The Manitowoc Company Shares Drop 2.58% – Is the Stock Price Too High?

January 19, 2023

Trending News 🌥️

The Manitowoc Company ($NYSE:MTW) Inc. is a leading global manufacturer of cranes and lifting solutions, as well as foodservice equipment. The company’s stock price has seen a significant drop of -2.58% from its prior closing of $12.01 to $11.70 at the close of business yesterday. This could be due to a number of factors such as market and economic conditions, investors’ assessment of the company’s performance and prospects, or other external events. Given this decrease in the share price, it is worth considering whether The Manitowoc Company Inc. shares are still too expensive at this price point. On the one hand, many investors may think that the company is undervalued and could be a good buy at the current price. The company reported strong revenue growth and a healthy balance sheet in its last quarterly report, which is likely to help drive the stock price up in the future.

On the other hand, some investors may be concerned that the stock is overvalued and could be an expensive buy at this point in time. The company’s revenue growth has slowed down recently, and the stock price may not rise significantly in the near future. Investors must consider the company’s financial performance, market conditions and other external factors when deciding whether or not to invest in the company’s shares. Ultimately, it is up to each individual investor to assess these factors and make an informed decision about whether or not to invest in The Manitowoc Company Inc. shares at this time.

Share Price

On Tuesday, the company’s stock opened at $11.7 and closed at $11.4, down 2.58% from its prior closing price of $11.7. So far, the media sentiment has been mostly positive for the company, with analysts citing its strong balance sheet and healthy earnings growth. Those who bought the stock recently could have taken a loss, though it is too early to tell if this is an isolated event or a sign of further trouble ahead. Analysts are now trying to figure out what is causing the drop in price and whether it is a sign of bad news to come.

Investors should continue to monitor the news surrounding this company, as well as its financial performance, to determine whether or not the stock is worth buying. The company’s future performance will be key in deciding if the current stock price is too high or if the company is a good investment. Overall, investors should consider the risks associated with investing in the Manitowoc Company Inc., as well as any other investments they may be considering. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Manitowoc Company. More…

| Total Revenues | Net Income | Net Margin |

| 1.91k | 16.9 | 0.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Manitowoc Company. More…

| Operations | Investing | Financing |

| 7.6 | -181.2 | -5.2 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Manitowoc Company. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.72k | 1.09k | 17.93 |

Key Ratios Snapshot

Some of the financial key ratios for Manitowoc Company are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 0.4% | -28.0% | 2.4% |

| FCF Margin | ROE | ROA |

| -2.2% | 4.4% | 1.7% |

VI Analysis

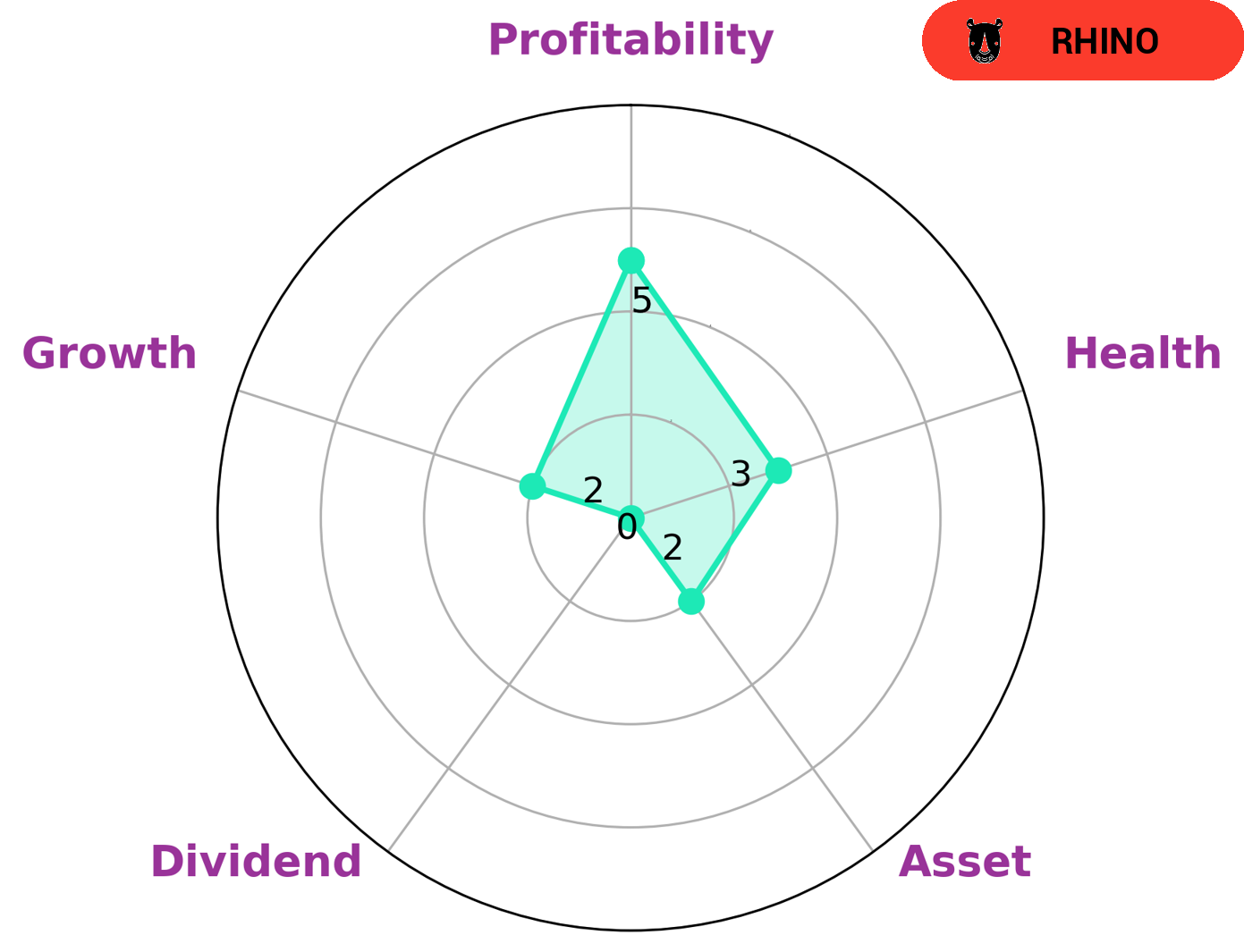

MANITOWOC COMPANY‘s fundamental metrics are analyzed through the VI app and show that it is strong in certain areas, such as profitability, but weak in others, such as asset, dividend and growth. The company has a low health score of 3/10, which means it is less likely to withstand any kind of crisis without the risk of bankruptcy. As it is classified as a ‘rhino’ company – one that has achieved moderate growth with regard to revenue or earnings – investors may be interested due to its potential. Generally, it is important to consider a company’s fundamentals when making an investment decision. A company’s balance sheet and cashflows can give investors insight into whether the company is likely to survive any economic downturns or not. Furthermore, key performance indicators such as dividend yield and growth rate can be used to gauge how attractive the stock may be over the long term. When looking at MANITOWOC COMPANY, its weak asset, dividend, and growth metrics suggest that it may not be the most attractive investment opportunity for long-term investors. However, its strong profitability metrics might be appealing to those looking for short-term investments, as the company is likely to generate high returns over the short term. Overall, MANITOWOC COMPANY’s fundamentals reflect its potential for short-term gains, so investors who are willing to take on higher risks may find it attractive. It is essential for investors to thoroughly research a company before investing in order to make an informed decision. More…

VI Peers

There is intense competition between Manitowoc Co Inc and its competitors Palfinger AG, Wacker Neuson SE, Volvo AB. All four companies are fighting for market share in the construction equipment industry. Manitowoc Co Inc has a strong presence in North America, while its competitors have a strong presence in Europe and Asia.

– Palfinger AG ($OTCPK:PLFRF)

Palfinger AG is a leading provider of innovative lifting, loading, and handling solutions. The company has a market capitalization of 704.98 million as of 2022 and a return on equity of 14.32%. Palfinger AG designs, manufactures, and markets a broad range of products, including cranes, aerial work platforms, and hydraulic loader arms. The company’s products are used in a variety of industries, including construction, agriculture, forestry, recycling, and material handling.

– Wacker Neuson SE ($OTCPK:WKRCF)

Wacker Neuson SE, with a market cap of 1.01B as of 2022, is a construction equipment company with a return on equity of 9.24%. The company has a strong focus on innovation and has a wide range of products that serve the construction, agriculture, and landscaping industries.

– Volvo AB ($OTCPK:VLVLY)

Volvo AB, together with its subsidiaries, manufactures and sells trucks, buses, construction equipment, and marine and industrial engines in Sweden, China, and internationally. The company operates through four segments: Trucks, Construction Equipment, Buses, and Financial Services. The Trucks segment offers medium to heavy-duty trucks. The Construction Equipment segment provides wheel loaders, articulated haulers, backhoe loaders, excavators, and compact equipment. The Buses segment offers city buses, intercity buses, coaches, and bus chassis. The Financial Services segment offers financing, leasing, and insurance products to its customers and dealers. Volvo was founded in 1915 and is headquartered in Gothenburg, Sweden.

Summary

Investing in The Manitowoc Company Inc. (MAN) can be a good opportunity for investors, as the stock price has recently dropped 2.58%. The company has a strong history of consistent growth and the current market sentiment is mostly positive. Investors should consider the company’s financials, including revenue, earnings, and cash flow, as well as their future growth prospects before making any decisions.

Additionally, investors should consider any potential risks associated with the company, such as competition, industry trends, and macroeconomic conditions. With careful analysis and a strong understanding of the company’s fundamentals, investing in MAN could be a profitable decision.

Recent Posts