Oshkosh Corporation Stock Intrinsic Value – Oshkosh Corporation’s Intrinsic Value Estimated at US$77.91 Per Share

May 17, 2023

Trending News ☀️

Oshkosh Corporation ($NYSE:OSK) is a leading designer, manufacturer, and marketer of specialty vehicles and vehicle bodies. The company’s products are used in a variety of applications, including construction, fire and emergency, military, and defense. Recently, the intrinsic value of Oshkosh Corporation has been estimated to be US$77.91 per share using a 2 Stage Free Cash Flow to Equity model. This is slightly higher than the current market price of US$73.09 for each share, suggesting that there may be some potential for investors. The 2 Stage Free Cash Flow to Equity model is a widely used method of estimating the intrinsic value of a company by looking at its free cash flow. The model takes into account the cash flows of the company over several years, as well as any expected growth in its future cash flows. After calculating the expected cash flows over the relevant period, the terminal value of the company is calculated. This gives an estimate of the company’s intrinsic value which can be compared to its current market price. The calculation of Oshkosh Corporation’s intrinsic value suggests that there may be some potential for investors. Its current share price is slightly lower than its estimated intrinsic value, meaning it could potentially offer a good return on investment.

However, it is important to remember that this is just an estimate and there is no guarantee that the stock will offer a positive return. Investors should do their own research and weigh up all potential risks before taking any action.

Price History

On Monday, OSHKOSH CORPORATION stock opened at $73.4 and closed at $74.0, up by 1.2% from prior closing price of 73.1. This increase in stock price comes after the recent estimates of the company’s intrinsic value was placed at US$77.91 per share. This suggests that the company’s stock is currently undervalued and offers potential investors an opportunity to buy at a discounted rate.

Analysts have suggested that the stock could be worth significantly more than the current market price if the company lives up to its potential. This is why investors should be closely monitoring the progress of the company as it looks to capitalize on its strong position in the industry. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Oshkosh Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 8.6k | 262.6 | 3.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Oshkosh Corporation. More…

| Operations | Investing | Financing |

| 352.2 | -537.4 | -218.2 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Oshkosh Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 7.92k | 4.67k | 48.66 |

Key Ratios Snapshot

Some of the financial key ratios for Oshkosh Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 1.3% | -13.7% | 5.1% |

| FCF Margin | ROE | ROA |

| -0.1% | 8.5% | 3.5% |

Analysis – Oshkosh Corporation Stock Intrinsic Value

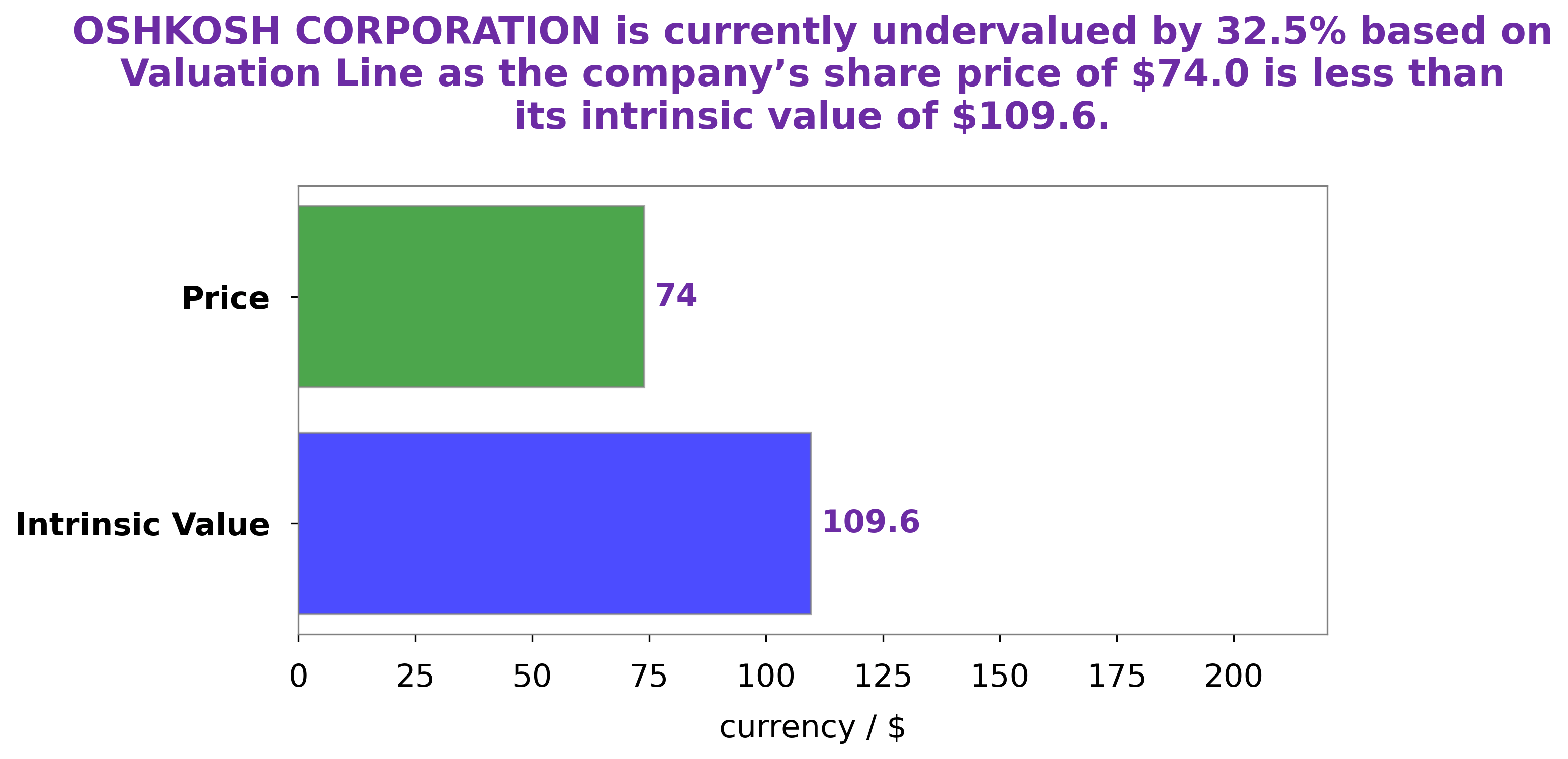

At GoodWhale, we have conducted an analysis of the fundamentals of OSHKOSH CORPORATION. After scrutinizing their financials, our proprietary Valuation Line has determined their intrinsic value to be around $109.6 per share. Currently, OSHKOSH CORPORATION stock is being traded at $74.0 per share, making it significantly undervalued by 32.5%. This presents a great opportunity for investors to pick up this stock at a bargain. More…

Peers

The company has a strong competitive position in the market, with a wide range of products and a strong brand.

However, the company faces competition from a number of other companies, including PACCAR Inc, Tadano Ltd, and Wacker Neuson SE.

– PACCAR Inc ($NASDAQ:PCAR)

PACCAR Inc is a global technology leader in the design, manufacture and customer support of high-performance, energy-efficient diesel engines and electric vehicles. The company’s products are used in a variety of applications including trucking, construction, mining, agriculture, logging and other commercial and industrial applications. PACCAR Inc also provides financial services through its subsidiary, PACCAR Financial Corporation, which offers financing for the purchase of PACCAR products and services.

– Tadano Ltd ($TSE:6395)

Tadano Ltd is a Japanese multinational corporation that manufactures and sells construction machinery, cranes, and other equipment. The company has a market cap of 114.35B as of 2022 and a return on equity of 3.54%. Tadano is a leading manufacturer of construction machinery and cranes, and has a strong global presence. The company’s products are used in a variety of industries including construction, mining, forestry, and material handling.

– Wacker Neuson SE ($OTCPK:WKRCF)

Wacker Neuson SE is a German company that manufactures construction equipment. The company has a market capitalization of 979.39 million as of 2022 and a return on equity of 9.24%. The company’s products include excavators, loaders, and pavers.

Summary

Oshkosh Corporation is an American industrial company with diversified market segments including defense, access equipment, and commercial and fire & emergency. Investment analysis of the company gives an insight into its potential for growth and stability. Based on this analysis, the company’s estimated fair value stands at US$77.91 per share.

This is determined using a two stage free cash flow to equity model. Overall, Oshkosh appears to be a suitable investment option for investors looking for solid returns with less risk.

Recent Posts