showed that ALICO is strong in dividend, medium in asset, profitability and weak in growth. This led us to conclude that ALICO is classified as a ‘cow’, a type of company which has a track record of paying out consistent and sustainable dividends. This makes ALICO an attractive option for investors who enjoy capital growth and steady income from dividend payments. Furthermore, the intermediate health score of 6/10 with regard to its cashflows and debt indicates that the company is likely to be able to pay off debt and fund future operations. This could be appealing for investors looking for a company with a good balance sheet. More…

Peers

The Company operates in the United States and Brazil. KSG Agro SA, MHP SE, and Seeka Ltd are all competitors of Alico Inc.

– KSG Agro SA ($LTS:0Q3Q)

KSG Agro SA is a publicly traded company with a market capitalization of 5.8 million as of 2022. The company has a return on equity of 28.28%. KSG Agro SA is engaged in the business of agriculture, including the production, processing and sale of agricultural products.

– MHP SE ($LSE:MHPC)

MHP SE is a German holding company that operates in the food and agriculture industry. The company has a market cap of 358.58M as of 2022 and a Return on Equity of 9.3%. MHP SE is involved in the production and marketing of poultry, pork, and beef products. The company also owns and operates a number of farms, processing plants, and retail outlets.

– Seeka Ltd ($NZSE:SEK)

Seeka Ltd is a New Zealand-based company engaged in the business of horticulture. The Company operates through two segments: Horticulture, and Post-harvest. The Horticulture segment is engaged in the growing and selling of kiwifruit, avocados, and other fruit. The Post-harvest segment is engaged in the provision of post-harvest services for kiwifruit and avocados.

Summary

Investors who have suffered losses exceeding $100,000 in Alico should contact James Wilson, a securities litigation partner, for further advice. Analysis of the company’s financial condition indicates potential challenges for investors in the near future. Analysts have cautioned against investing in Alico at the current time until more information on the company’s financials is released. Investors should be aware of the risks associated with investing in this company and should research their options carefully before investing.

Recent Posts