Alico Intrinsic Value Calculator – Alico Investors: Don’t Miss Out on Potential Recovery of Losses – Contact the Portnoy Law Firm Now!

April 19, 2023

Trending News 🌧️

Alico ($NASDAQ:ALCO) Inc. is a multinational company with operations in a variety of industries, including insurance, investments, and consumer products.

However, due to recent market volatility and other factors, some investors may have suffered losses due to their investments in the company. The Portnoy Law Firm is available to help these investors recover any losses they may have suffered as a result of their investments. They have extensive experience in securities litigation, investment disputes, and other related legal matters. The firm is fully versed in the nuances of the stock market, and has the resources and expertise to take on cases related to Alico, Inc. If you have suffered losses due to your investments in Alico, Inc., please do not hesitate to contact the Portnoy Law Firm for more information. They are committed to providing you with the legal assistance you need to get back on your feet and start recovering any losses that you may have incurred. Don’t miss out on this potential opportunity for recovery – contact the Portnoy Law Firm now!

Market Price

Investors of Alico Inc. have something to be excited about: on Monday, the stock opened at $24.2 and closed at $24.9 – a 3.1% increase from its prior closing price of 24.1. They understand the complexities of stock market fluctuations and know how to help you maximize your financial outcome. Their team of financial experts can provide you with personalized guidance tailored to your investment goals and can help you make an informed decision. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Alico. More…

| Total Revenues | Net Income | Net Margin |

| 87.2 | -0.82 | -25.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Alico. More…

| Operations | Investing | Financing |

| 6.47 | 17.89 | -24.16 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Alico. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 412.99 | 167.39 | 31.68 |

Key Ratios Snapshot

Some of the financial key ratios for Alico are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -9.7% | 11.1% | 6.3% |

| FCF Margin | ROE | ROA |

| -15.7% | 1.4% | 0.8% |

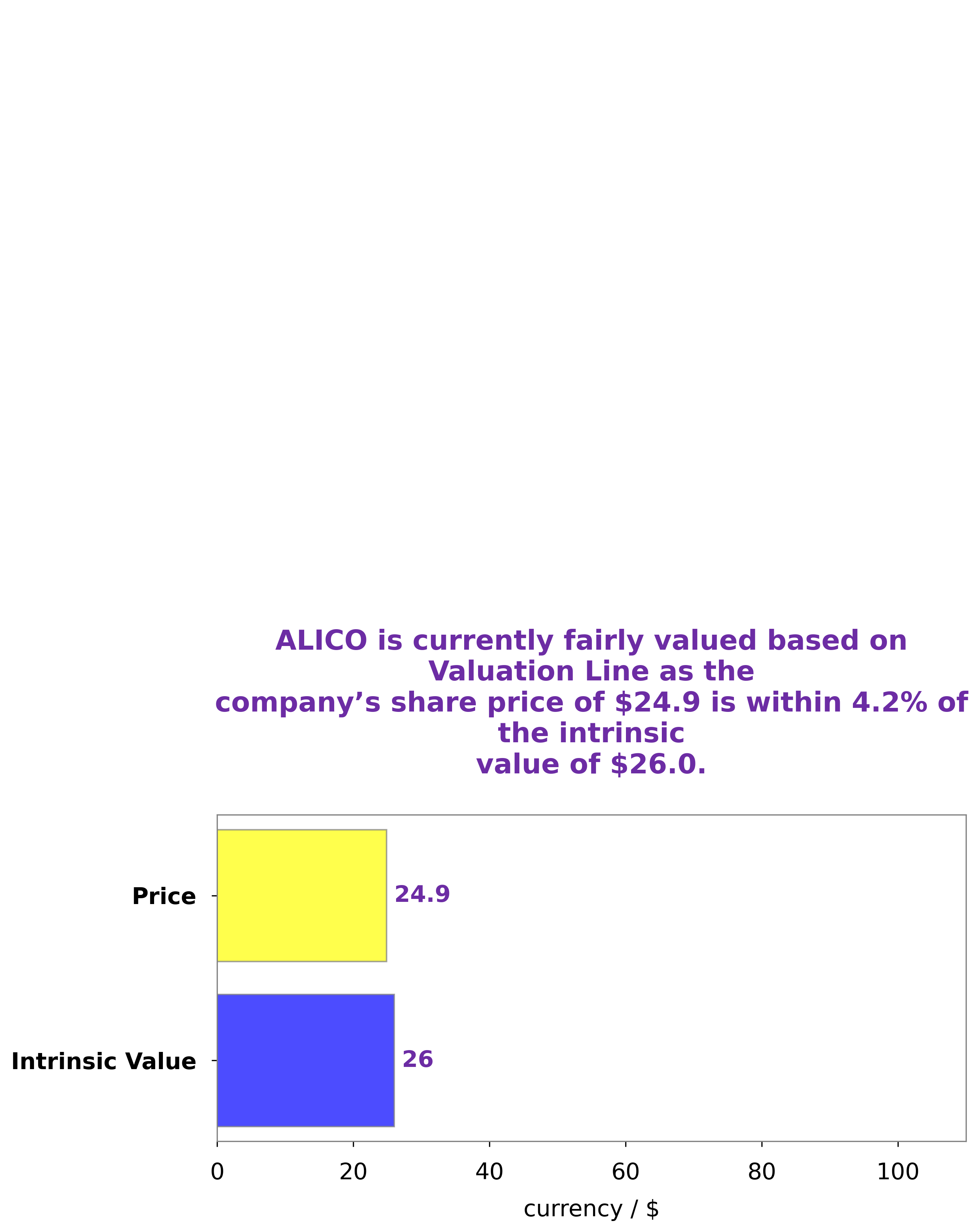

Analysis – Alico Intrinsic Value Calculator

GoodWhale has conducted an analysis of ALICO’s wellbeing and the results are very encouraging. Our proprietary Valuation Line has calculated the fair value of ALICO share to be around $26.0. Surprisingly, ALICO stock is currently traded at $24.9, which is 4.2% lower than what is considered a fair price. This makes ALICO stock an attractive investment option for those looking for undervalued stocks. Alico_Investors_Dont_Miss_Out_on_Potential_Recovery_of_Losses_-_Contact_the_Portnoy_Law_Firm_Now”>More…

Peers

The Company operates in the United States and Brazil. KSG Agro SA, MHP SE, and Seeka Ltd are all competitors of Alico Inc.

– KSG Agro SA ($LTS:0Q3Q)

KSG Agro SA is a publicly traded company with a market capitalization of 5.8 million as of 2022. The company has a return on equity of 28.28%. KSG Agro SA is engaged in the business of agriculture, including the production, processing and sale of agricultural products.

– MHP SE ($LSE:MHPC)

MHP SE is a German holding company that operates in the food and agriculture industry. The company has a market cap of 358.58M as of 2022 and a Return on Equity of 9.3%. MHP SE is involved in the production and marketing of poultry, pork, and beef products. The company also owns and operates a number of farms, processing plants, and retail outlets.

– Seeka Ltd ($NZSE:SEK)

Seeka Ltd is a New Zealand-based company engaged in the business of horticulture. The Company operates through two segments: Horticulture, and Post-harvest. The Horticulture segment is engaged in the growing and selling of kiwifruit, avocados, and other fruit. The Post-harvest segment is engaged in the provision of post-harvest services for kiwifruit and avocados.

Summary

Investors in Alico, Inc. should contact the Portnoy Law Firm for recovery of any losses. This comes after the stock price moved up on the same day, suggesting a potential opportunity to make a profit. Analysts suggest that investors should focus on researching the company’s dividend policy, financial stability, growth potential, and market trends before investing.

It is recommended to also review Alico’s past financial performance and compare it to that of its competitors. Investors should also bear in mind that any investment involves risk and may result in a loss.

Recent Posts