Fresh Del Monte Produce Sees 9% YTD Gain Despite Macro Headwinds Thanks to Improved Product Mix and Logistics Optimization

February 13, 2023

Trending News ☀️

The company specializes in fresh fruits and vegetables, as well as prepared foods such as salads, juices and smoothies. Despite the macroeconomic headwinds, Fresh Del Monte ($NYSE:FDP) Produce has seen a 9% rise in its shares YTD, thanks to improvements in product mix, logistics optimization, and the completion of its integration with Mann. The company has been able to maintain healthy profit margins as the sector is relatively stable, allowing them to pass on any increased costs due to higher inflation to the end consumer, thus supporting their operating margins. Furthermore, Fresh Del Monte Produce has strengthened its supply chain management capabilities by investing in technology and automation, allowing them to optimize costs and improve efficiency. This has resulted in an improved product mix and more efficient delivery, leading to a better customer experience. The company has also implemented a number of sustainability initiatives, including reducing food waste, increasing their use of renewable energy, and investing in sustainable packaging solutions. These efforts have allowed them to reduce their carbon footprint and demonstrate their commitment to protecting the environment.

In addition, Fresh Del Monte Produce has established a network of collaborations with local farmers and suppliers to ensure quality produce is available year-round at competitive prices. By continuing to invest in product mix and logistics optimization, they are well-positioned to capitalize on the growing demand for fresh produce and other prepared foods. Furthermore, their commitment to sustainability initiatives is likely to further bolster their reputation in the industry and create long-term value for shareholders.

Share Price

Right now, news around the company is mostly positive. On Wednesday, the stock opened at $28.5 and closed at $28.2, down by 1.9% from its previous closing price of 28.8. The company’s stock has been on a steady upward trend since the beginning of the year, likely due to its successful efforts of improving its product mix and optimizing its logistics. Fresh Del Monte Produce’s product portfolio includes a wide range of fresh fruit and vegetables, as well as prepared foods and beverages.

The company has been able to leverage its strong global sourcing capabilities and supply chain network to provide customers with fresh, quality products year-round. This has enabled the company to reduce its delivery costs, improve customer service, and enhance its competitive positioning in the market. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for FDP. More…

| Total Revenues | Net Income | Net Margin |

| 4.42k | 69.1 | 1.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for FDP. More…

| Operations | Investing | Financing |

| 82.6 | -52.9 | -23.5 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for FDP. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.4k | 1.44k | 39.46 |

Key Ratios Snapshot

Some of the financial key ratios for FDP are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -0.7% | 0.2% | 2.4% |

| FCF Margin | ROE | ROA |

| 0.7% | 3.2% | 1.8% |

Analysis

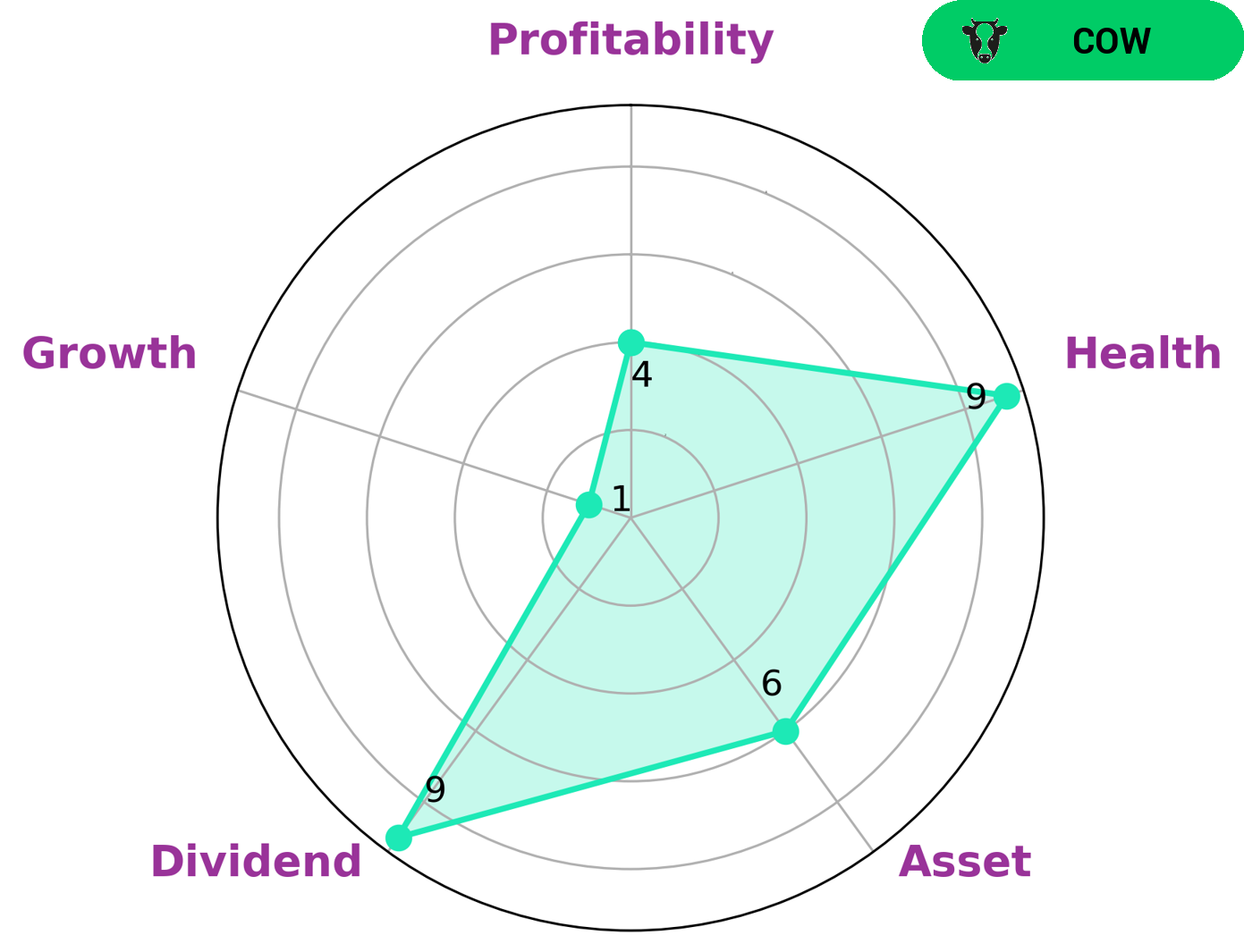

Analyzing the financials of FRESH DEL MONTE PRODUCE with GoodWhale, it is classified as a “cow” – a company with a track record of paying out consistent and sustainable dividends – and has a high health score of 9/10. Investors who are looking for steady returns, lower risk, and steady cash flow may be interested in investing in this type of company. Companies like FRESH DEL MONTE PRODUCE have the capability to safely ride out any crisis due to their healthy cashflows and debt, without the risk of bankruptcy. For those investors who are looking for higher returns or growth opportunities, FRESH DEL MONTE PRODUCE may not be the most ideal investment choice. As the company is weak in terms of growth and its returns are not as high as other investments. Additionally, investors should also be aware of the risks associated with investing in such a company, including dividend cuts and stagnation in growth. Overall, FRESH DEL MONTE PRODUCE is an attractive investment choice for investors seeking steady returns and lower risk. However, investors need to weigh out the risks associated with investing in this type of company before making a decision. More…

Peers

Fresh Del Monte Produce Inc is one of the leading companies in the fresh fruit and vegetable industry. The company has a wide variety of products and services that are offered to their customers. They have a strong global presence and are constantly innovating to stay ahead of the competition. Some of their main competitors include Vilmorin & Cie, Apex Frozen Foods Ltd, Helio SA.

– Vilmorin & Cie ($LTS:0HJC)

Vilmorin & Cie is a French company that specializes in the breeding and distribution of seeds. The company has a market cap of 1.02B as of 2022 and a return on equity of 7.29%. Vilmorin & Cie has a long history, dating back to the 17th century, and is one of the oldest seed companies in the world. The company has a strong presence in Europe and North America, and is continuing to expand its operations globally.

– Apex Frozen Foods Ltd ($BSE:540692)

Apex Frozen Foods Ltd has a market cap of 8.79B as of 2022, a Return on Equity of 12.21%. The company is engaged in the business of processing and marketing frozen shrimp and fish products. Its products are sold in the United States, Europe, Japan and other Asian countries. The company has a strong presence in the frozen shrimp market with a market share of approximately 20%.

– Helio SA ($LTS:0LU6)

Helio SA is a publicly traded company with a market capitalization of 57.02 million as of 2022. The company has a return on equity of 11.55%. Helio SA is engaged in the business of providing environmental and engineering consulting services. The company was founded in 1997 and is headquartered in Santiago, Chile.

Summary

Fresh Del Monte Produce has seen a 9% year-to-date gain in stock price, despite the macroeconomic headwinds. The company has focused on improving their product line, expanding their distribution channels, and streamlining their supply chain. These initiatives have helped to increase their profits, leading to an increase in stock price. This positive trend is expected to continue in the future, making it an attractive investment for investors.

Recent Posts