PACCAR Inc [NASDAQ: PCAR] Shares Trade Around $69.81 Per Share: What’s Next in 2023?

March 27, 2023

Trending News ☀️

Despite the losses of -0.75%, or -0.53 points, investors are curious to know what could be the next move for the stock. In the upcoming year of 2023, PACCAR ($NASDAQ:PCAR) Inc is expected to experience growth in their business, driven by the increasing demand for commercial trucks, truck parts, and services. The company is also focused on increasing the efficiency of their operations, including the implementation of technological advancements in their manufacturing processes.

Additionally, PACCAR Inc will benefit from the growth of their subsidiaries, such as Peterbilt Motors Company and DAF Trucks, as they continue to expand in the global market. Analysts also expect PACCAR Inc to benefit from potential one-time cost savings from their restructuring initiatives as well as continued cost optimization. Moving forward into 2023, PACCAR Inc will work to optimize its balance sheet and capital structure. Furthermore, the company’s strong balance sheet and strong free cash flow will allow them to pursue other growth opportunities. Overall, analysts anticipate that PACCAR Inc will post strong financial results in 2023 and will likely continue to rise in value over the course of the year. Although the stock may experience some volatility due to macroeconomic uncertainties, its strong fundamentals are likely to keep it well-positioned for long-term success in 2023 and beyond.

Price History

News coverage of PACCAR INC NASDAQ: PCAR has been largely positive since its stock opened at $69.3 and closed at $69.9 on Friday, an increase of 0.1% from its prior closing price of 69.8. The company continues to demonstrate strong potential for growth and its shares have been trading around the same price for the past few weeks. As we look forward to 2023, investors should expect PACCAR INC to continue to grow and strengthen its market position. The company has recently announced a number of initiatives such as new product launches, strategic partnerships and the expansion of existing operations which all indicate a bright future for the company, making PACCAR INC a good investment for investors looking to maximize their returns in the long run. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Paccar Inc. More…

| Total Revenues | Net Income | Net Margin |

| 28.82k | 3.01k | 10.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Paccar Inc. More…

| Operations | Investing | Financing |

| 3.03k | -2.03k | 304.9 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Paccar Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 33.28k | 20.11k | 25.22 |

Key Ratios Snapshot

Some of the financial key ratios for Paccar Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 4.0% | 7.3% | 12.8% |

| FCF Margin | ROE | ROA |

| 5.7% | 17.6% | 6.9% |

Analysis

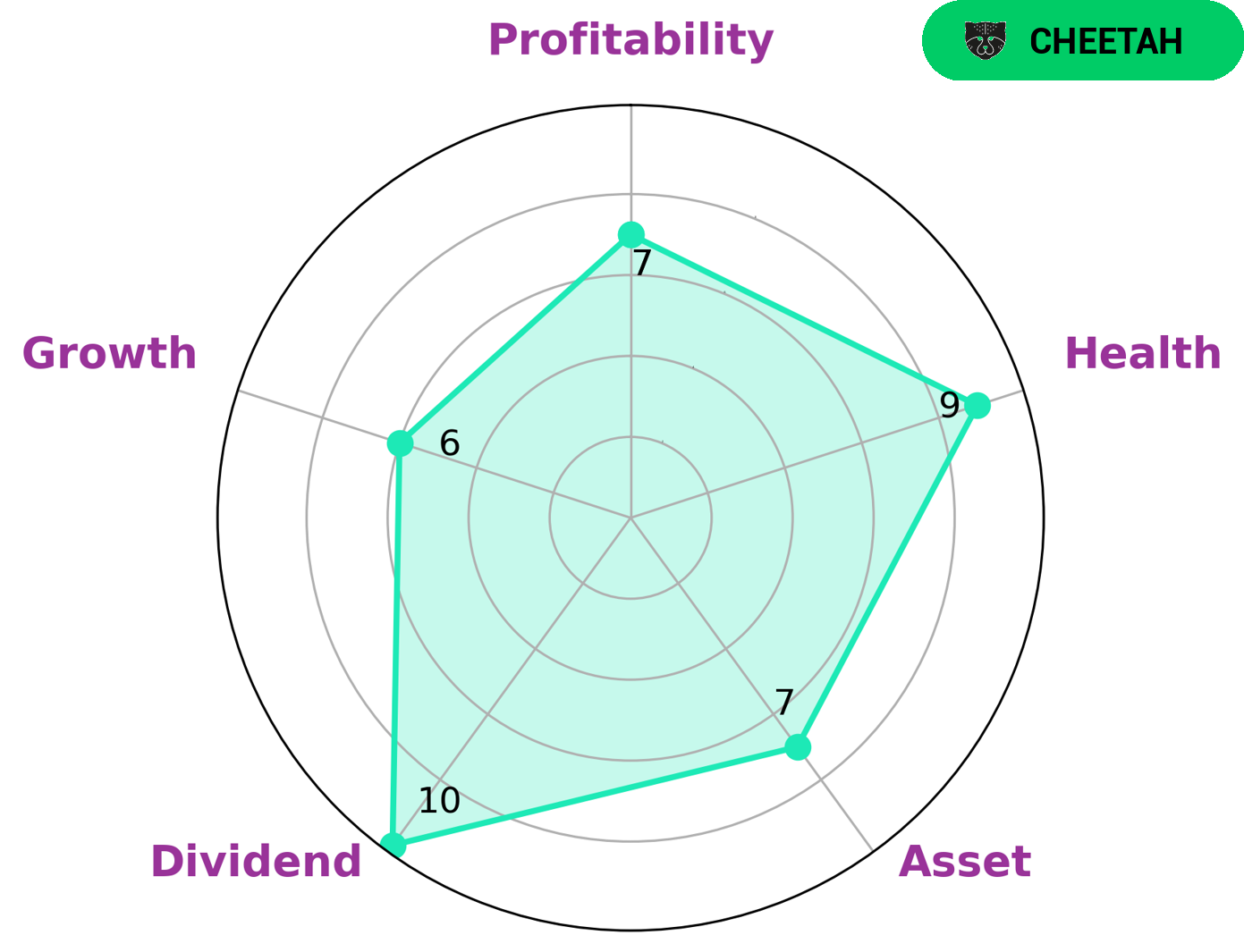

At GoodWhale, we conducted an analysis of PACCAR INC‘s fundamentals and found that according to Star Chart, PACCAR INC is strong in asset, dividend, profitability and medium in growth. The company also achieved an overall health score of 9/10, which indicates that it is capable of paying off its debt and funding future operations. We classified PACCAR INC as a ‘cheetah’, a type of company that has achieved high revenue or earnings growth but is considered less stable due to lower profitability. Given the nature of this type of company, we believe that investors looking for higher potential returns with a greater risk appetite may be interested in PACCAR INC. Its strong asset and dividend performance may provide a cushion of stability in the event of any financial downturns or other external risks. Additionally, its medium level of growth may indicate opportunities for long-term growth within the company. More…

Peers

PACCAR Inc is one of the world’s leading truck manufacturers. The company’s main competitors are Oshkosh Corp, Daimler Truck Holding AG, Caterpillar Inc. PACCAR Inc manufactures and sells a wide range of trucks and related parts and services. The company operates in three segments: Truck, Parts, and Financial Services. PACCAR Inc is headquartered in Bellevue, Washington, and has manufacturing facilities in the United States, Mexico, Australia, the Netherlands, and the United Kingdom.

– Oshkosh Corp ($NYSE:OSK)

Oshkosh Corporation is a leading manufacturer and marketer of access equipment, specialty vehicles and vehicle bodies for the primary markets of defense, concrete placement, refuse hauling, access equipment, and fire & emergency. Oshkosh Corporation manufactures, sells and services products under the brands of Oshkosh®, JLG®, Pierce®, McNeilus®, Jerr-Dan®, Frontline™, CON-E-CO®, London® and IMT®.

– Daimler Truck Holding AG ($OTCPK:DTRUY)

Daimler Truck Holding AG is a holding company that provides trucks and services for the transportation sector. The company has a market capitalization of 21.1 billion as of 2022 and a return on equity of 8.52%. Daimler Truck Holding AG operates in three segments: Daimler Trucks, Daimler Buses, and Daimler Financial Services. The company offers a range of trucks for different applications, including heavy-duty trucks, medium-duty trucks, and light-duty trucks. Daimler Truck Holding AG also provides financing, leasing, and insurance services for its customers.

– Caterpillar Inc ($NYSE:CAT)

Caterpillar Inc.’s market capitalization is 97.35 billion as of 2022. Its return on equity is 33.83%. The company manufactures construction and mining equipment, diesel and natural gas engines, and industrial gas turbines. It also provides financing and leasing services through its subsidiaries.

Summary

PACCAR Inc (NASDAQ: PCAR) is a manufacturer of commercial vehicles and engines, serving a broad range of markets across the globe. Recent financial reports have shown that PACCAR has had a string of positive financial performances, with high revenue growth and consistently increasing profits. Analysts expect PACCAR to continue its success in the upcoming years, predicting steady growth in both the short-term and the long-term. In particular, analysts anticipate that PACCAR will further capitalize on its current market position and expand its portfolio of products and services.

Over the next few years, PACCAR is expected to invest heavily in research and development, as well as capitalize on new technologies to make its products more efficient and cost-effective. Given the company’s impressive track record and promising outlook, investors should consider adding PACCAR to their portfolio in 2023.

Recent Posts