Fresh Del Monte Produce and Moze Holding Forge Multi-Year Banana Partnership in Somalia to Support Economic Resurgence and Provide Consumers with Fresher, Lower-Cost Fruit.

February 3, 2023

Trending News ☀️

Fresh Del Monte ($NYSE:FDP) Produce, a leading international producer and distributor of high-quality fresh and prepared food products, and Moze Holding, a Talc Investment Co. based in Somalia, have recently announced a multi-year banana partnership. This partnership is intended to help provide fresher and lower-cost bananas to consumers in the Middle East and North Africa through shorter transport times, and to contribute to the economic resurgence of Somalia. As the former renowned banana belt area, Somalia is an ideal location for the distribution of bananas due to its favorable climate and soil conditions. This partnership will allow Fresh Del Monte Produce to access the region’s resources and supply chain infrastructure while also providing a much-needed boost to the local economy.

The partnership is expected to create new jobs in the area, as well as bring more investments and business opportunities to the region. It will also provide local farmers with the necessary resources needed to increase their production of bananas, allowing them to maximize their yields and profits. This multi-year banana partnership is expected to have a positive impact on both the economy of Somalia and the consumers of the Middle East and North Africa.

Market Price

This partnership marks a significant step in the development of the Somali agricultural sector, which has been devastated by decades of conflict. The agreement will create jobs, build infrastructure, and help to stabilize the Somali economy. The initial reaction to the news has been largely positive, with media outlets praising the partnership as a potential game-changer for the Somali economy. Some have noted that the partnership could help Somalia to become a major producer of bananas, allowing it to compete with other African countries for market share. On Thursday, Fresh Del Monte Produce stock opened at $28.8 and closed at $28.7, up by 0.6% from last closing price of 28.5.

In addition, it could create jobs and stimulate economic activity in the region. All in all, the partnership is an encouraging development for Somalia’s future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for FDP. More…

| Total Revenues | Net Income | Net Margin |

| 4.42k | 69.1 | 1.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for FDP. More…

| Operations | Investing | Financing |

| 82.6 | -52.9 | -23.5 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for FDP. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.4k | 1.44k | 39.46 |

Key Ratios Snapshot

Some of the financial key ratios for FDP are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -0.7% | 0.2% | 2.4% |

| FCF Margin | ROE | ROA |

| 0.7% | 3.2% | 1.8% |

Analysis

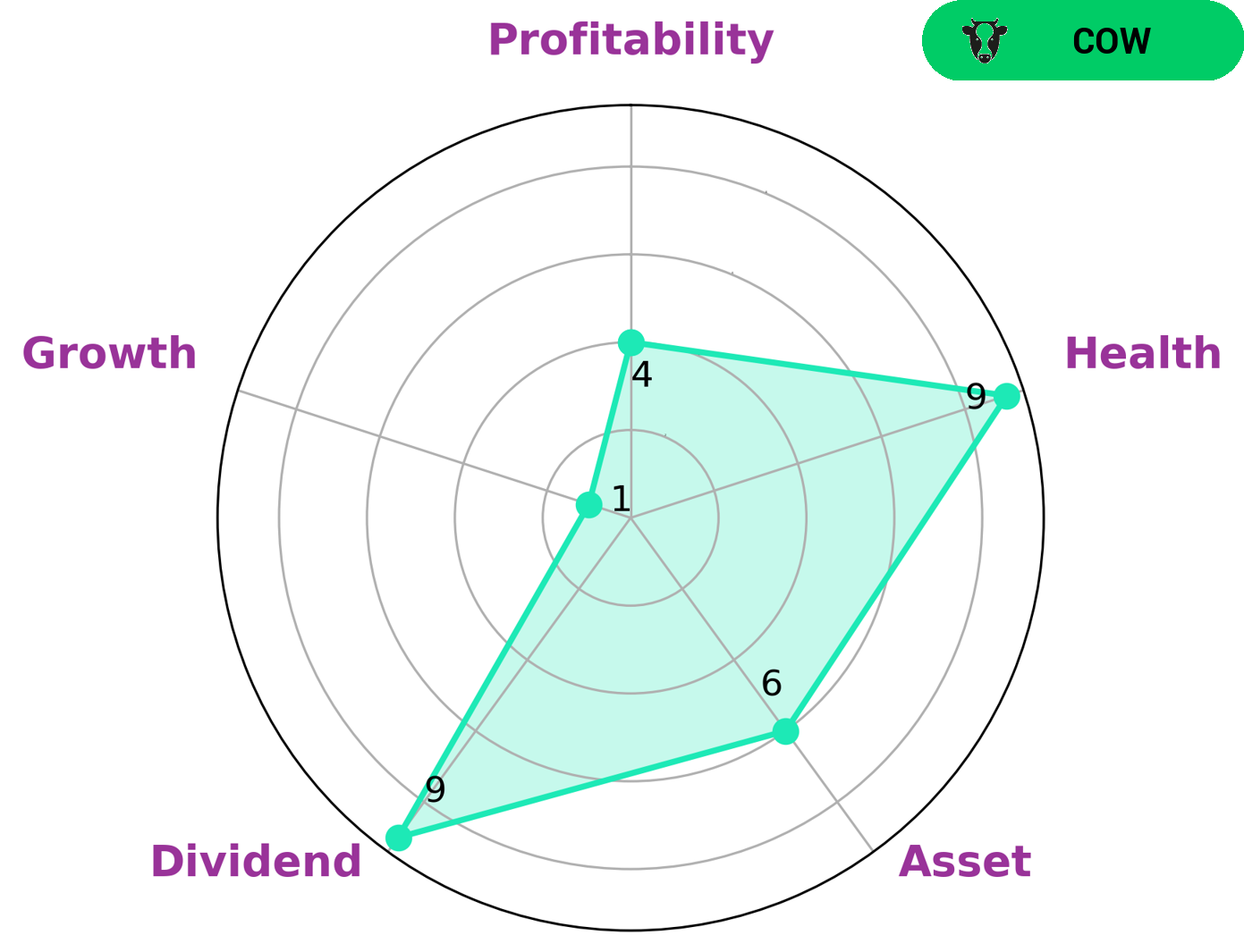

GoodWhale has provided an analysis of FRESH DEL MONTE PRODUCE’s wellbeing, which has been classified as the ‘cow’ type of company. This means that the company has a track record of paying out consistent and sustainable dividends, making it a desirable prospect for investors who are looking for reliable returns. The company is strong in dividend but medium in asset, profitability and growth. This indicates that it is not growing particularly rapidly, but still has a steady performance overall. The Star Chart also shows that FRESH DEL MONTE PRODUCE has a high health score of 9/10, due to its strong cashflows and low debt. This suggests that the company is capable of riding out any crisis without the risk of bankruptcy. In conclusion, investors looking for reliable returns and are comfortable with a slower growth rate should take interest in FRESH DEL MONTE PRODUCE. The company’s track record of paying out consistent dividends and its high health score make it an attractive option for those looking for sustainable investments. More…

Peers

Fresh Del Monte Produce Inc is one of the leading companies in the fresh fruit and vegetable industry. The company has a wide variety of products and services that are offered to their customers. They have a strong global presence and are constantly innovating to stay ahead of the competition. Some of their main competitors include Vilmorin & Cie, Apex Frozen Foods Ltd, Helio SA.

– Vilmorin & Cie ($LTS:0HJC)

Vilmorin & Cie is a French company that specializes in the breeding and distribution of seeds. The company has a market cap of 1.02B as of 2022 and a return on equity of 7.29%. Vilmorin & Cie has a long history, dating back to the 17th century, and is one of the oldest seed companies in the world. The company has a strong presence in Europe and North America, and is continuing to expand its operations globally.

– Apex Frozen Foods Ltd ($BSE:540692)

Apex Frozen Foods Ltd has a market cap of 8.79B as of 2022, a Return on Equity of 12.21%. The company is engaged in the business of processing and marketing frozen shrimp and fish products. Its products are sold in the United States, Europe, Japan and other Asian countries. The company has a strong presence in the frozen shrimp market with a market share of approximately 20%.

– Helio SA ($LTS:0LU6)

Helio SA is a publicly traded company with a market capitalization of 57.02 million as of 2022. The company has a return on equity of 11.55%. Helio SA is engaged in the business of providing environmental and engineering consulting services. The company was founded in 1997 and is headquartered in Santiago, Chile.

Summary

Investors should consider investing in Fresh Del Monte Produce, a global leader in the production and distribution of fresh fruits and vegetables. The company recently announced a multi-year banana partnership with Moze Holding in Somalia, which is expected to contribute to the local economy, while providing consumers with fresher, lower-cost fruit. This strategic move highlights the company’s commitment to sustainability and growth, making it an attractive choice for investors.

Fresh Del Monte Produce is well-positioned to capitalize on the increasing demand for fresh produce and is backed by a strong financial position. This is a great opportunity to invest in a reliable and profitable business.

Recent Posts