Cal-Maine Foods Appoints Todd Walters as Chief Operating Officer in 2023

March 30, 2023

Trending News 🌥️

CAL-MAINE ($NASDAQ:CALM): Cal-Maine Foods Inc., listed on the New York Stock Exchange (NYSE), is delighted to announce the appointment of Todd Walters as its new Chief Operating Officer effective 2023. Mr. Walters has extensive experience in the food production industry, having worked at various leading food companies for many years. At Cal-Maine Foods, Walters will be responsible for overseeing the company’s operations and production processes, as well as developing and implementing strategies for growth and profitability. He will also be tasked with leading a team of executives to ensure that the company meets its objectives and implements new initiatives.

With his extensive experience in the food production sector and proven expertise in operational management, Walters is the perfect fit to take on the role of Chief Operating Officer at Cal-Maine Foods. Following his appointment, Cal-Maine Foods is confident that it can continue to produce the highest quality products, while expanding its presence in the industry and growing its profits.

Market Price

This news came as the stock opened at $55.3, but closed at $54.3, a decrease of 1.8% from its last closing price of 55.3. This appointment demonstrates the commitment of CAL-MAINE FOODS to strengthening its leadership team and continuing to grow and diversify its operations. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Cal-maine Foods. More…

| Total Revenues | Net Income | Net Margin |

| 3.05k | 757.08 | 24.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Cal-maine Foods. More…

| Operations | Investing | Financing |

| 811.89 | -453.33 | -152.54 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Cal-maine Foods. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.99k | 457.6 | 31.36 |

Key Ratios Snapshot

Some of the financial key ratios for Cal-maine Foods are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 37.3% | 42.3% | 32.8% |

| FCF Margin | ROE | ROA |

| 23.0% | 43.7% | 31.4% |

Analysis

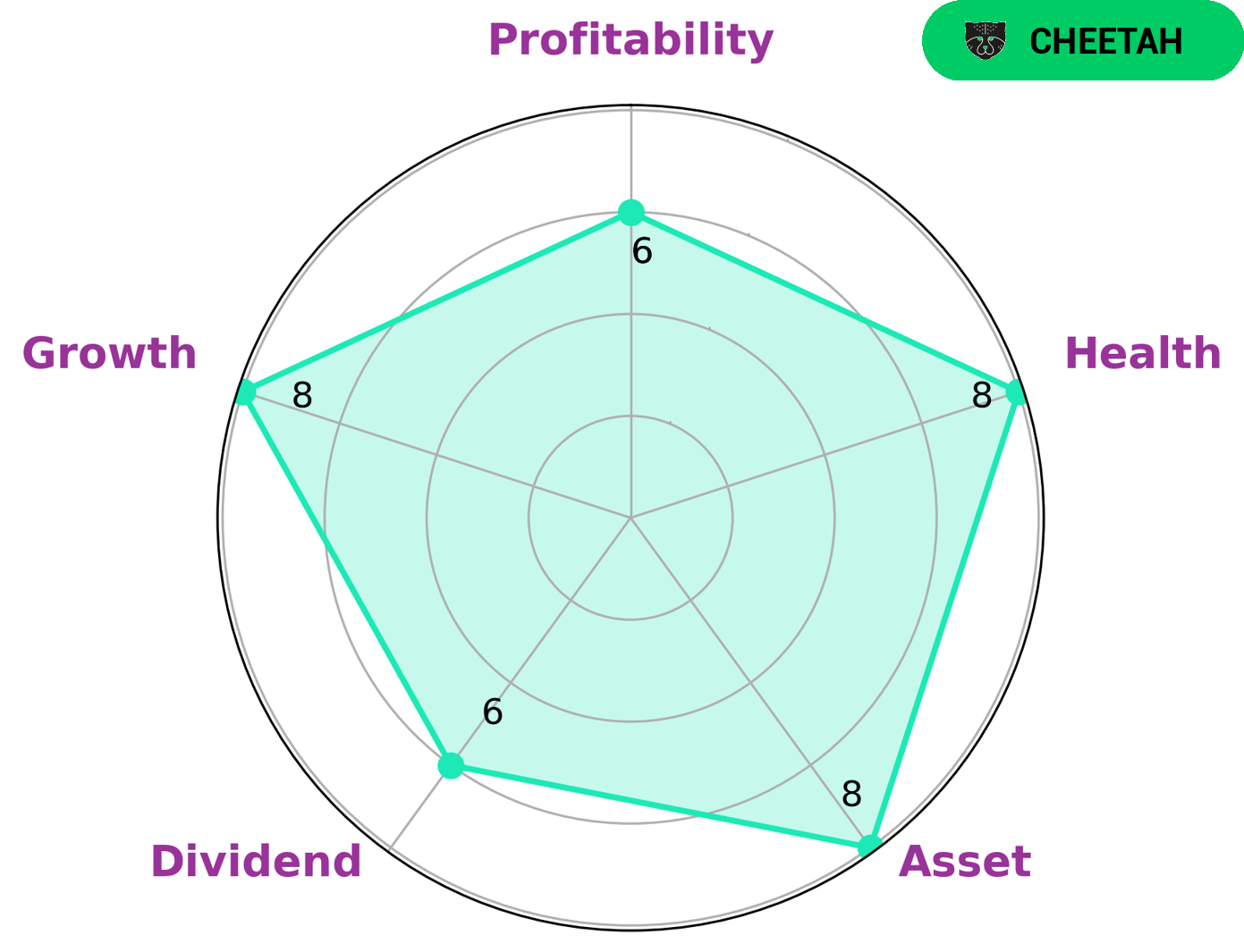

GoodWhale has completed a thorough evaluation of CAL-MAINE FOODS‘s fundamentals, and the results have been promising. Using the Star Chart, we can see that CAL-MAINE FOODS is strong in asset and growth, and medium in dividend and profitability. Based on this data, CAL-MAINE FOODS is classified as a “cheetah” company, meaning it has achieved high revenue or earnings growth but is considered less stable due to lower profitability. The type of investors that may be interested in such a company are those who are looking for a long-term growth opportunity and are comfortable with the risk associated with it. Additionally, CAL-MAINE FOODS has a high health score of 8/10, considering its cashflows and debt, showing that it is capable of sustaining future operations in times of crisis. More…

Peers

The competition among Cal-Maine Foods Inc and its competitors is fierce. Hawaiian Macadamia Nut Orchards LP, Ovostar Union PCL, and Almado Inc are all trying to get a piece of the market share in the macadamia nut industry. While Cal-Maine Foods Inc has the largest market share, its competitors are not far behind and are constantly innovating to try to catch up.

– Hawaiian Macadamia Nut Orchards LP ($LTS:0Q6C)

Ovostar Union PCL is a leading egg and egg products producer in Ukraine with a market share of approximately 25% of the total Ukrainian egg market. The company was founded in 2004 and is headquartered in Kiev, Ukraine. Ovostar Union PCL is listed on the London Stock Exchange.

The company’s market capitalization is $53.62 million as of 2022. The company has a return on equity of -12.79%.

Ovostar Union PCL is a leading egg and egg products producer in Ukraine. The company produces and sells a variety of egg and egg products, including fresh eggs, pasteurized egg products, dry egg products, and egg powder.

– Ovostar Union PCL ($TSE:4932)

Almado Inc is a publicly traded company with a market capitalization of $13.54 billion as of 2022. The company has a return on equity of 13.91%. Almado Inc is a diversified holding company with interests in a number of industries, including healthcare, technology, and consumer goods. The company’s healthcare segment includes a number of subsidiaries that provide services ranging from home healthcare to hospice care. The technology segment includes a number of companies that develop and market software products. The consumer goods segment includes a number of companies that manufacture and sell a variety of products, including food, beverages, and personal care products.

Summary

Investors should consider Cal-Maine Foods as an attractive opportunity due to their recent appointment of Todd Walters as Chief Operating Officer in 2023. Their operating efficiency, brand recognition, and diversity of products provide competitive advantages that should continue to drive future growth. Their well-established egg production capabilities and their vertically integrated supply chain have allowed them to consistently achieve profitability.

In addition, Cal-Maine Foods has an impressive dividend yield and a strong balance sheet. As a result, investors should take a look at this company as an attractive investment opportunity.

Recent Posts